RoboStreet – December 1, 2022

Economic Data Supports Markets Ahead of Holidays

After the ISM showed that American factory activities contracted to a 30-month low in November, stocks finished mostly lower after a rocky Thursday session. U.S. stocks mostly opened higher on Thursday after the Federal Reserve’s preferred inflation measure showed price pressures cooling in October. At the same time, reports suggested China is taking steps to relax its COVID restrictions to allow for economic growth.

This comes a day after market sentiment turned positive from Federal Reserve Chairman Powell’s latest comments that the central bank could reduce its interest-rate increases at its December meeting. The optimistic news came as investors were evaluating a range of economic data, including weaker-than-expected private-sector payrolls and a positive revision to third-quarter economic growth – both of which were positively received. With traders evaluating Federal Reserve Chairman Jay Powell’s speech indicating the central bank may raise interest rates more slowly at its next policy meeting, U.S. equities were able to close out the month positively.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

In the report, the Institute for Supply Management’s (ISM) manufacturing index decreased to 49% in November from 50.2% in October. The ISM report is used as a good gauge of the economy’s strength with reports below traditionally 50% meaning that the economy is contracting. The most recent ISM data likely implies that the Fed will soon have to begin slowing down the pace of interest rate increases. With previous reports this year showing inflation slowing, yearly inflation appears to finally be impacted by the Fed’s actions.

Following these inflation reports, the next major mover in the market will be the upcoming Federal Open Market Committee meeting, scheduled for December 13-14. A rate hike is expected but the size is yet to be determined, with the likelihood of a super-sized decrease from previous meetings. Additionally, after a predominantly positive earnings season, several major retailers are seeing shares slide this week.

With the market rally continuing for the most part after several supportive economic reports and a strong earnings season, we can expect the market to make incremental gains into the end of the year. Some volatility is in store but the current direction should hold as long as SPY trades above its recent lows. This brings me to one particular sector and symbol, but before we dive into that let’s break down the current market conditions.

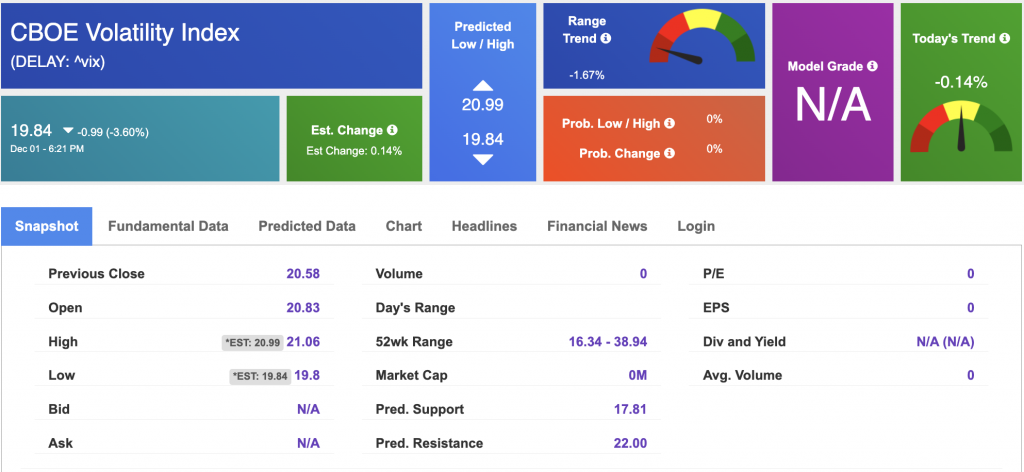

The $VIX is trading near the $20 level. In the SPY, overhead resistance levels sit at $410 and then $416. The $SPY support is at $390 and then $380. The market will probably keep rallying for the next two to four weeks, as it’s trading in a well-defined range right now. I’m not bullish or bearish at the moment, and I advise readers not to buy just because prices are going up or sell just because they’re dropping.

Looking at Treasury yields, the short 2-year yield approached 3.5% after trading extremely high while the 10-year yield approached 3.5%. Looking at the dollar, while the latest swing had it move higher the dollar still appears weak and could fuel the rally. As previously stated, I expect a short Christmas rally while the Bear market will continue next year – when the next earnings season will start impacting the market next.

With better-than-expected GDP and inflation data supporting markets, and an expectation of a more hawkish Fed, the focus now turns to the upcoming FOMC meeting after Friday’s employment data. This puts one particular sector in a great spot to rally for the coming weeks.

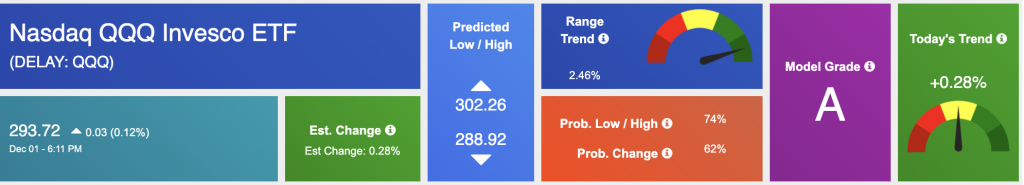

With interest rates going down and a dollar that is also trading lower, tech becomes an optimal sector to book profits as we wrap up 2022. When it comes to tech there is just one ETF I use as my go-to tech symbol: Nasdaq QQQ Invesco ETF (QQQ).

The symbol tracks the Nasdaq’s movement and is one that ranks at the top of my data universe for accuracy. With a model grade “A” as seen above, QQQ is in the top 10% for accuracy within my data universe and the symbol is currently flashing great signals for an upward swing.

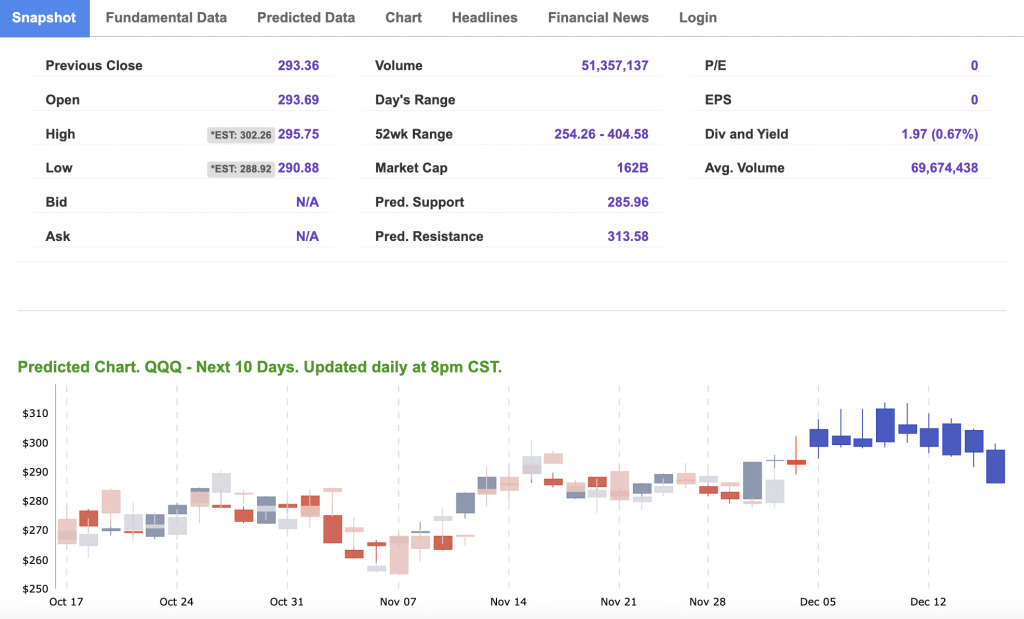

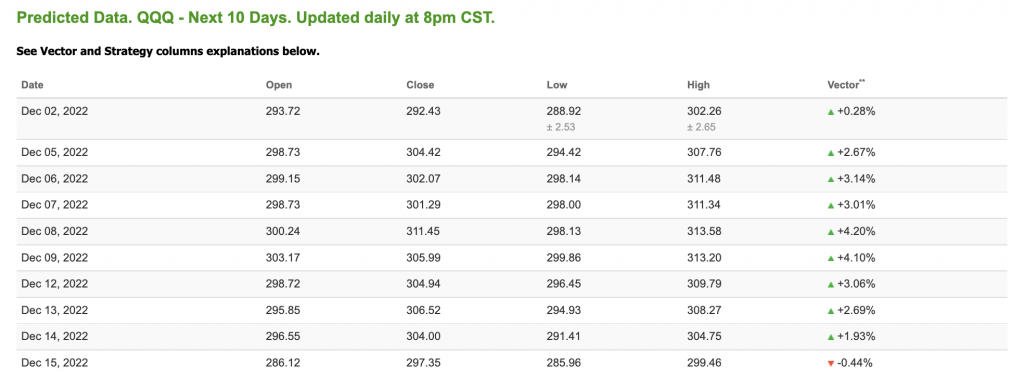

Trading near the 52-week low, there is plenty of room for the upside for this symbol and with several market-supporting events ahead of us, I believe that’s exactly what we are in store for. Likewise, looking at the forecast’s vector trend via the predicted data, QQQ is primed for a great run in the next ten days with the current vector trend being a steady and strong one towards the upside.

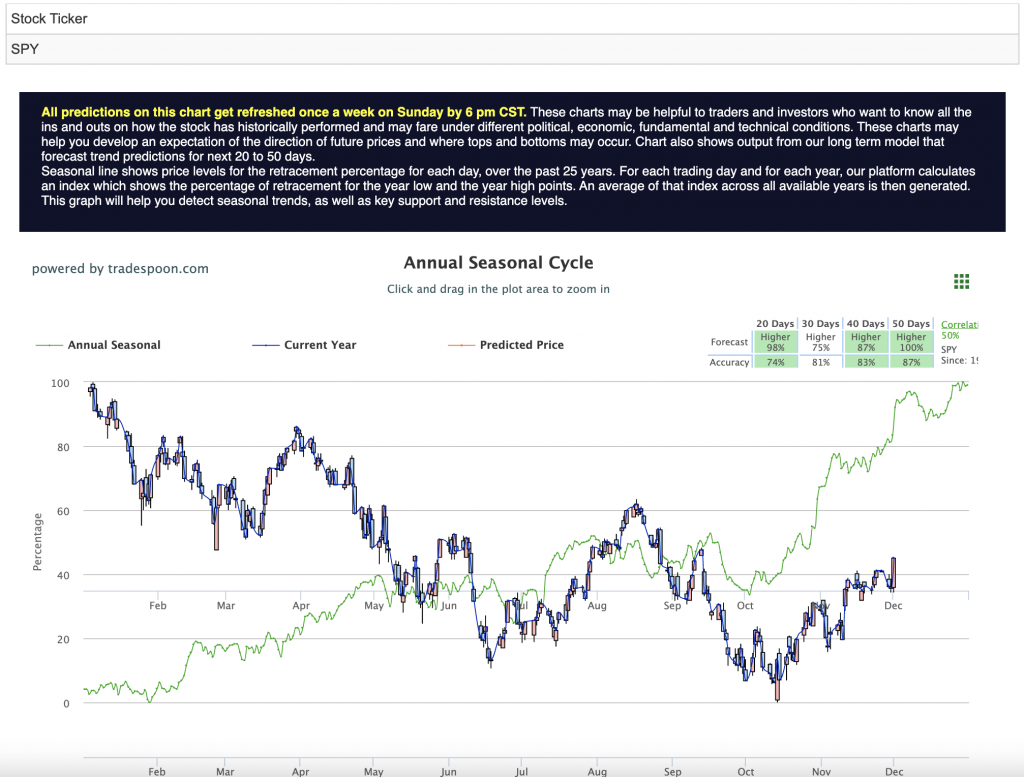

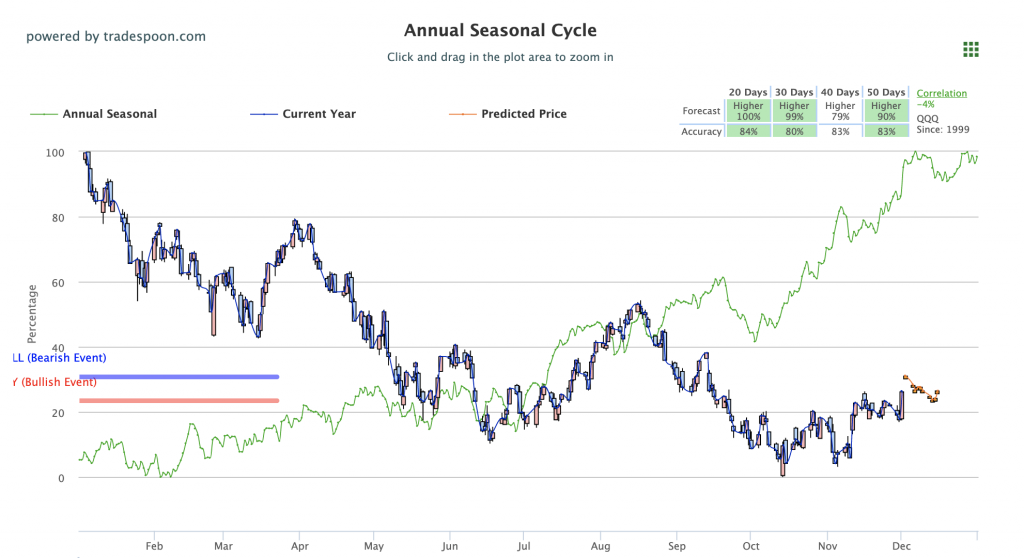

Looking into the Seasonal Chart of $QQQ, our model for longer-range forecasts, we see several additional positive indicators. Specifically, the symbol has developed a sizable gap between the annual seasonal price and its current price, which could push the symbol higher in the coming weeks. However, the most impressive signal is that of all four time ranges flashing the trading “higher” signal for the 20, 30, 40, and 50-day ranges. This is great when viewed through the lens of the upward swing that is predicted in the market through the end of 2022. See QQQ Seasonal Chart below:

Usually, the market rallies near the end of every year, and I presume that this pattern will continue. Even though the bear market might come back next year, QQQ is presently in a great spot to purchase before any future rallies occur. According to my recent findings after analyzing different market trends, I am positive about QQQ’s potential success in the future.

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

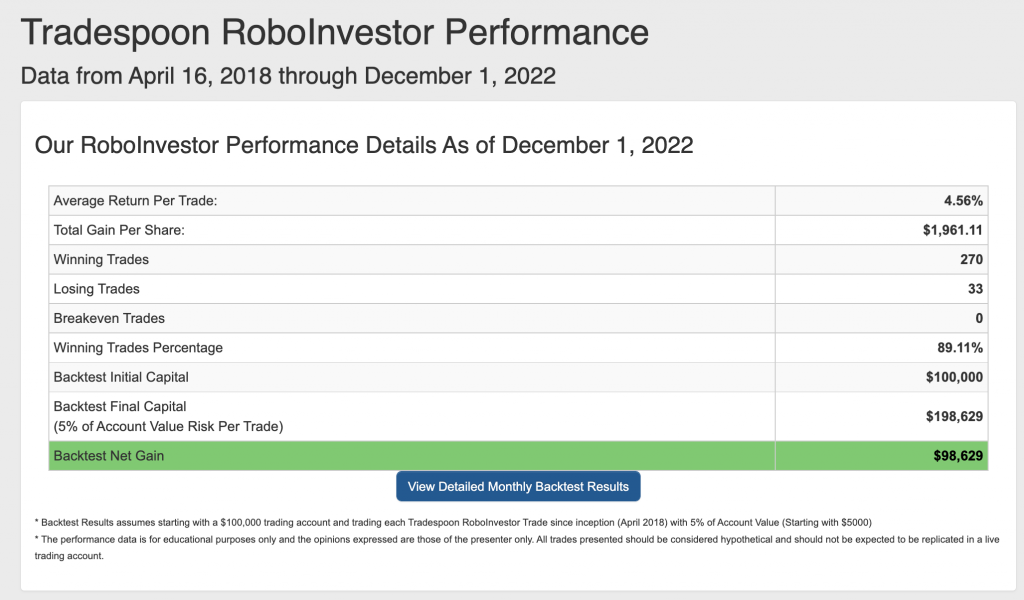

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 89.11% going back to April 2018.

The market continues to shape up to be as unpredictable as I’ve seen since the pandemic broke out in early 2020 – and we just started Q4! Inflation, Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!