The bullish momentum of the S&P 500 and Nasdaq came to an abrupt halt on Thursday afternoon, signaling a break in the winning streaks. In the past seven sessions, the market has undergone a significant reversal from its 200-day moving average (DMA) and is currently trading above the 50 DMA. Surprisingly, the Christmas rally has kicked in earlier and stronger than anticipated by most market participants.

However, the positive sentiment took a hit following the latest 30-year Treasury auction, which revealed weaker-than-expected demand. Federal Reserve Chairman Jerome Powell’s remarks at the International Monetary Fund event added to the uncertainty, leaving the door open for another rate increase if inflation remains high.

While initial jobless claims came in below expectations at 217,000, the oil market experienced a slight rise after facing deep losses.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

All eyes are on Powell’s speech this week, with expectations of no groundbreaking information. The focus shifts to the Consumer Price Index (CPI) and Producer Price Index (PPI) next week, as the Federal Reserve remains data-dependent. The million-dollar question revolves around when the Fed will initiate rate reductions. Current expectations point to the first half of 2024, and the market is poised to react based on the accuracy of these predictions.

Powell emphasized, “If it becomes appropriate to tighten policy further, we will not hesitate to do so,” raising concerns among traders. The market, previously optimistic about the Fed concluding rate hikes, pulled back in response to Powell’s comments and lackluster demand at the Treasury bond auction.

The Dollar Index (DXY) started to pull back, and longer-dated treasuries dropped, retesting the 50 DMA. As long as the dollar remains weak, coupled with yields trending lower towards the year-end, the market rally is expected to continue.

Powell’s remarks align with a week-long series of commentaries from central bank officials, emphasizing the possibility of further tightening. With inflation showing signs of deceleration and economic growth outpacing expectations, the Fed remains cautious, avoiding premature declarations of victory over inflation.

In the corporate realm, Walt Disney reported fourth-quarter adjusted earnings, beating estimates, fueled by the success of Disney+ and a more ambitious cost-cutting plan. On the flip side, AMC Entertainment tumbled 14% as it filed to offer up to $350 million of stock.

Affirm Holdings reported a narrower-than-expected fiscal first-quarter loss, with shares rising on robust revenue and increased total merchandise volume. However, chip designer Arm Holdings fell short of estimates in its forecasts, leading to a 5.2% decline in its U.S.-listed shares.

Tesla faced a 5.5% drop after HSBC initiated coverage with a Sell rating and a price target of $146.

Market participants are closely watching the potential government shutdown in the upcoming week. Treasury auctions, despite concerns, performed better than expected, resulting in dropping yields.

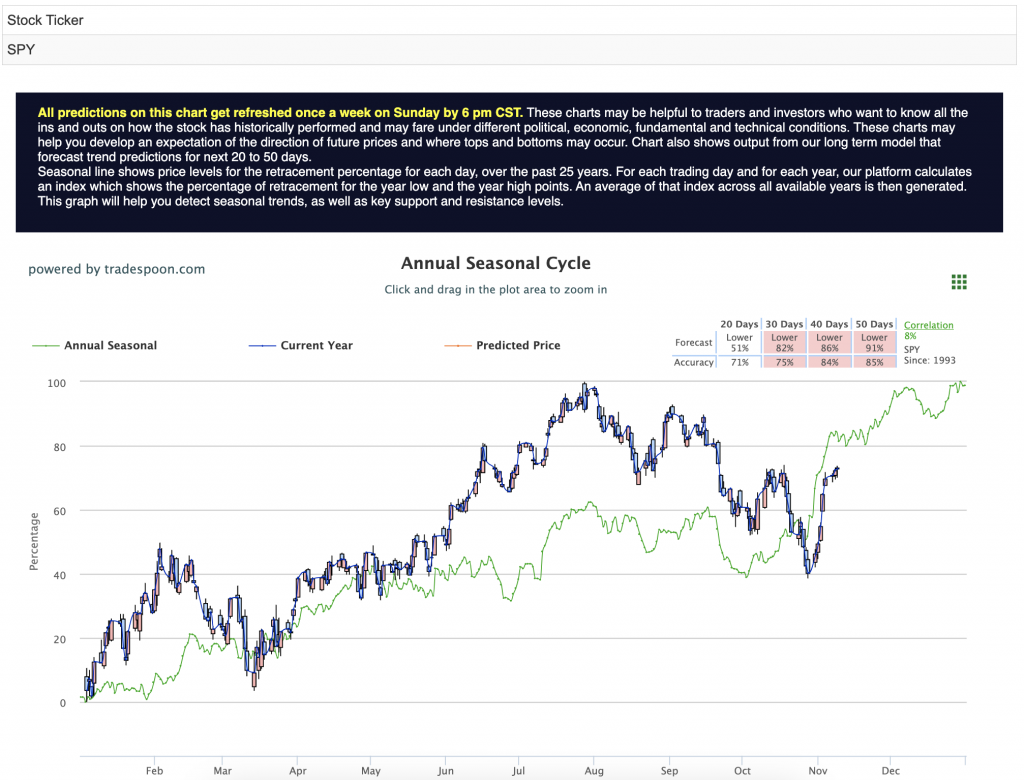

With a cautious eye on economic data indicating a low probability of recession, some investors are shifting to a market-neutral stance. However, the lingering uncertainty prompts a conservative outlook, with expectations that the SPY rally may be capped between $450-470 levels, and short-term support lies between $400-$430 for the next few months. For reference, the SPY Seasonal Chart is shown below:

Energy stocks experienced a significant pullback, testing the 200 DMA, driven by weak global demand and a decrease in geopolitical risks, at least for the time being. As the market navigates these challenges, the pattern of higher highs and higher lows is anticipated to emerge in the next few weeks, signaling a shift in the trajectory of the current rally, which may have already witnessed its peak.

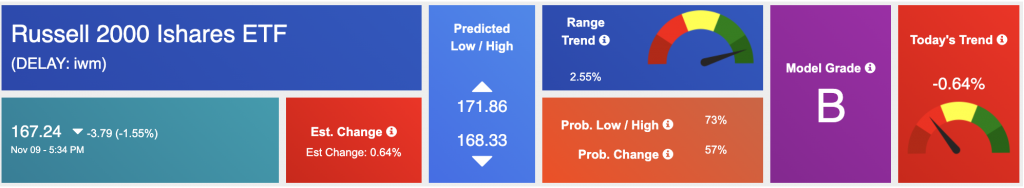

Amidst the recent market shakeup, astute investors are turning their attention to small-cap stocks, particularly represented by the iShares Russell 2000 ETF ($IWM). This segment has the potential to shine in the current economic landscape characterized by a weakening dollar and declining yields.

iShares Russell 2000 ETF ($IWM) tracks the Russell 2000 Index, capturing the performance of around 2,000 small-cap U.S. stocks. Known for resilience during market shifts, $IWM offers investors exposure to agile, innovative businesses. In a weaker dollar environment with softening yields, $IWM stands as a strategic choice for diversification and growth potential, embodying the dynamism of small-cap enterprises.

While large-cap stocks experienced a setback, small caps, as represented by $IWM, often exhibit resilience during market turbulence. The recent reversal from the 200-day moving average and a robust Christmas rally signify an opportune moment for investors to consider diversifying their portfolios.

The retreat of the Dollar Index (DXY) provides a tailwind for small-cap stocks. A weaker dollar tends to benefit smaller companies, as it can boost their export competitiveness and overall market appeal. Investors eyeing $IWM can leverage this currency dynamic to potentially capitalize on the strength of small-cap businesses.

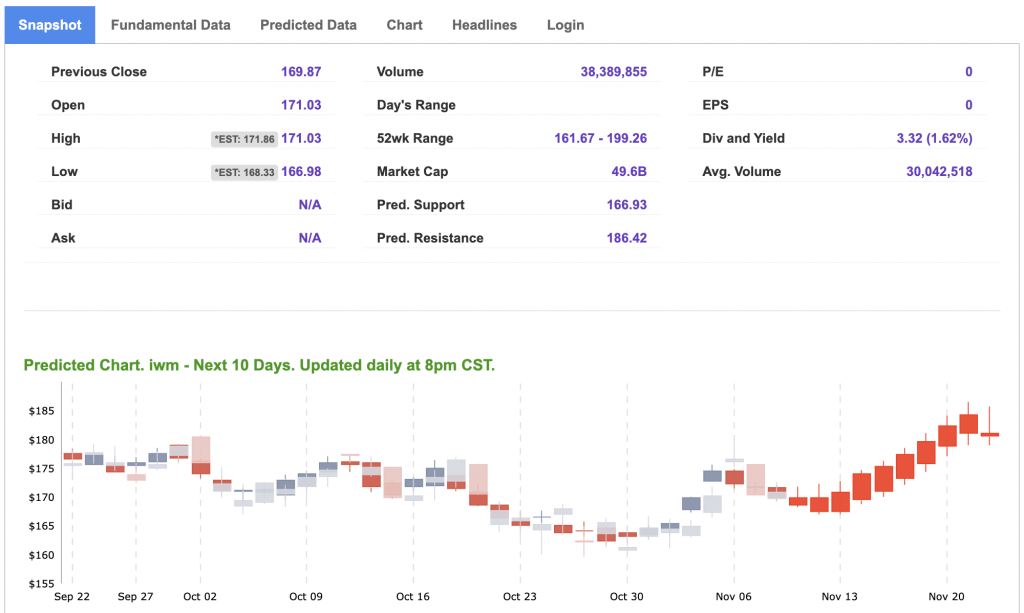

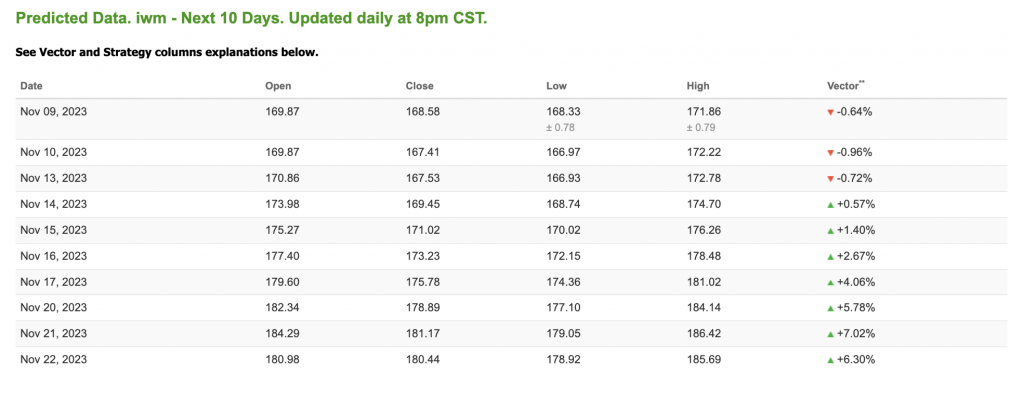

As longer-dated treasuries retest the 50 DMA and yields show signs of softening, small-cap stocks become an attractive option. Typically, smaller companies are more sensitive to interest rate movements, and a lower-yield environment can contribute to a favorable backdrop for their growth. And our A.I. models agree! Just take a look at the 10-day Predicted Data for IWM:

Considering the prevailing conditions—$IWM’s resilience, a weakening dollar, and softer yields—it appears to be an opportune time for investors to explore or reinforce their positions in small-cap stocks. While uncertainties linger in the broader market, small caps can offer a haven, potentially outperforming their larger counterparts.

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

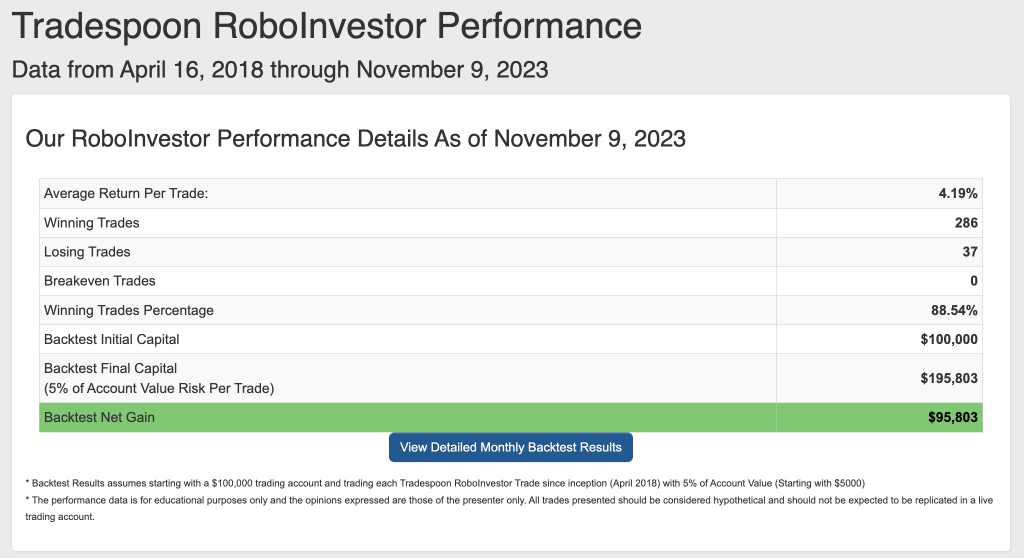

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.47% going back to April 2018.

As we enter Q4, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!