Stocks moved higher on Thursday, the final trading day before the Easter weekend; however, investors’ concerns remained centered on inflation and the economy. The market’s focus is firmly on Friday’s release of the monthly jobs report, with economists expecting it to show an increase of 240,000 jobs – a drop from February’s 311,000. The report is essential for the Federal Reserve before its next rate decision due after the May 2-3 meeting of its policy-setting committee.

The Labor Department disclosed that initial jobless claims fell to 228,000 for the week ended April 1, lower than the revised 246,000 reported in the week prior. However, economists had expected 199,000 claims. The disappointing news only added to concerns that the Fed’s actions could cause an economic slowdown.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Traders are split over whether the Fed will deliver another 25-basis point rate increase or pause for the first time in this hiking cycle. Currently, markets price in a 52.6% chance that the central bank will hold rates as is. The report is especially crucial after downbeat data earlier this week fueled fears that the Fed risks spurring a painful economic slowdown.

Meanwhile, yields for the two-year and ten-year Treasury notes have dropped below multi-month support, with the ten-year yield at 3.2%. If the yield does not hold, many believe it is likely that the market has seen the top for the next couple of months and investors should sell into any further rallies. Additionally, money market funds are at a historical high of $2 trillion, similar to the situation in 2008. Cash deposit outflows are also at a multi-year high, with investors incentivized to move money from equities to money market funds and bonds which pay an average of 4.8%.

With the week drawing to a close, several reports have already impacted market sentiment, including a fall in the ISM services index for March, which came in below expectations at 51.2, down from 55.1 in February. The ADP Research Institute also reported that private employers added only 145,000 jobs in March, lower than expected and a drop from the previous month’s 261,000 jobs. With fewer private jobs added than anticipated and mortgage applications showing a decline over the past four weeks, the Fed’s potential for raising interest rates this year is being closely monitored.

Click Here To Subscribe To Our Youtube Channel, Don’t Miss Out!

As the United States awaits the release of its latest economic indicator, there is a lot of anticipation for what March’s jobs report will bring. The labor market has become increasingly competitive and significant attention is being paid to various employment figures as well as average hourly wages set to be revealed on Friday. Further compounding inflation worries are OPEC+’s recent decision to decrease production output in addition to Cleveland Federal Reserve President Loretta Mester suggesting interest rates should exceed 5%. All this creates headwinds that could make navigating the markets difficult moving forward.

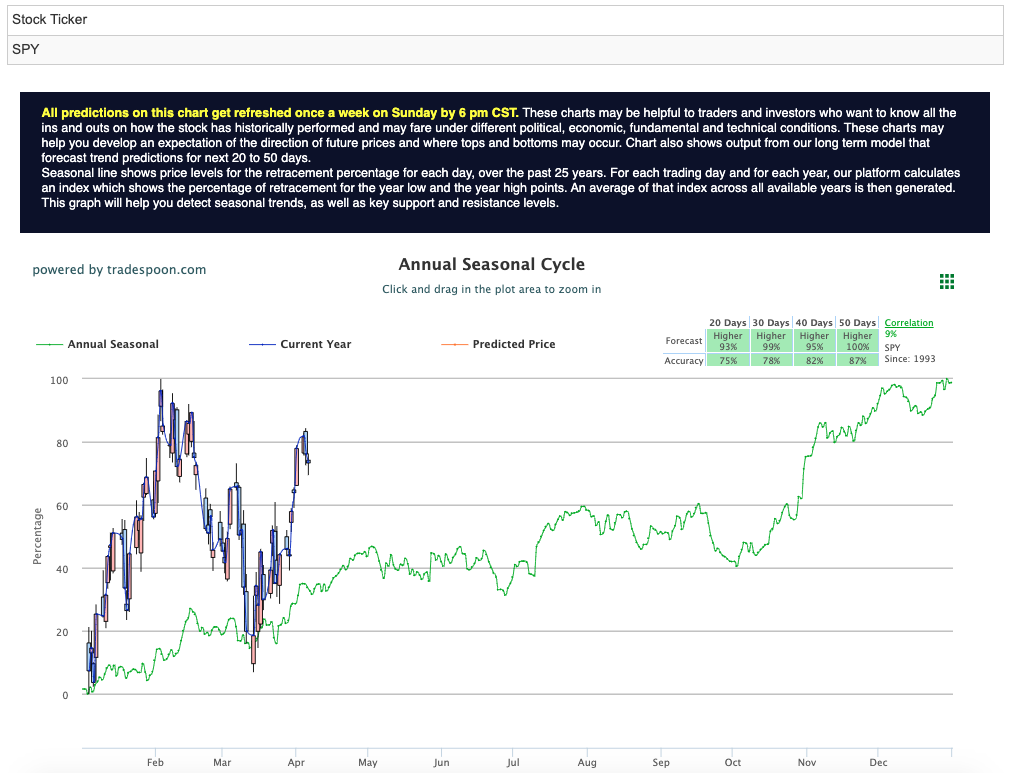

Market watchers are keeping a close eye on the $VIX, which is currently trading near the $18 level. This week’s earnings reports from $STZ and $CAG, along with the March unemployment data, could influence the next move in the market. The SPY’s overhead resistance levels, currently at $412 and $418, and support levels, at $406 and $402, are also being closely monitored. Despite the recent uptick in stocks, some experts are predicting a sideways market for the next two to eight weeks and recommending remaining market-neutral while encouraging readers to hedge their positions. See $SPY Seasonal Chart:

Looking ahead, all eyes are on next week’s CPI data and the start of earnings season in the following two weeks. The season will begin with global and regional banks, and forward-looking guidance will set the tone for the market in the coming few quarters. With the 2-year Treasury at 3.5%, and the Fed’s target rate at 5%, QQQ and BTC have made impressive rallies, but many believe this trend will not last long.

With this in mind, I have identified the next RoboStreet symbol which I will be looking to add to my portfolio when the price is right.

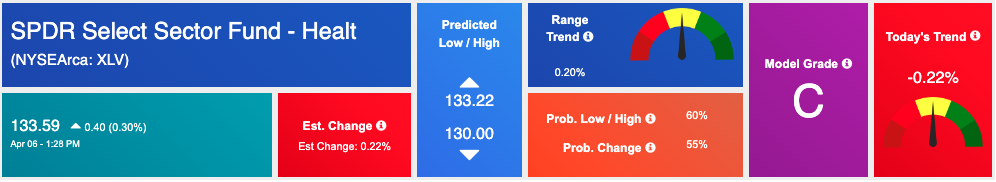

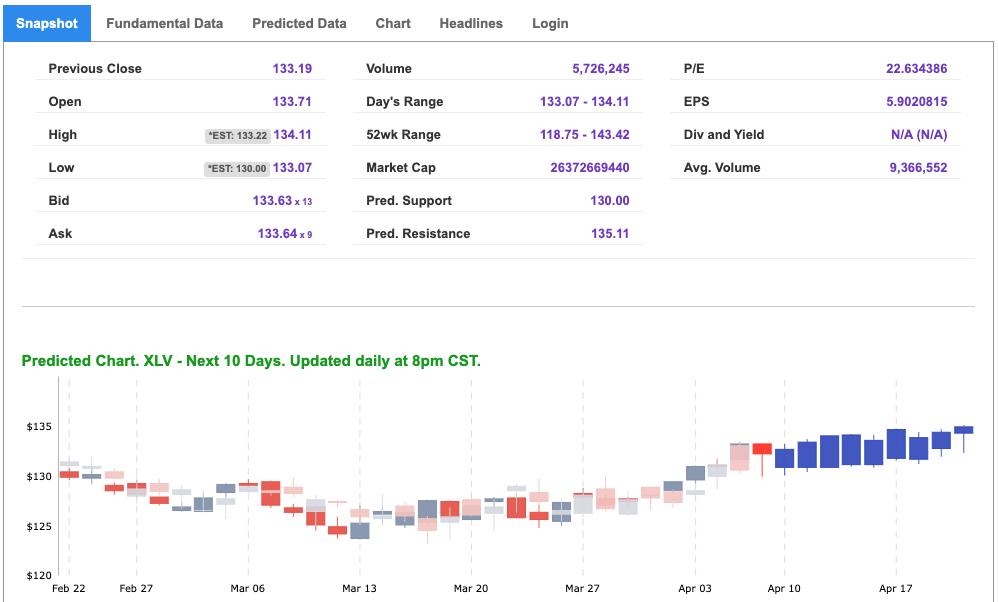

The Health Care Select Sector SPDR Fund ($XLV) is an exchange-traded fund that tracks the performance of companies in the healthcare sector of the S&P 500 Index. The ETF’s holdings include companies engaged in the research, development, production, and distribution of drugs, medical equipment, and supplies, as well as healthcare providers and services. The fund is one of the largest healthcare ETFs in terms of assets under management and provides investors with exposure to the healthcare sector, which has historically demonstrated resilience during economic downturns.

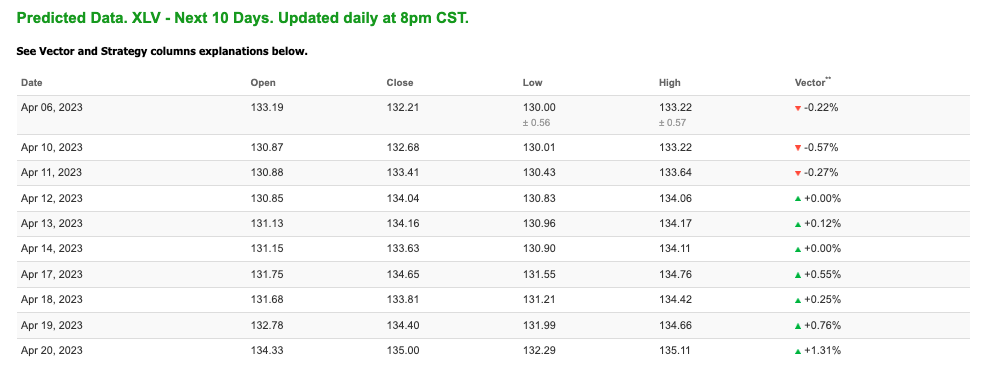

XLV is trading below its 52-week high and showing several promising signals within its 10-day forecast. The healthcare ETF is showing an impressive vector trend that is consistent and one-directional, which is exactly the type of trend I look for in symbols I am bullish on. As stated, XLV is in a prime spot to benefit from economic uncertainty and provide a haven during volatility. See $XLV 10-day predicted data:

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

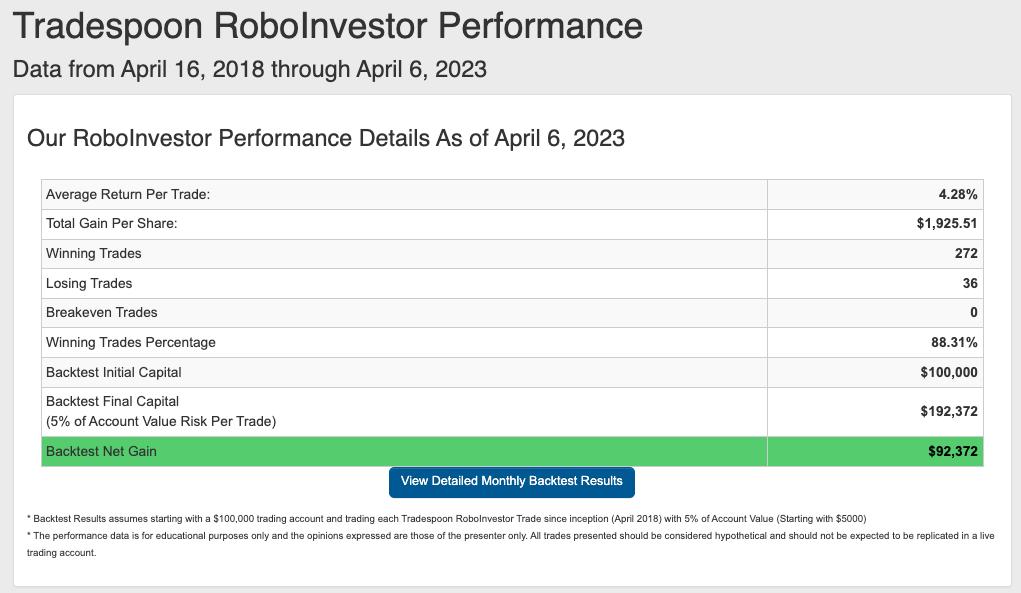

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.31% going back to April 2018.

In 2023, investors are facing a dynamic market affected by a combination of factors such as inflation, Federal policies, and geopolitical tensions, including the ongoing conflict in Ukraine. To successfully navigate this complex landscape, it is crucial to partner with a trustworthy and knowledgeable investment platform. RoboInvestor provides the necessary expertise and tools to help investors manage their portfolios with confidence and capitalize on opportunities in the fast-paced market.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!