As February concludes, financial markets remain on edge following a series of significant developments, including hotter-than-expected inflation data and corporate earnings reports. The S&P 500 and Nasdaq Composite showed resilience on Thursday, hinting at investor optimism despite lingering uncertainties.

In the wake of robust Consumer Price Index (CPI) and Producer Price Index (PPI) reports, interest rates have surged to the upper echelons, with the 10-year Treasury yield hovering around 4.3%. Concurrently, the US Dollar Index ($DXY) is grappling with overhead resistance, ranging between $105 and $107. Eyes are now turned towards forthcoming Unemployment data, with analysts closely monitoring the trajectory of interest rates, which have become the focal point of market movements.

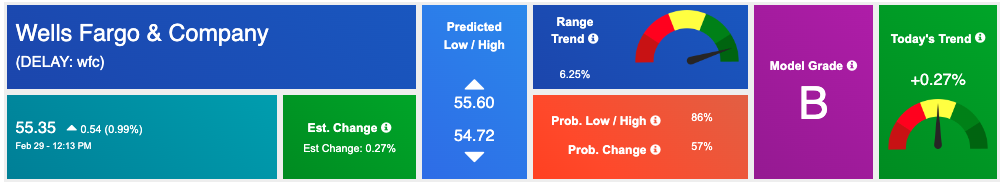

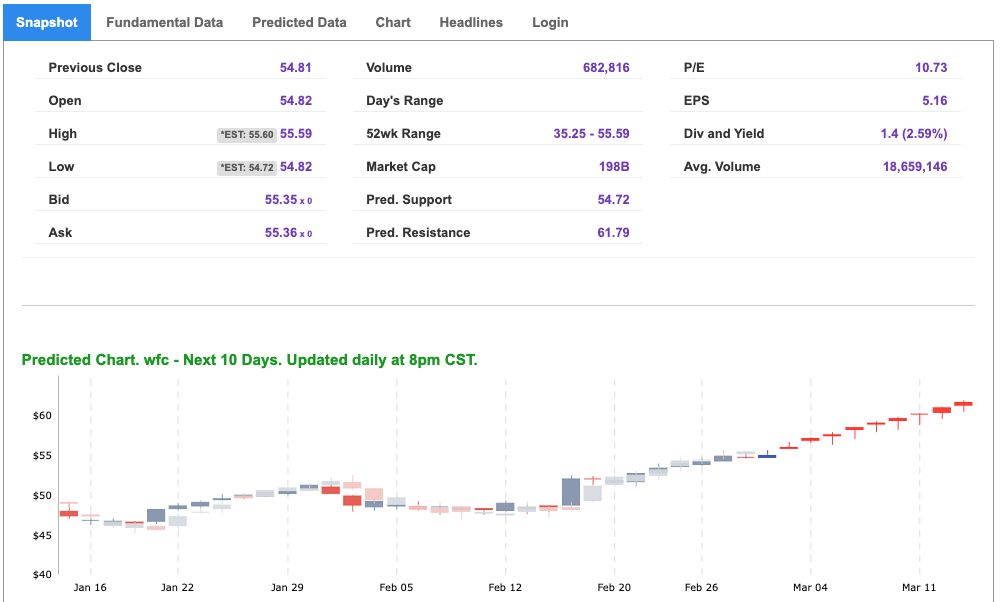

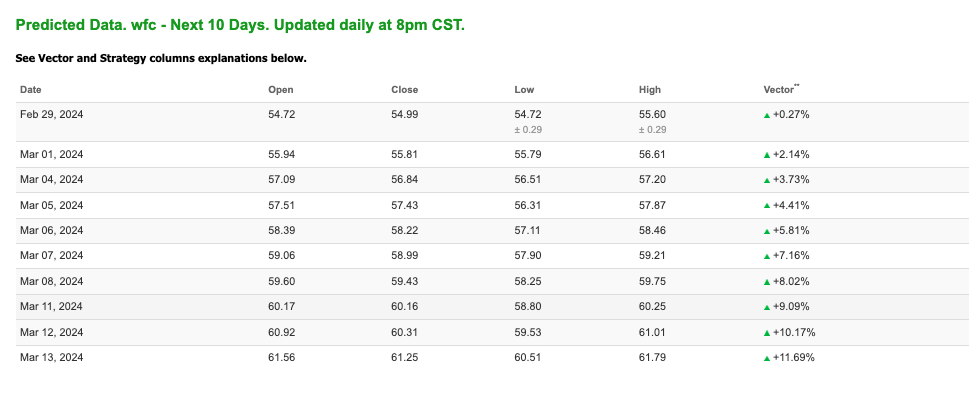

The earnings season, which is winding down, has captured significant attention, particularly the performance of major companies amid inflationary pressures. Wells Fargo ($WFC) led gains in the banking sector as optimism persists regarding the normalization of the yield curve and expectations of declining inflationary pressures.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Notably, Salesforce ($CRM) and Snowflake, prominent players in the enterprise software domain, unveiled their quarterly results, triggering varied market reactions. Salesforce surpassed expectations, reporting adjusted earnings per share of $2.29 and revenue of $9.29 billion for the fourth quarter of fiscal 2024. Despite this positive performance, the company’s outlook for the fiscal first quarter fell short of consensus estimates, prompting a modest decline in after-hours trading.

While Salesforce faced some headwinds post-earnings, other companies like C3.ai and Okta experienced more favorable receptions, with their shares soaring during the after-hours session.

Tech-heavy ETFs like the QQQ have shown signs of stalling, with limited movement over the past four weeks, even in the wake of notable earnings releases such as Nvidia ($NVDA). Conversely, sectors like biotech, ARKK, Bitcoin, and small-cap high-beta stocks continue to rally, driven by catch-up trades. The market landscape also witnessed notable events such as the gamma squeeze in Beyond Meat ($BYND) and heightened expectations for significant price movements in stocks like AMC, BYND, and Marathon Digital Holdings ($MARA).

Meanwhile, the Treasury market has experienced heightened volatility as participants reassess the likelihood and magnitude of future rate adjustments by the Federal Reserve. While many anticipate the Fed to refrain from further rate hikes in 2024 and potentially even begin easing monetary policy, uncertainties linger, particularly regarding the performance of leading tech stocks like Apple ($AAPL), Tesla ($TSLA), Microsoft ($MSFT), and Alphabet ($GOOGL).

One of the pivotal metrics guiding market sentiment is the Personal Consumption Expenditures (PCE) price index, the Federal Reserve’s preferred gauge of inflation. The January core PCE index, excluding the volatile costs of food and energy, rose by 0.4% from December, in line with expectations. While the reported increase wasn’t worse than anticipated, it underscored the persistent upward pressure on prices.

The Federal Reserve, committed to achieving its 2% inflation target, closely monitors the pace of price gains. Thursday’s data, while not alarming, indicated a notable uptick in core prices, which poses challenges for the Fed’s inflation-targeting efforts. Moreover, while the annual pace of PCE inflation remains below 3%, the strong core price reading suggests lingering inflationary pressures that could impact monetary policy decisions moving forward.

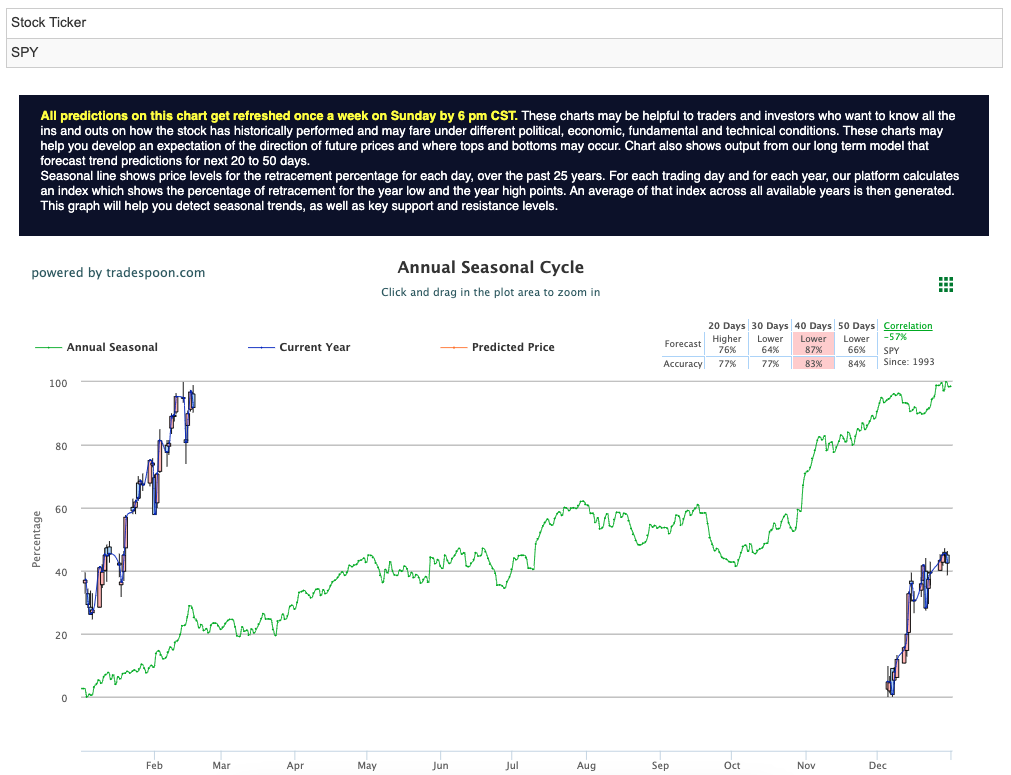

Against this backdrop, market participants are closely monitoring key levels in the S&P 500 (SPY) to gauge market sentiment and potential price movements. With the index showing resilience and hovering near all-time highs, analysts anticipate a rally potentially capped at $510-520 levels. However, amid uncertainties surrounding inflation and monetary policy, short-term support is seen around the 480-490 range, serving as a critical threshold for market stability. To provide a visual reference, the SPY Seasonal Chart is presented below:

As investors navigate through a complex landscape characterized by inflationary concerns and corporate earnings, attention to key economic indicators like the PCE data remains paramount. The interplay between inflation dynamics, interest rates, and market sentiment will continue to shape the trajectory of asset prices in the coming weeks, with implications for investors across various sectors and asset classes.

Wells Fargo & Company (WFC) is a diversified financial services company with a rich history spanning over 150 years. Headquartered in San Francisco, California, Wells Fargo operates as one of the largest banks in the United States, offering a comprehensive range of banking, investment, mortgage, and consumer finance services. Amidst the evolving landscape of financial markets, Wells Fargo (WFC) emerges as a compelling investment opportunity, supported by several key factors.

As the banking sector rallies on expectations of a yield curve normalization, Wells Fargo stands out as a beneficiary. The bank’s diversified business model, encompassing retail banking, commercial lending, and wealth management, positions it well to capitalize on improving interest rate environments.

With market participants anticipating a moderation in inflationary pressures, banks like Wells Fargo are poised to benefit from a potential easing of cost pressures and improved lending conditions. As inflation concerns subside, Wells Fargo’s earnings outlook could brighten, bolstering investor confidence in the stock.

Despite recent gains in the banking sector, Wells Fargo’s stock remains attractively valued relative to its peers. With a forward price-to-earnings ratio below industry averages and a dividend yield that provides income stability, Wells Fargo presents an appealing investment opportunity for value-conscious investors seeking exposure to the financial sector.

In conclusion, Wells Fargo (WFC) stands out as an attractive investment proposition in the current market environment, driven by expectations of yield curve normalization, easing inflationary pressures, strengthening economic fundamentals, and attractive valuation metrics. As investors navigate through uncertainties, Wells Fargo’s resilient business model and potential for earnings growth make it a compelling choice for those seeking exposure to the banking sector.

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

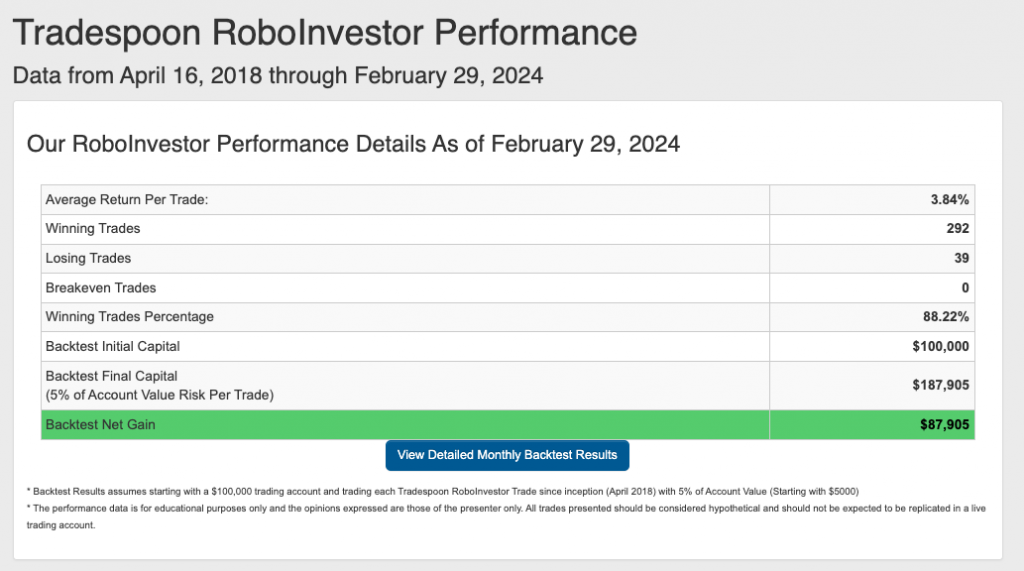

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.22% going back to April 2018.

As we step further into 2024, investors are confronted with a complex market scenario shaped by elements like inflationary forces, evolving Federal policies, and persistent geopolitical tensions, such as the ongoing conflict in Ukraine. Successfully maneuvering through this intricate landscape demands a dependable and well-informed investment platform. This is where RoboInvestor proves its worth, acting as a reliable ally by providing a spectrum of invaluable resources and expert guidance. With RoboInvestor at your service, you can adeptly oversee your portfolio and capitalize on lucrative opportunities within the dynamic and fast-paced market environment.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!