The past week has been a whirlwind for investors, characterized by a flurry of economic indicators, corporate earnings, and geopolitical events that have sent shockwaves through financial markets. From Federal Reserve Chairman Jerome Powell’s remarks on inflation to the release of the Beige Book and the latest retail sales figures, investors have been grappling with a myriad of factors shaping market sentiment.

Investor sentiment was jolted by remarks from Federal Reserve Chairman Jerome Powell, who acknowledged a stall in progress toward the inflation target. Powell’s remarks, which coincided with solid economic growth indicators, fueled uncertainty regarding the possibility of interest rate cuts this year. The 10-year Treasury yield breaking above the critical 4.5% level added to investors’ concerns, with speculation swirling about the potential for it to reach 5%. Such a scenario could exert significant pressure on equities, compounding the market’s unease.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Amidst this uncertainty, the release of retail sales figures provided a glimmer of hope. March’s retail sales surged by 0.7% compared to February, surpassing economists’ expectations and highlighting robust consumer spending. Additionally, core retail sales, excluding volatile sectors, saw a 1% increase, signaling underlying strength in consumer demand despite broader economic headwinds.

However, the Beige Book painted a more nuanced picture of the economy. While it indicated that the U.S. economy had “expanded slightly” since late February, firms reported greater difficulty in passing on higher costs, contributing to ongoing inflationary pressures. The findings aligned with Powell’s assessment of solid economic growth but limited progress toward the inflation target, further fueling speculation about the Fed’s monetary policy trajectory.

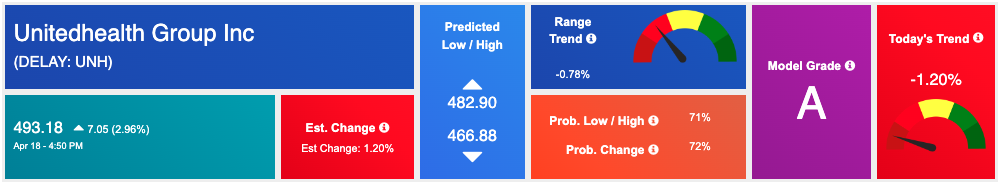

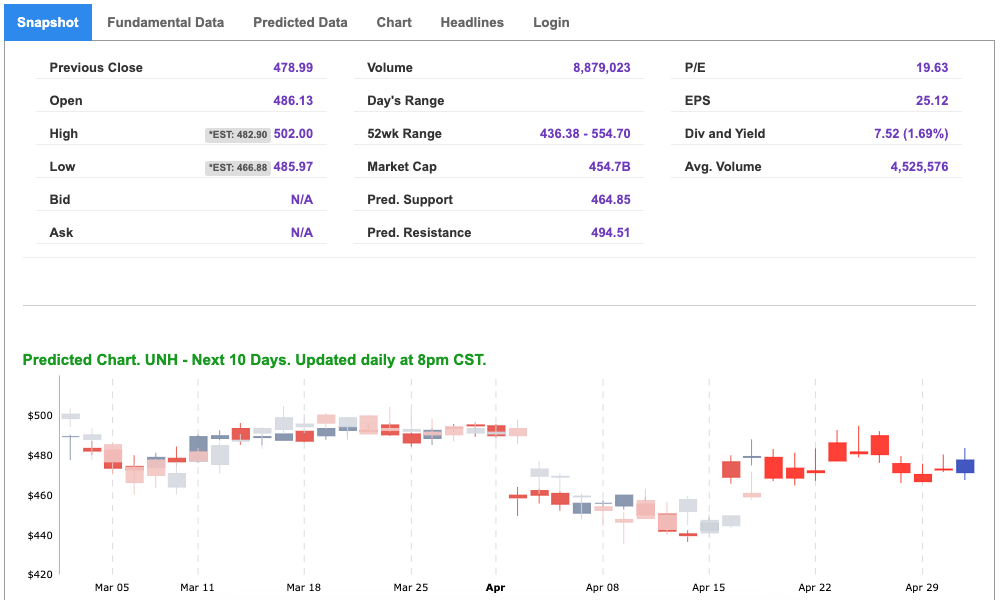

As financial markets grapple with uncertainty, corporate earnings reports provide a crucial glimpse into the resilience of companies amidst economic headwinds. Amidst the flurry of earnings announcements, UnitedHealth Group (UNH) has emerged as a standout performer, demonstrating strength and stability in a volatile market environment.

UnitedHealth Group, a leading diversified healthcare company, has consistently delivered strong financial results and maintained its position as a leader in the healthcare industry. With a diverse portfolio spanning health insurance, pharmacy benefits management, and healthcare services, UNH has established itself as a cornerstone of the healthcare sector, providing essential services to millions of customers worldwide.

UnitedHealth Group’s recent earnings report exceeded expectations, demonstrating resilience in a challenging healthcare landscape. The company’s strong performance underscores its robust business model and strategic initiatives. Amidst market volatility, UNH’s earnings offer investors confidence and highlight its reliability and resilience. In summary, UNH’s stellar performance in a volatile market cements its position as a compelling investment opportunity in the healthcare sector.

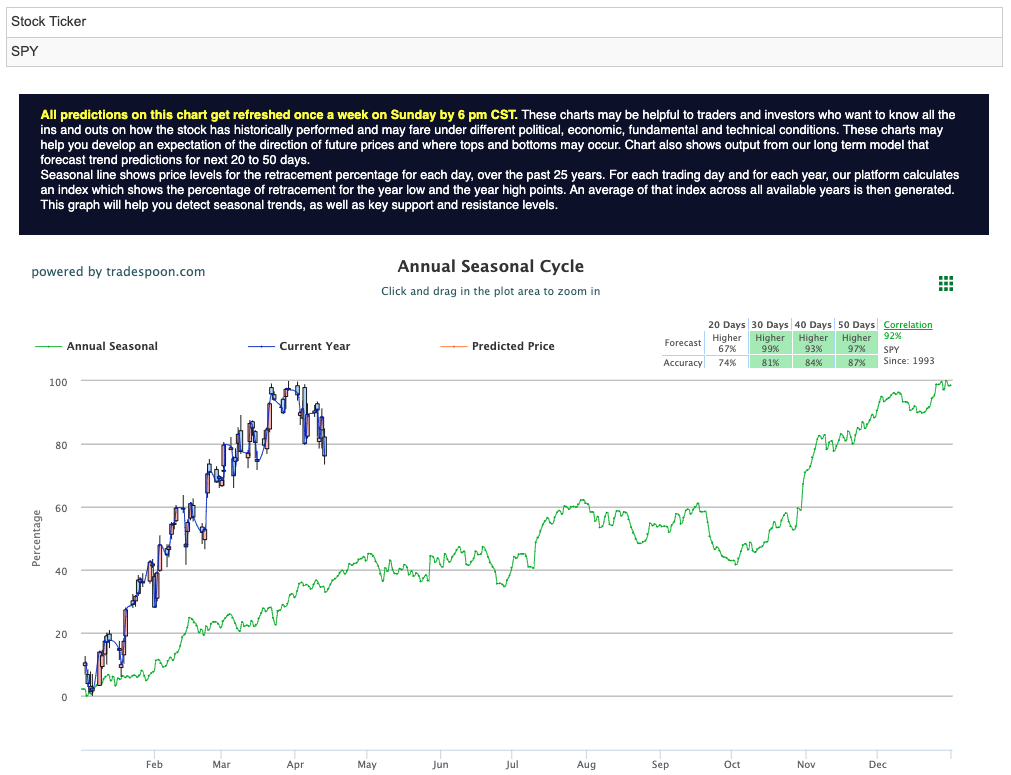

Against this backdrop, major indices, including the S&P 500, experienced heightened volatility. Technology stocks, in particular, faced headwinds, contributing to the S&P 500’s fifth consecutive day in the red. Moreover, SPY trading below its key support level of the 50-day moving average (DMA) signaled increased market fragility. With the Fed potentially holding off on rate cuts in the first half of 2024, I am adopting a neutral stance amidst rising inflation and geopolitical tensions. As we await the Fed’s April decision, the SPY rally may hit $530-$540 with short-term support at $480-$500. Expect choppy markets and a downward bias in Q2. For reference, the SPY Seasonal Chart is shown below:

As investors look ahead, they are carefully anticipating the Federal Reserve’s decision at the end of April amidst concerns about inflation and geopolitical tensions. Given the current market climate, adopting a market-neutral stance seems wise, offering a balanced approach to navigating uncertainties. While caution prevails in the broader market sentiment, ensuring a diversified portfolio and vigilant monitoring of economic indicators will be essential strategies to navigate the unpredictable landscape ahead. In these conditions, UnitedHealth Group (UNH) emerges as a strong symbol poised to weather market uncertainties.

UnitedHealth Group (UNH) stands out as a beacon of strength amidst the turbulence in financial markets. As one of the leading diversified healthcare companies globally, UNH has established itself as a stalwart in the industry. With a diverse portfolio of health insurance, pharmacy benefits management, and healthcare services, UNH is well-positioned to weather market fluctuations and deliver consistent performance.

Amidst the current market conditions characterized by interest rate speculation, geopolitical tensions, and heightened volatility, UNH shines as an attractive investment opportunity for the upcoming week. Despite the challenges posed by the uncertain economic landscape, UNH has demonstrated resilience, posting strong earnings and outperforming market expectations.

The company’s recent earnings report showcased its ability to navigate through a challenging quarter, underscoring the robustness of its business model. Furthermore, UNH’s solid performance offers investors a sense of stability and reliability amidst the market turmoil.

Given the uncertainty surrounding interest rates and the broader market sentiment, UNH emerges as a symbol to watch in the coming week. Its strong fundamentals, coupled with its proven track record of delivering value to shareholders, position it as a compelling buy opportunity.

Investors seeking stability and growth potential in volatile markets may find UNH to be an attractive addition to their portfolios. With its solid earnings and resilience in the face of market headwinds, UNH embodies strength and stability in uncertain times, making it a symbol to consider for investors looking to navigate the choppy waters ahead.

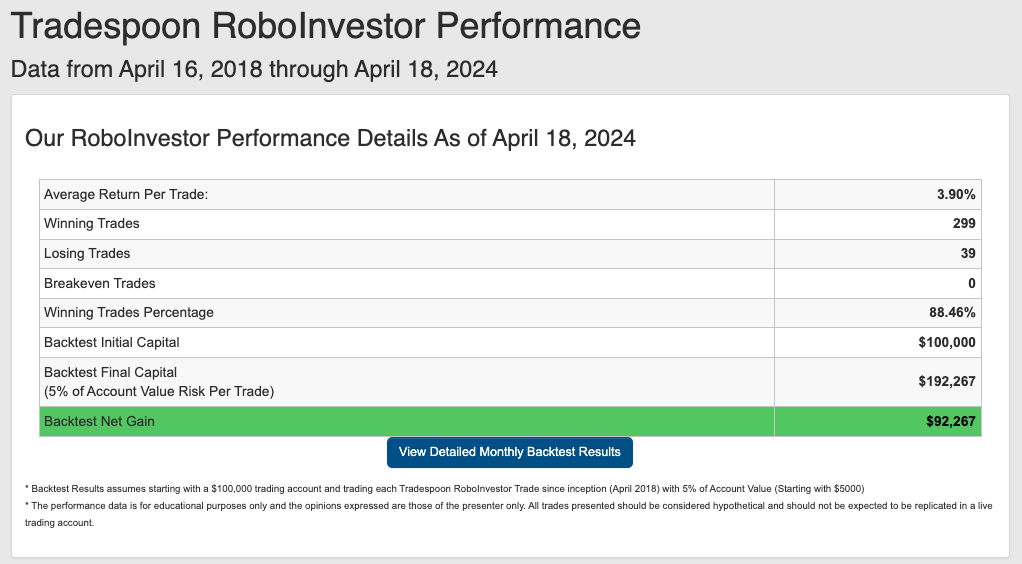

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.46% going back to April 2018.

As we navigate deeper into 2024, investors face a labyrinth of market challenges, from surging inflation to shifting Federal policies and geopolitical uncertainties like the ongoing conflict in Ukraine. In such turbulent times, having a trusted and informed investment partner becomes paramount. Enter RoboInvestor – your steadfast ally in the ever-evolving financial landscape. Offering a comprehensive array of resources and expert insights, RoboInvestor empowers you to navigate your portfolio with confidence and seize promising opportunities amidst the rapid pace of market dynamics.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!