The U.S. stock market experienced a volatile week, starting with positive momentum but facing downturns by midweek. While the Nasdaq attempted a rebound on Thursday, it ultimately closed in the red, and the Dow Jones Industrial Average managed to edge higher. Key earnings reports, GDP figures, and upcoming Personal Consumption Expenditures (PCE) data were significant influences on market movements. Given the current levels and economic indicators, I am transitioning to a market-neutral stance.

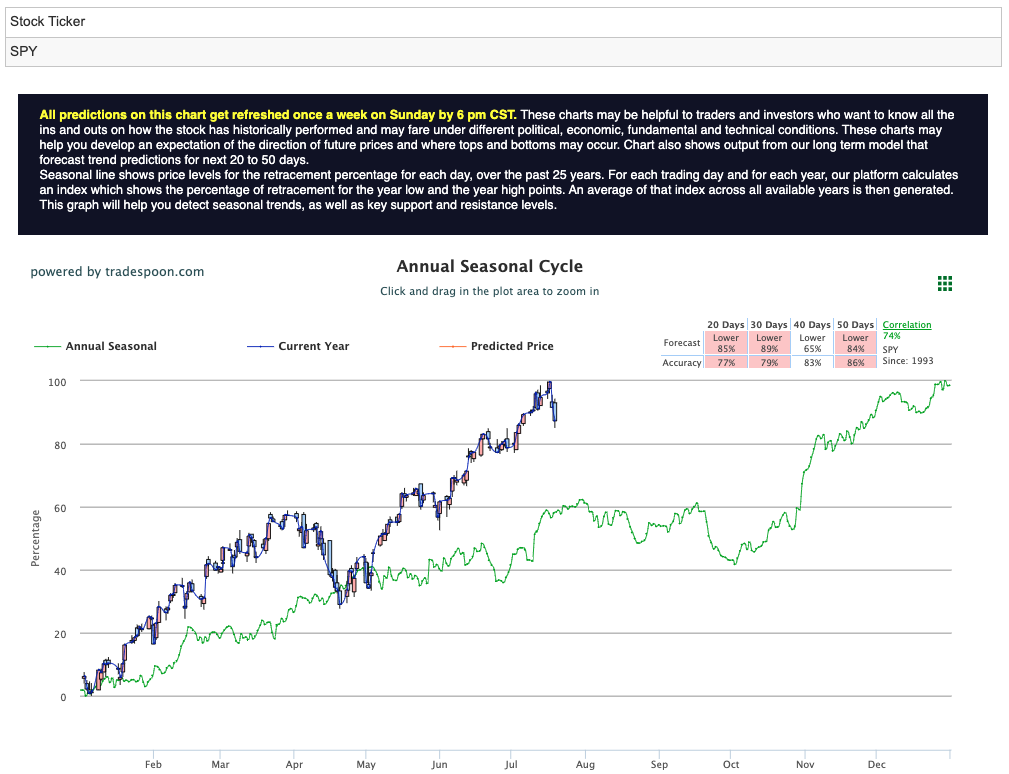

Although inflation aligns with expectations and the earnings season has surpassed predictions, risks remain as the economy shows signs of cooling, unemployment ticks up, and there is a looming threat of small bank failures due to exposure to commercial and residential real estate. The SPY rally is capped at $560-$575, with short support between $520 and $530 over the coming months. I anticipate the market to trade sideways in the short and medium term, while the long-term trend remains intact. For reference, the SPY Seasonal Chart is shown below:

The week began with a robust rebound in the stock market, led by a recovery in the Magnificent Seven and chip stocks, following a challenging previous week. The Dow Jones Industrial Average, however, lagged behind, reflecting uneven sector performance. This surge was driven in part by President Joe Biden’s unexpected announcement of not seeking re-election and his endorsement of Vice President Kamala Harris as the Democratic frontrunner. As investors processed this significant political shift, they braced for a week filled with pivotal earnings reports, a preview of second-quarter GDP, and the Federal Reserve’s latest inflation metrics for June. High-profile companies, including Tesla, Alphabet, Visa, Coca-Cola, Texas Instruments, and others, were scheduled to report their earnings, playing a crucial role in shaping market sentiment as we navigate the second quarter’s economic landscape.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Earnings reports from major corporations have been a focal point for investors, with results providing critical insights into the health of various sectors. Companies like Tesla and Alphabet released earnings that fell short of Wall Street’s high expectations, contributing to volatility in the tech sector. As a result, the Nasdaq had its worst day since 2022 on Wednesday, with the Magnificent Seven stocks falling into correction territory. Investors are reevaluating their perspective on artificial intelligence and whether the massive investments will see the payoff they’ve imagined.

The GDP report released this week showed the U.S. economy growing at a 2.8% annualized pace in the second quarter, surpassing the forecast of 2.1%. This growth was bolstered by an increase in inventories, which, while boosting GDP figures, may mask underlying weaknesses in demand. The report indicated that while the economy is expanding, the pace is moderate, neither too hot nor too cold. This balance is crucial as it suggests the economy is healthy enough to avoid immediate recession fears but not so strong as to preclude potential interest rate cuts by the Federal Reserve.

The PCE price index, a key measure of inflation closely watched by the Federal Reserve, rose by 2.6% for the second quarter, down from the 3.4% recorded in the first quarter. Core PCE prices, which exclude food and energy, increased by 2.9%, also down from 3.7%. This deceleration in price growth is encouraging for the Fed as it suggests that inflation pressures may be easing, aligning with their targets and potentially opening the door for rate cuts in the future.

Despite these positive signals, the personal savings rate has continued to decelerate, falling to 3.5% from 3.8% in the first quarter. This decline raises concerns about consumer resilience and spending power, which are vital for sustained economic growth. Additionally, the labor market showed mixed signals, with initial jobless claims declining by 10,000, suggesting some stability but not enough to dispel fears of rising unemployment.

Investor concerns drive the ongoing rotation into smaller stocks outside the tech sector that the hype surrounding artificial intelligence may have been overdone, coupled with hopes for potential interest rate cuts by the Federal Reserve. Interest-sensitive stocks have shown resilience, with small-cap stocks nearing their 2021 highs and banks benefiting from last week’s lower CPI print. Meanwhile, value stocks and other interest-sensitive equities are trending upward, while the QQQ and SPY are consolidating.

The 10-year Treasury yield has been volatile, fluctuating between 4.2% and 4.7%, testing the 4.3% level amid discussions about potential interest rate cuts. The 2-year yield is lower than the 30-year yield for the first time in two years, potentially contributing to market volatility. The VIX, a measure of market volatility, is elevated at 18, indicating increased market fear. However, equity expirations this week have added complexity to the trading environment, contributing to the market’s recent sell-off.

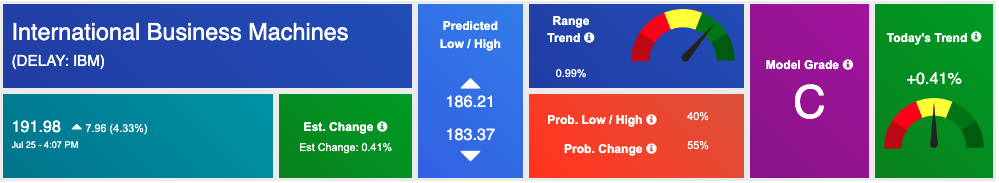

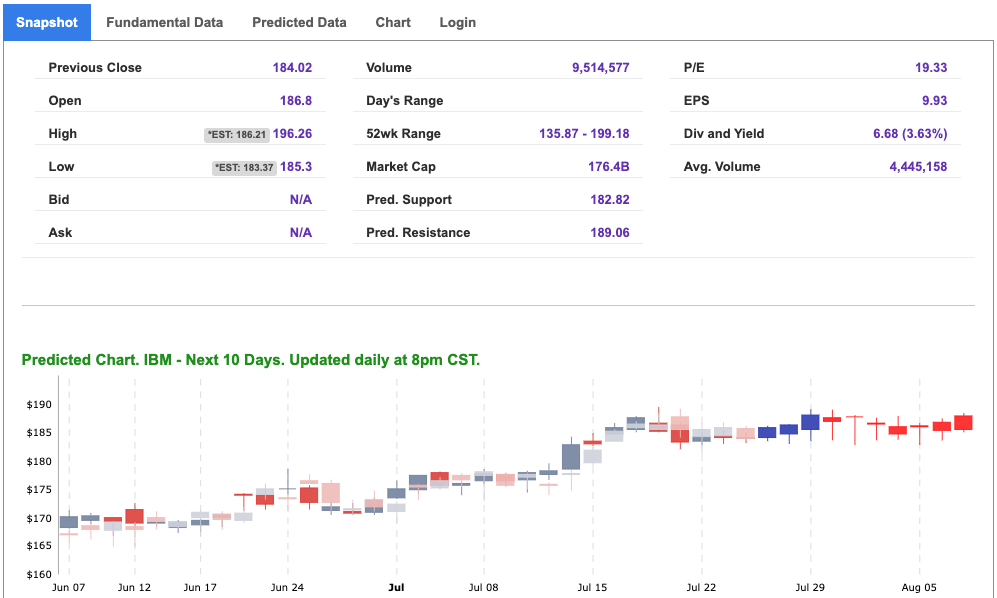

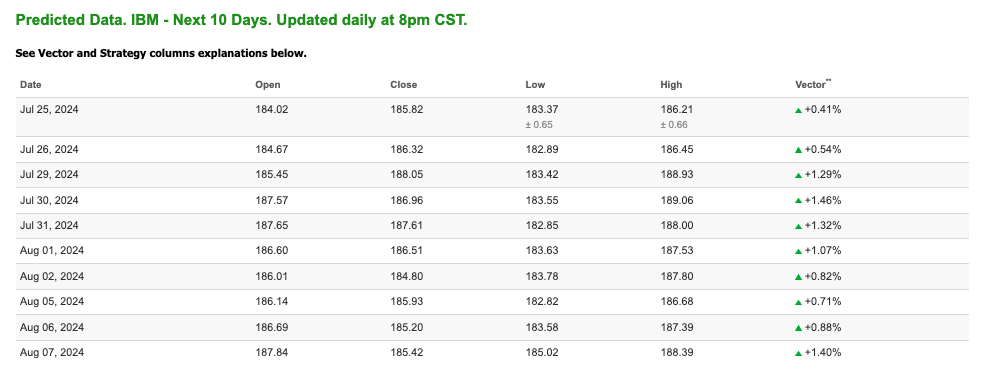

Given the current market dynamics and economic conditions, one stock that stands out as a promising investment for the upcoming week is IBM. Amid the rotation into value and interest-sensitive stocks, IBM presents a compelling opportunity due to its stable financial performance and strategic positioning.

International Business Machines Corporation (IBM) is a global technology and consulting company with a rich history of innovation and leadership in information technology. Founded in 1911, IBM operates in more than 170 countries and provides a broad portfolio of services and products, including cloud computing, artificial intelligence, and data analytics. Over the years, IBM has reinvented itself to adapt to technological advancements, making significant strides in emerging fields like quantum computing and blockchain technology.

In the current market environment, there is a noticeable rotation into value stocks as investors seek stability amid uncertainty. IBM, with its strong dividend yield and consistent cash flow, is a classic example of a value stock that offers potential for growth with a degree of safety.

With discussions of potential interest rate cuts by the Federal Reserve, IBM is well-positioned to benefit as a company sensitive to these movements. Lower interest rates could enhance IBM’s borrowing capacity and reduce debt servicing costs, which would positively impact its financial performance. This financial advantage, coupled with the stability that IBM consistently delivers, makes it a compelling choice for investors.

Unlike some tech giants that have struggled to meet high earnings expectations, IBM has consistently achieved steady results. The company’s recent earnings reports demonstrate resilience, driven by growth in its cloud and cognitive software segments. This stability is particularly appealing in a market characterized by volatility and shifting investor sentiment, making IBM a reliable choice in uncertain times.

The recent GDP growth at an annualized pace of 2.8% suggests a moderately expanding economy, which bodes well for IBM’s business operations. Furthermore, the deceleration in inflation, as indicated by the PCE price index, aligns with a favorable environment for IBM’s cost management and pricing strategies.

In summary, IBM is well-positioned to capitalize on the current market dynamics, offering investors a blend of stability, growth potential, and income generation. Its strategic focus on high-growth areas, coupled with favorable economic indicators, makes IBM a compelling buy for the upcoming week.

To further enhance your investment decisions, consider harnessing the power of AI through our RoboInvestor stock and ETF advisory service. This service leverages cutting-edge technology to pinpoint trades with a high probability of profitability. Our proprietary AI platform eliminates the noise and emotional factors that often influence investor decisions, providing our members with clear, data-driven insights and strategies for success.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

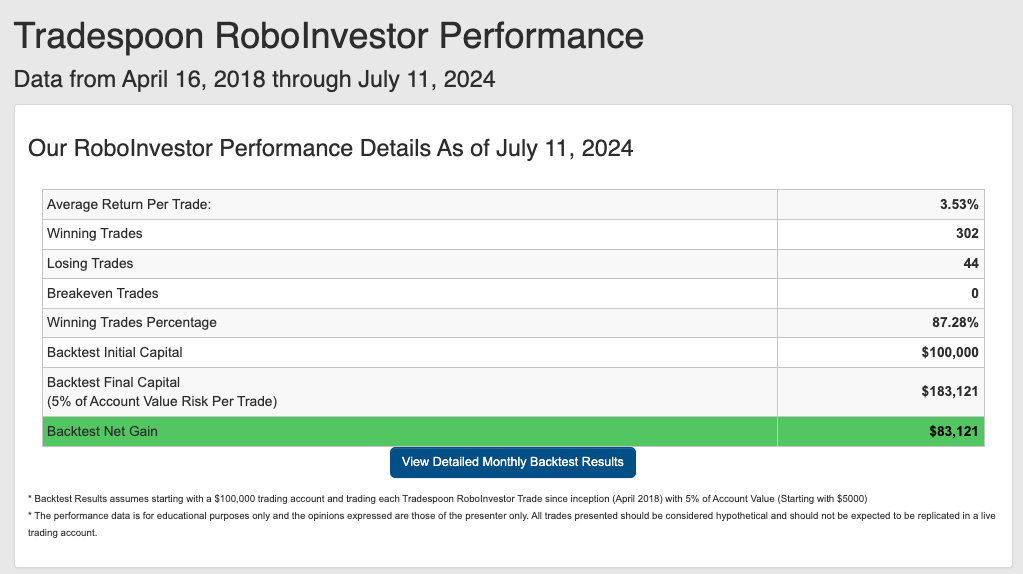

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.28% going back to April 2018.

As we move beyond the halfway mark of 2024 and into the dog days of summer, investors continue to navigate a challenging market landscape. Persistent issues like inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine, shape the current investment environment. In these uncertain times, the role of a reliable and knowledgeable investment partner becomes increasingly vital for making informed decisions amidst fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!