Despite many central bankers’ hawkish comments about inflation recently, the stock market had its best day in a month with all three major U.S. indices closing in the green. The Nasdaq rose over 2% while the Dow and S&P saw nice gains of over 1%. On Wednesday, Federal Reserve Vice Chairman Lael Brainard said that “the [Federal Open Market Committee] will need to raise rates even further and maintain rates at exceptionally high levels for an extended period of time in order to provide confidence that inflation is declining toward target.” Also on Wednesday, we saw the release of the latest Beige Book which showed that, although the U.S. economy grew slightly by the end of August, surveyed individuals have a generally weak outlook for the coming year because of labor and supply shortages as well as rising interest rates. The study is published ahead of the Federal Open Market Committee meetings and provides comprehensive statistics that can assist with important economic decisions. Stocks have given up much of their mid-August gains as the summer bounce came to an end, with Federal Reserve officials indicating that they are unlikely to reverse course on higher interest rates this year or the next.

According to the Beige Book, increased prices from earlier in the year have begun to dissipate, after hitting a record high of 9.1% in June, but inflation remains “high.” In nine of the 12 Federal Reserve districts across the country, prices increased at a “less rapid” pace during the surveyed period, although prices still rose overall. The U.S. economy expanded slightly according to a Federal Reserve survey- however, the outlook for the next twelve months is bleak because of climbing interest rates and an inadequate labor supply that fails to meet industry demands. Although not as severe, shortages in labor and resources still caused issues for the economy. The labor market is as tight as ever, the Fed found, and that’s pushing up wages as companies compete for workers. There was some good news–consumer spending remained the same even as Americans spent more money on leisure and hospitality activities. On Wednesday, another report was released which showed that the U.S. trade deficit fell to a nine-month low of $70.6 billion in July, adding to the notion that the U.S did not fall into a recession during the first half of 2022.

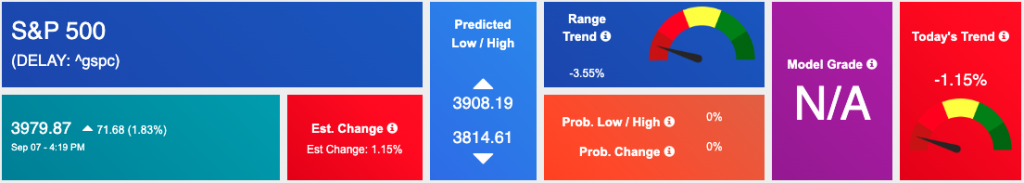

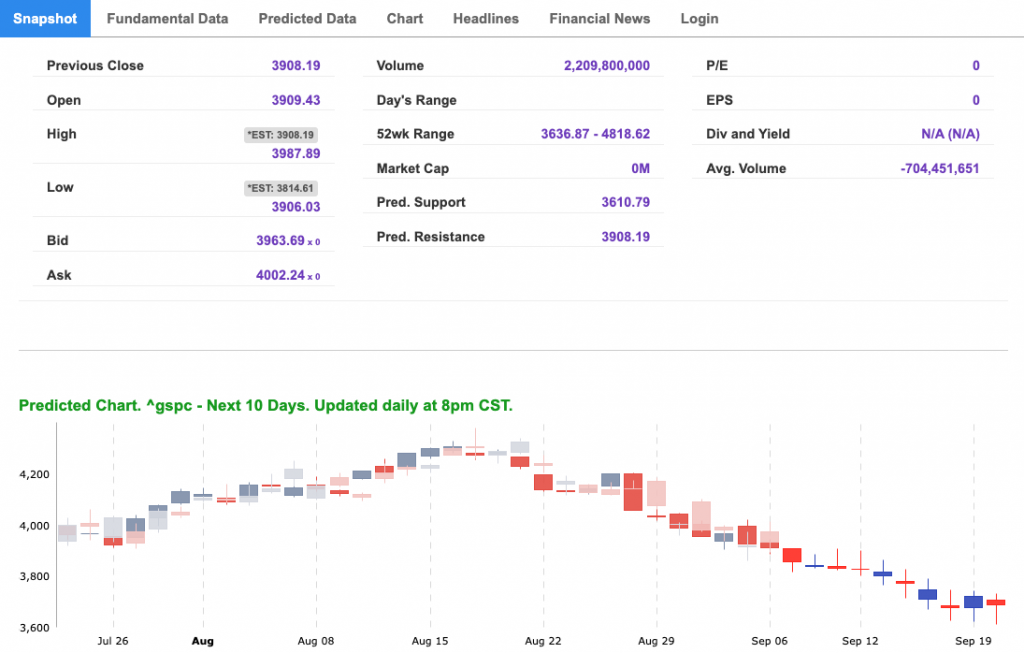

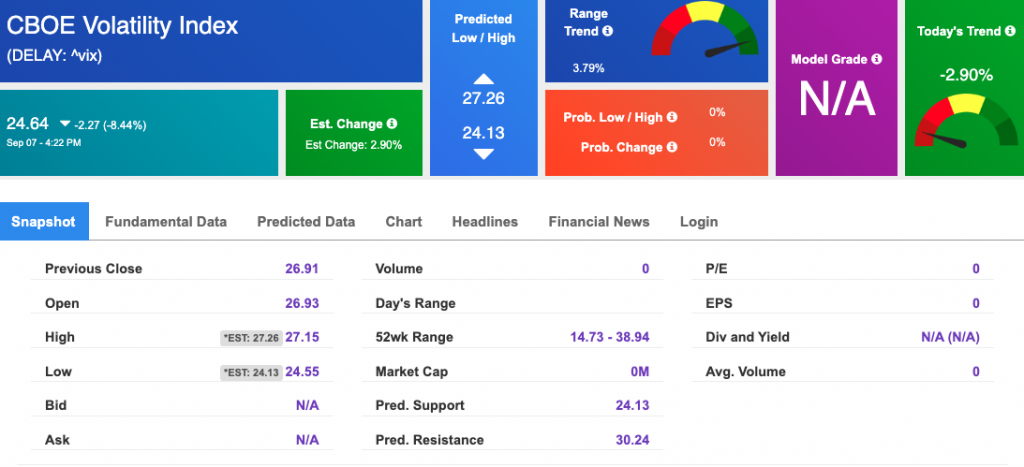

To finish off the week, look out for $ZS, $HR, and $COUP earnings, and the ECB decision on Thursday which can influence the next move in the market. We are monitoring the overhead resistance levels in the SPY, which are presently at $396 and then $404. The $SPY support is at $390 and then $380. We expect the market to continue the current pullback for the next 2-8 weeks. Globally, both Asian and European markets closed with mixed results while the VIX traded higher, near the $28 level. We encourage all market commentary readers to maintain clearly defined stop levels for all positions. For reference, the SPY Seasonal Chart is shown below:

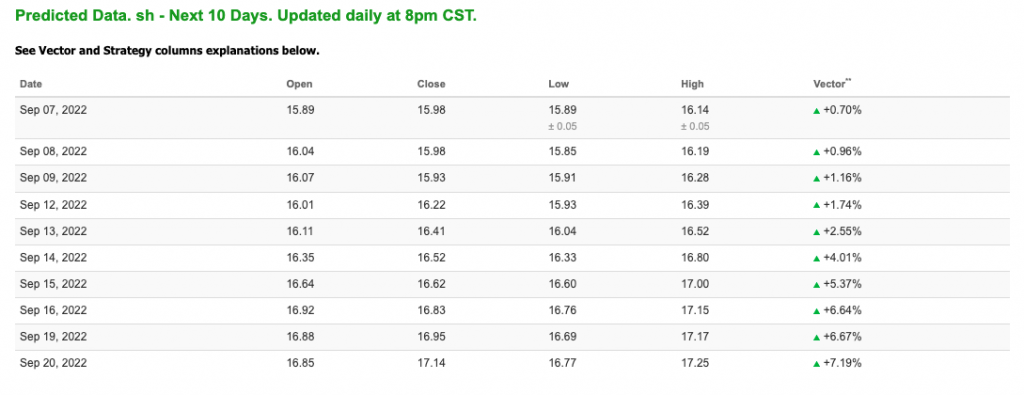

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

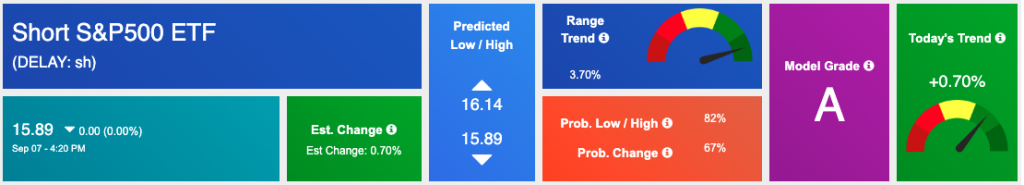

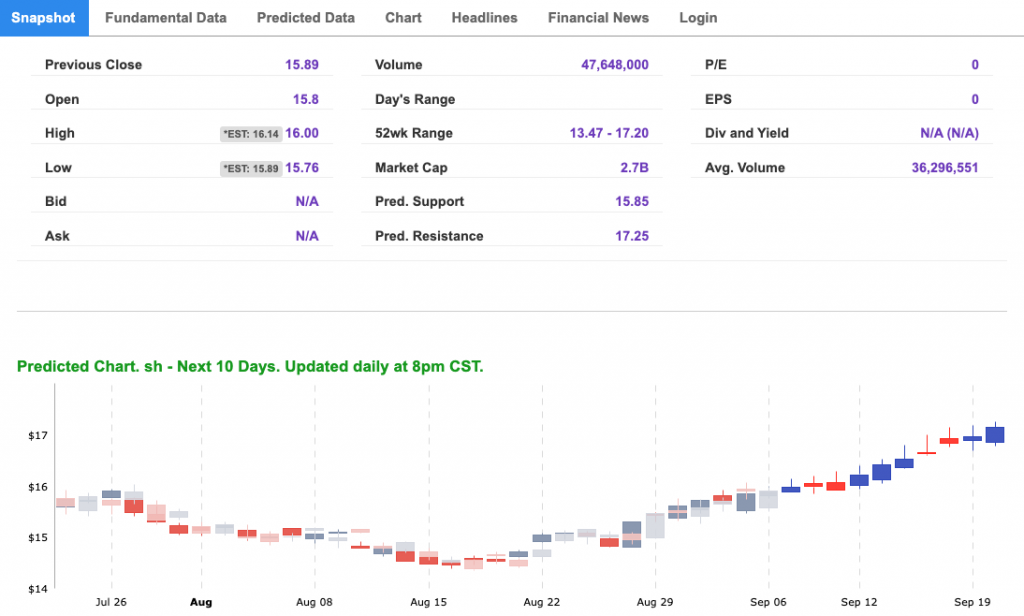

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, SH. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

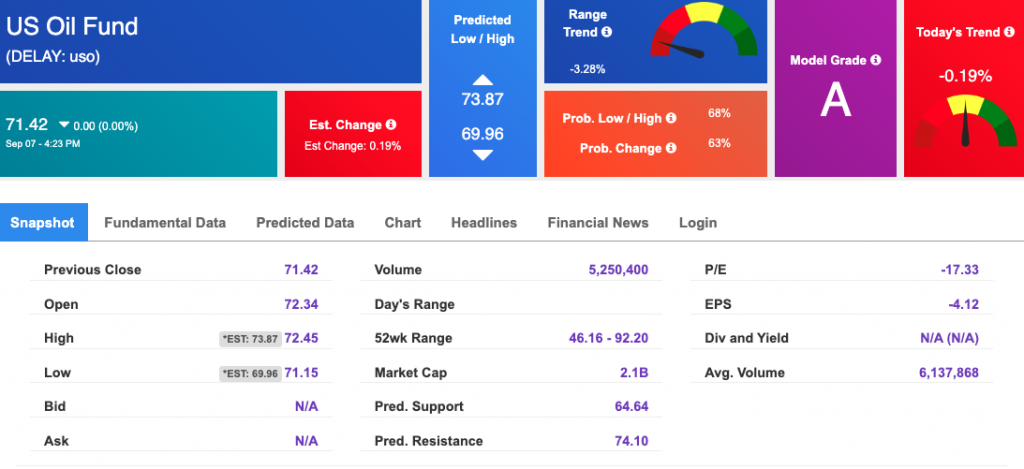

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $81.66 per barrel, down 6.01%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $71.42 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

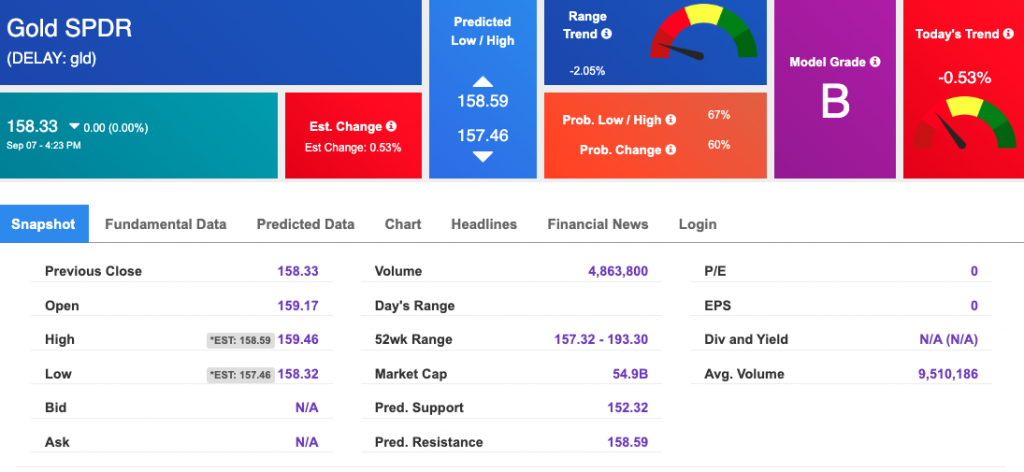

The price for the Gold Continuous Contract (GC00) is up 0.97% at $1729.60 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $158.33 at the time of publication. Vector signals show -0.53% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

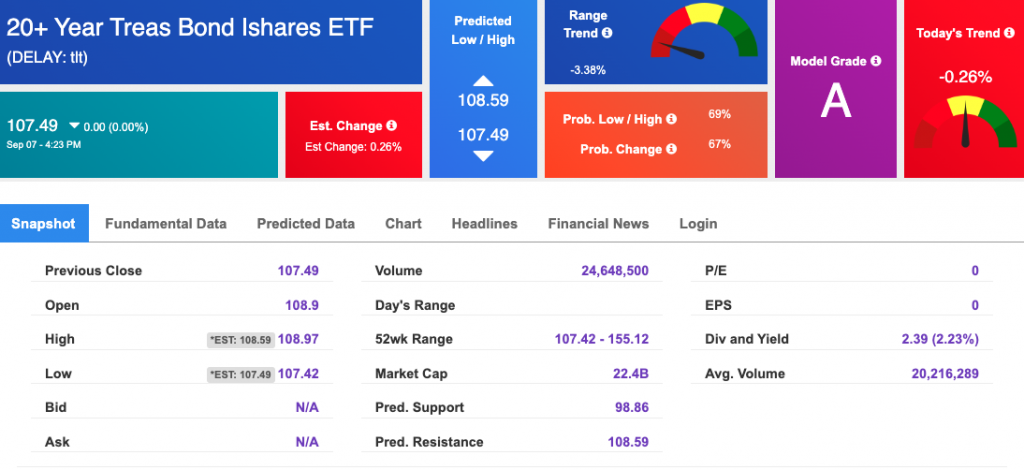

The yield on the 10-year Treasury note is down, at 3.267% at the time of publication.

The yield on the 30-year Treasury note is down, at 3.414% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is $24.64 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!