RoboStreet – January 27, 2022

Volatility Rules The Day

Wild swings for stocks are a daily event and do a real number of investor sentiment at what is historically a month for the market. This week’s Fed meeting revealed fiscal policy loaded with uncertainty and no backing off of the hawkish stance voiced back in December. In fact, one could surmise that Fed Chairman Jerome Powell was even more aggressive in his post-FOMC press conference.

Dow futures were down over 400 points overnight heading into Thursday’s session and then a strong fourth-quarter GDP print of 6.9%, well above the 5.6% consensus estimate, had the Dow up over 600 points before giving back all those gains to where the S&P and other major averages were testing the Monday lows. Most of the volatility being experienced is directly related to high-frequency trading firms where algorithms are dictating the wide price swings.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Market shakeouts are nothing new, but the new narrative is that the “Fed put,” that has been a bedrock of the primary uptrend these past several years, has been removed. And like any spoiled child, when you take away his candy they throw a fit. The real issue at work here is the Fed’s intention to raise interest rates and reduce the balance sheet to fight inflation at the same time as when there is a growing perception that the economy is beginning to slow. And this mindset needs to be resolved in order for the market to get back onto good footing.

The $SPY continued to trade in the high volatility condition and remains range-bound. The $SPY has been trading between $420 and $440 and closed at $434, below the 200-DMA. The value/reflationary closed lower, down 0.2%, below the 50-DMA. The technology sector ($QQQ) is below the 200-DMA, closed down 0.2% at $345 near the October low.

The $DXY staged an impressive rally and is approaching the recent highs. The $TLT traded lower, down 1.2%, and closed below the 200-DMA, at recent lows. The $VIX traded near 35 and closed at the 32 levels.

The $SPY short-term support level is at $420 (key long-term support) followed by $400. The SPY overhead resistance is at $460.

The $QQQ’s second wave of the sell-off is approaching the end and traded at the October low, on the extreme spike in the volatility and volume. The worst-case scenario would be a marginal break of the October low, $350 is still on the table.

I would be a seller of the high beta stocks into the rallies and continue rotating the portfolio into the value stocks ($XLE, $XLI, and $XLF). Since the DXY broke the long-term bull trend, I would accumulate $EEM, $XME, $SLV, $FCX.

The $VIX has finally reached the “extreme” levels, and one should expect $SPY to start the rebound toward the $460 level this week or next.

I would consider rebalancing portfolio at this time and have an overall market BULLISH portfolio. I do expect the $SPY’s sell-off to come to an end in the next 1-2 weeks, followed by a rebound in the next 1-2 months.

If you are trading options consider selling premium with April and May expiration dates. Based on our models, the market (SPY) will trade in the range between $400 and $470 for the next 2-4 weeks.

In terms of a forward investment strategy, our RoboInvestor advisory service will be following the lead of our AI-driven platform. Currently, our primary indicators are signaling to sell into rallies those stocks that don’t fit the narrative of long energy and defensive sectors. Small-cap stocks and high-beta stocks have been hit hard, but remain highly exposed to further downside risk.

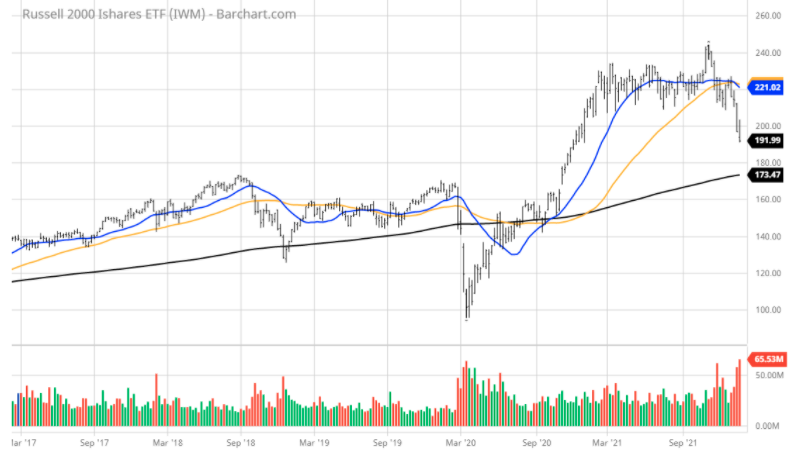

Just a quick view of the iShares Russell 2000 ETF (IWM) paints a picture of a market where risk is concentrated in the bluest of blue-chip stocks with modest to lower P/E ratios coupled with visible sales and earnings growth. There is more downside for the Russell and high price-to-sales growth stocks where earnings are non-existent.

Our AI models will screen for effective hedges and bearish opportunities in scenarios such as the present. One trade that emerged was taking the side of shorting the ARKK Innovation ETF (ARKK) – a high-beta growth stock ETF managed by the now-famous Cathy Wood who was the darling of Wall Street in 2020 when her funds raised over $50 billion in assets to invest in many of the highest-flying stocks.

Shares of ARKK are trading at $67 and look like they are on a path to $45 given the loss of appetite for stocks that carry no P/E. One way to play the downside without using put options is to buy the Tuttle Capital Short Innovation ETF (SARK) – a pure downside bet on the further decline of ARKK shares. As a specialized inverse ETF, it removes upside risk if the market rebounds, but maintains short exposure to a fund undergoing extreme multiple contractions.

When we input SARK into our AI-based Forecast Toolbox we see a continuation of upside relative strength, implying further downside momentum for ARKK. While this is a two-week prediction, it is just one way to trade the volatility with some precision. AI removes all the emotion from investing and trading, affording us to manage our RoboInvestor portfolio with a high level of confidence.

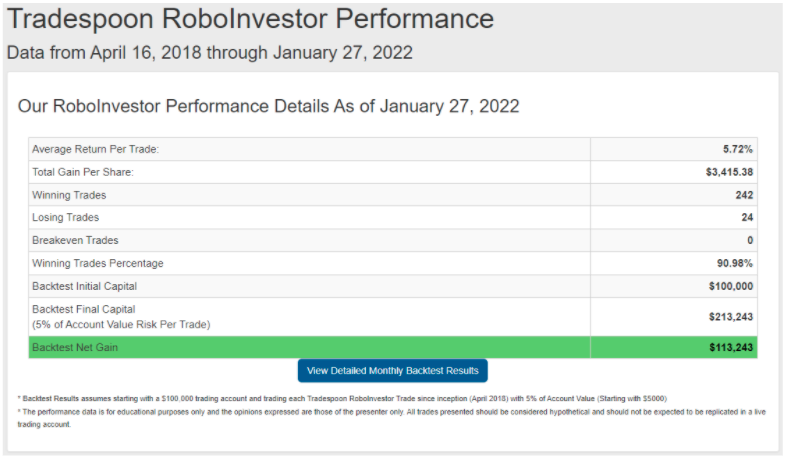

We feel pretty good about how our AI-based investing system is working – having delivered a Winning Trades Percentage of 90.98% going back to April 2018. Booking profits on 9 out of every 10 trades is uncanny, and to my knowledge, the best scorecard in the retail advisory industry, but we are getting it done at RoboInvestor.

Very simply, at RoboInvestor, utilize blue-chip stocks and ETFs in indexes, market sectors, sub-sectors, commodities, precious metals, currencies, interest rates, volatility, and shorting opportunities using inverse ETFs such as SARK. It’s an unrestricted service that finds opportunities every day to profit from.

As a member of RoboInvestor, you will receive an online newsletter every other week that hits your inbox over the weekend. In it, I provide my current market commentary, a technical take, and two recommendations to act on come Monday morning. We maintain a fluid portfolio of 15-25 positions depending on market conditions and look to keep our track record intact by harvesting gains when our IT signals indicate to do so.

Join me on a mutual journey to grow wealth on a consistent basis. My personal capital is in every trade I recommend, so I’m right there with you every step of the way. As 2022 has started out in a highly charged investing atmosphere, having the power of AI is about as essential of a set of tools as one could hope for. Make RoboInvestor that set of tools for your portfolio and let’s have a great year ahead!

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!