This week marked a crucial turning point for financial markets, driven by the Federal Reserve’s latest decision on interest rates. After a volatile midweek, investor sentiment reversed on Thursday, with all three major indices—Dow Jones, S&P 500, and Nasdaq—closing in the green. The market turnaround followed an initial decline on Wednesday after the Federal Open Market Committee (FOMC) announced a significant half-point rate cut.

The FOMC’s decision on Wednesday to reduce the federal funds rate by 50 basis points took many by surprise, as some expected a more moderate cut. Additionally, the Fed’s September Summary of Economic Projections hinted at a total of 100 basis points in rate cuts by the end of the year. This signals that the Fed may be prioritizing economic support over inflation concerns as growth shows signs of slowing.

While the announcement sparked a brief market rally, stocks closed lower by the end of Wednesday, reflecting ongoing uncertainty. Investors grappled with the mixed signals from the Fed, highlighting the complexity of balancing growth stimulation and inflation management.

Earlier in the week, the Dow Jones Industrial Average kicked off on a strong note, closing at a record high on Monday, thanks in part to falling bond yields. The lower yields, which are often seen as an indicator of lower borrowing costs, fueled optimism that the Fed would take a dovish stance. While the S&P 500 also gained, the Nasdaq lagged slightly as the tech-heavy index awaited the Fed’s critical decision later in the week.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

In a surprising development, New York’s manufacturing sector reported its first growth since November, signaling an unexpected economic boost. This optimism fed into expectations of a Fed rate cut, which many hoped would further spur business activity and stabilize market conditions.

However, the calm was short-lived as Wall Street braced for a series of economic data releases that would provide more clues on the Fed’s next steps.

On Tuesday, the U.S. Census Bureau’s report on retail sales showed moderate growth. Retail and food services sales increased by 0.1% in August, reflecting slow but steady growth. Year-over-year, sales were up 2.1%, with total sales for the June-August period rising by 2.3% compared to the same period in 2023.

When adjusted for inflation, the retail picture appeared less rosy. Real retail sales declined by 0.14% month-over-month, and on a year-over-year basis, they were down 0.45%. The subdued growth, despite easing inflation, highlights the challenges facing consumer demand in the current economic landscape. This data initially supported a rise in the S&P 500, as investors remained hopeful that the Fed’s half-point rate cut would provide a needed economic boost.

The Fed’s bold rate cut reverberated across global markets. In Europe, major indices like the Stoxx 600, Paris’s CAC 40, and London’s FTSE 100 saw gains, mirroring the U.S. market’s response. The optimism extended to Asia, where Japan’s Nikkei 225 jumped 2.1%, and Hong Kong’s Hang Seng Index closed up 2%.

Yet, currency markets showed signs of stress. The Japanese yen neared multi-year highs, and volatility in U.S. Treasury yields, which ended Wednesday at 3.685%, reflected the uncertainties surrounding global monetary policy. The U.S. Dollar Index, tracking the dollar against other major currencies, swung wildly in response to the rate cut, signaling that further volatility could lie ahead.

Labor market data released on Thursday also fueled investor sentiment. Initial jobless claims for the week ending September 14 came in at 219,000, down from 231,000 the prior week. The decline in jobless claims supports the narrative of a relatively stable labor market, even as unemployment ticked up to 4.2%. These labor trends, along with moderating inflation, gave the Fed more room to focus on economic growth over price stability.

This week also marked the expiration of options (OPEX), a regular occurrence that tends to heighten market volatility. As traders repositioned and recalibrated their portfolios, market swings became more pronounced. The VIX, commonly referred to as the “fear gauge,” rebounded to 18, reflecting a rise in market anxiety following a mix of worse-than-expected economic data and rate uncertainty.

Gold surged to new all-time highs following the Fed’s decision, as investors sought safe-haven assets amid a weaker dollar. Treasury markets remained extremely volatile, with the 10-year yield fluctuating between 3.6% and 4.4%. This volatility is often seen as a sign that market participants are recalibrating their expectations around the timing and magnitude of future Fed rate cuts.

Bonds, in particular, are flashing warning signs of a potential recession, as investors continue to price in the likelihood of slower economic growth. The bond market’s distress could be further exacerbated if the Fed’s rate cuts are not enough to stave off economic cooling.

Given the current environment, I maintain a market-neutral stance. While inflation is coming in within expectations and corporate earnings have been better than anticipated, risks remain. The potential for small bank failures due to exposure to commercial and residential real estate, coupled with increasing unemployment, raises concerns about broader economic stability.

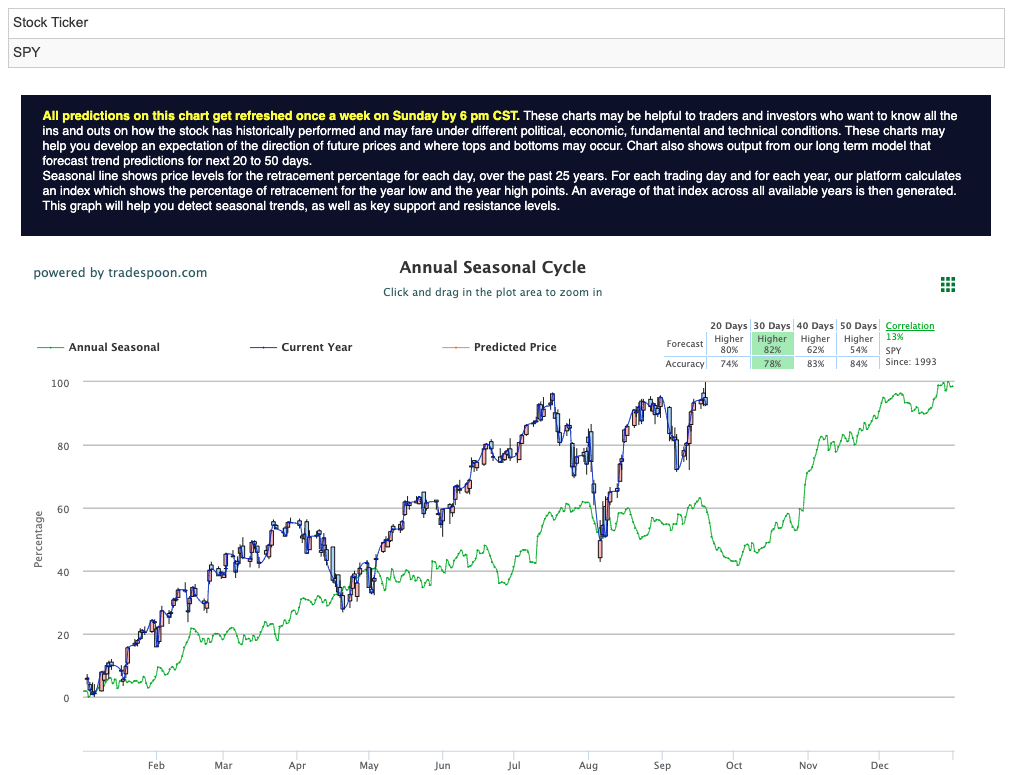

The S&P 500 appears to have a rally cap in the $560-$575 range, with short-term support expected between $480-$510 over the coming months. For now, I anticipate the market will trade sideways in the short to medium term, with long-term trends remaining intact. However, caution is warranted, and I would recommend holding off on deploying additional capital during rebounds until further clarity on economic conditions emerges. For reference, the SPY Seasonal Chart is shown below:

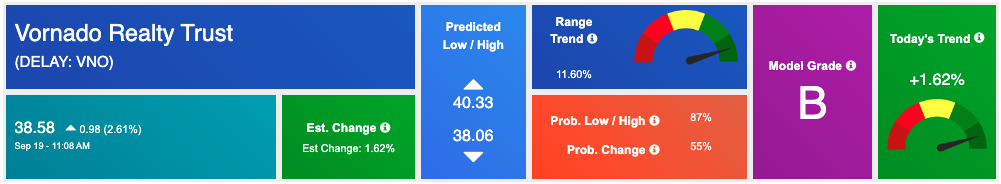

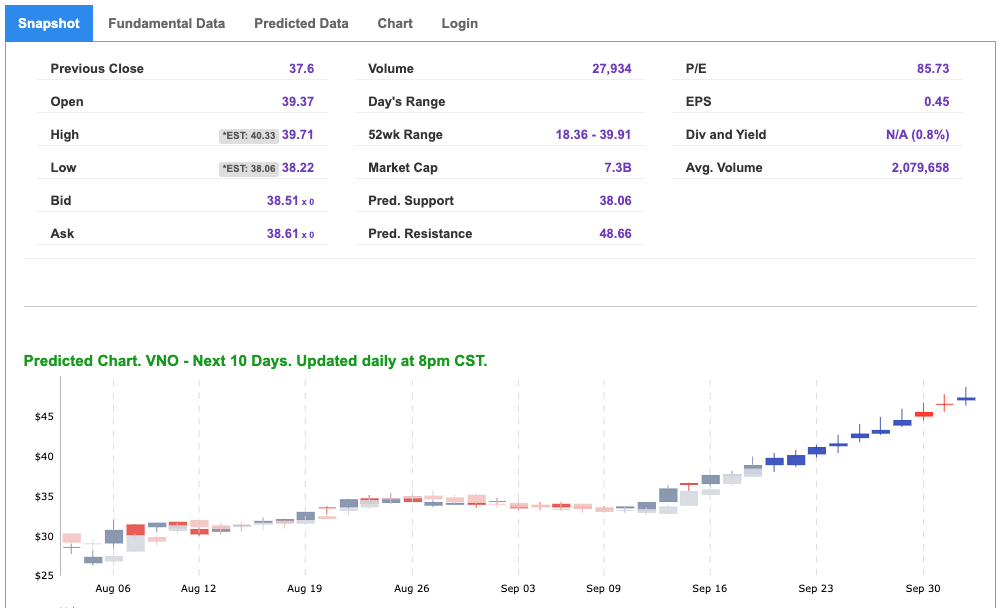

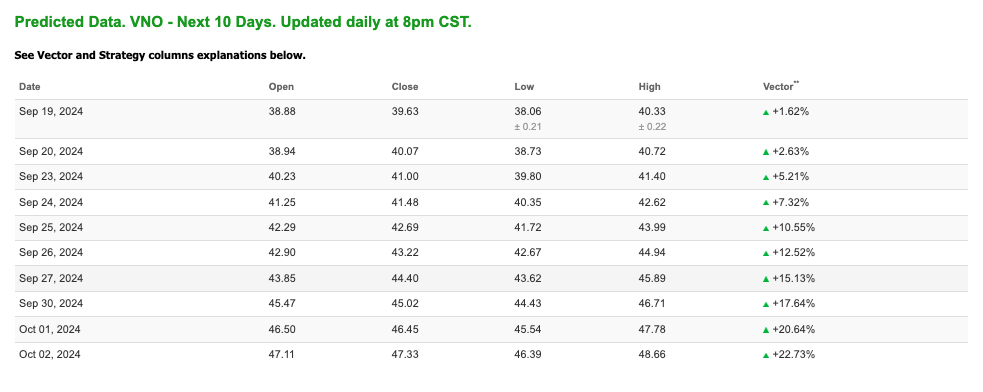

As the market navigates the impact of the Federal Reserve’s recent rate cut and ongoing economic uncertainty, attention is shifting toward sectors that offer stability and long-term growth. Real Estate Investment Trusts (REITs) have emerged as an attractive option, providing both steady income and the potential for capital appreciation. With bond yields fluctuating and the broader market facing potential headwinds, this week’s RoboStreet Pick is Vornado Realty Trust (VNO), a standout REIT poised to benefit from current market dynamics.

REITs are gaining favor in times of volatility because they offer income resilience. As bond yields continue to swing between 3.6% and 4.4%, and with the Fed moving towards more rate cuts, REITs provide a solid alternative for income-seeking investors. Vornado Realty Trust stands out as a compelling choice within the sector, boasting a strong portfolio of premier office and retail properties, particularly in New York City’s key urban locations. While concerns about commercial real estate have weighed on VNO in recent months, the Fed’s decision to reduce interest rates creates a tailwind for real estate investments by lowering borrowing costs, making VNO an appealing buy for those anticipating a recovery in the sector.

The recent rate cut directly benefits Vornado’s outlook, as lower interest rates reduce the cost of financing new real estate projects and refinancing existing debt. This is crucial for a company like Vornado, which manages high-demand urban properties that require significant capital to maintain and develop. Lower borrowing costs allow the company to optimize its portfolio and potentially unlock greater value in its premium properties.

Moreover, VNO has proven its resilience through strong income generation, supported by its consistent dividend payouts. Even amid broader economic challenges, the company has maintained its dividend, offering a stable income stream to shareholders. As inflation moderates and the labor market shows signs of stability, the risk of a severe economic downturn diminishes, reinforcing the strength of real estate assets like Vornado’s.

At its current valuation, VNO also presents an attractive opportunity for investors. The stock has been under pressure due to broader market concerns, but this has driven its price to appealing levels, especially when compared to its historical performance and industry peers. As the market adjusts to the new interest rate environment, VNO’s potential for both income and capital growth is enhanced, making it a strong candidate for investors looking to balance risk and reward.

Vornado’s prime real estate portfolio, particularly in high-demand areas like New York, positions it well for a rebound as the commercial real estate market stabilizes. While challenges remain, the company’s exposure to some of the most sought-after properties in the country gives it a unique advantage, especially as the economy continues to recover and businesses seek premium office and retail spaces.

In conclusion, Vornado Realty Trust (VNO) offers a balanced and compelling opportunity in the current market environment. As the Fed’s rate cut provides a favorable backdrop for real estate investments, VNO stands out for its strong income potential, prime real estate exposure, and attractive valuation. For investors navigating the current volatility, VNO is a timely pick that combines stability with long-term growth prospects.

Enhance your investment decisions by leveraging the power of AI with our RoboInvestor stock and ETF advisory service. Utilizing advanced technology, this service identifies trades with a high probability of profitability. Our proprietary AI platform cuts through market noise and removes emotional biases, delivering clear, data-driven insights and strategies to help you succeed in today’s dynamic market environment.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

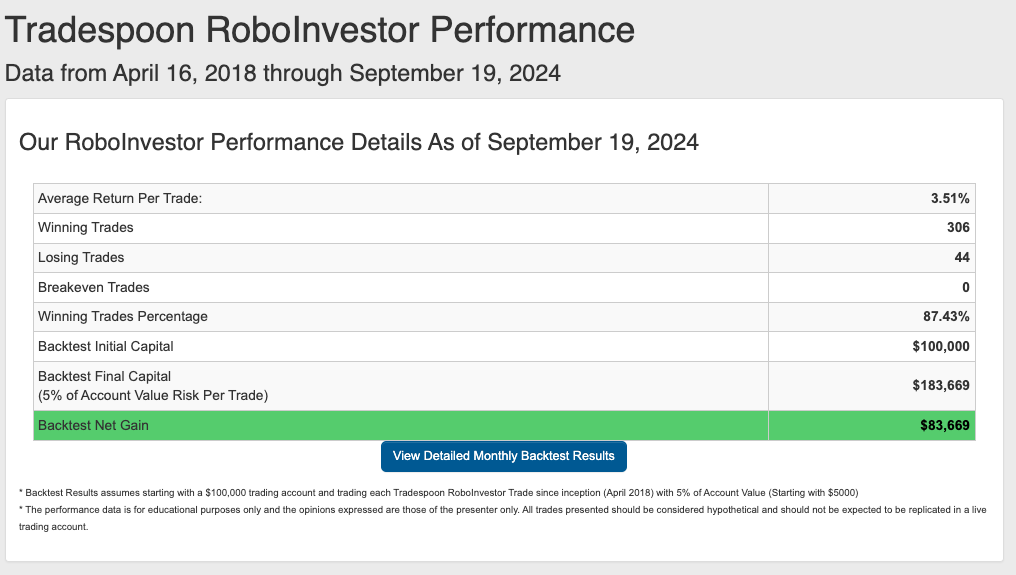

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.43% going back to April 2018.

As we advance toward the back end of 2024, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and navigating the fluctuating market conditions effectively.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!