RoboStreet – December 12, 2024

This week was marked by a mix of inflation surprises, labor market shifts, and central bank moves, all of which shaped investor sentiment as the year winds to a close. Here’s a breakdown of the key developments and their implications.

On Thursday, the Producer Price Index (PPI) for November came in hotter than expected, rising 0.4% month-over-month and 3% annually. The monthly increase was slightly above economists’ forecasts of 0.3%, and the annual rate was the highest since February 2023.

A surge in goods prices—up 0.7% in November after a 0.1% rise in October—was largely responsible for the headline increase. Food prices skyrocketed by 3.1%, with a staggering 54.6% jump in egg prices accounting for nearly a quarter of the overall rise in goods prices.

However, the core PPI, which excludes food and energy prices, offered a glimpse of progress. It rose 0.2% in November, matching expectations, though the year-over-year core figure ticked up to 3.4% from 3.1%.

Services prices, which make up the bulk of the PPI basket, increased by 0.2%, marking a third consecutive month of deceleration. Meanwhile, construction costs remained flat.

This report underscores ongoing inflationary pressures, particularly in goods and food, even as some areas—such as services—show signs of moderation.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

On the same day, the Labor Department reported an increase in initial jobless claims to 242,000, surpassing the consensus estimate of 220,000. While the labor market remains historically tight, the uptick in claims suggests some early signs of cooling as businesses prepare for slower growth ahead.

Despite the higher-than-expected PPI, markets remain confident that the Federal Reserve will deliver a 25-basis-point rate cut at its upcoming December meeting. The probability of a rate cut climbed to 98.1%, up from 97.5% earlier in the week.

However, stickier-than-expected inflation could influence the pace of future cuts. The Fed may proceed cautiously in 2025, balancing its 2% inflation target with stronger-than-expected U.S. economic growth.

In contrast, the European Central Bank (ECB) also cut its key interest rate by 25 basis points this week but signaled a more aggressive trajectory. With weaker economic growth and slower inflation in Europe, the ECB is likely to continue reducing rates into next year.

Earlier in the week, the Consumer Price Index (CPI) report showed a 0.3% monthly increase in November, slightly above expectations, and a 2.7% annual rise. Notably, housing-related inflation—a major component of the CPI—showed signs of slowing, offering hope that this historically sticky category may contribute less to inflation in the months ahead.

The personal consumption expenditures (PCE) price index, which the Fed uses as its preferred inflation gauge, has yet to fully reflect these trends. Key components like financial services, airfares, and medical services saw mixed results in November, with airfares declining by 2.1% and medical service prices remaining largely flat.

Markets dipped on Tuesday as investors treaded cautiously ahead of a key U.S. inflation report, with corporate updates fueling mixed sentiment. Nvidia saw its shares slide as China opened an antitrust investigation into the AI chipmaker, raising concerns about its growth prospects in a market that accounts for a significant portion of its revenue. Similarly, Oracle faced investor disappointment, with shares dropping sharply after its earnings missed expectations despite strong growth in its cloud infrastructure business, fueled by record AI demand.

On the brighter side, Walgreens Boots Alliance soared on news of potential buyout talks with Sycamore Partners, signaling a possible strategic overhaul that energized investors. Tesla also posted gains after an analyst upgrade highlighted confidence in the EV maker’s future growth, while Toll Brothers reported solid earnings and robust guidance for the year ahead. However, despite its strong performance, the homebuilder’s stock declined as investors took a cautious stance amidst broader market uncertainty.

These developments underscore a market grappling with competing narratives—optimism around AI and EV innovation, tempered by regulatory challenges and earnings misses. With the inflation report looming, investors appeared hesitant to make bold moves, choosing instead to weigh the evolving corporate and macroeconomic landscape.

Despite inflationary pressures, markets displayed remarkable resilience. On Wednesday, the Nasdaq Composite hit a record high, crossing the 20,000 mark for the first time, fueled by strength in technology stocks. The S&P 500 edged closer to its all-time high, while the Dow Jones wavered between gains and losses, dragged down by weakness in UnitedHealth shares.

Investors were buoyed by easing bond yields, with the 10-year Treasury yield trending lower in a range between 3.6% and 4.4%. Meanwhile, the VIX volatility index hovered at a subdued 14, reflecting optimism despite ongoing risks.

Globally, markets face additional uncertainties from geopolitical tensions, including the Russia-Ukraine conflict, Israel-Hamas war, and broader instability in the Middle East. These events continue to pose risks to market stability as investors monitor U.S. jobs data, manufacturing, and services PMIs for signs of economic performance.

Despite ongoing challenges, the long-term bullish case for equities remains strong. Inflation is gradually coming in line with expectations, corporate earnings have exceeded forecasts, and economic growth remains resilient.

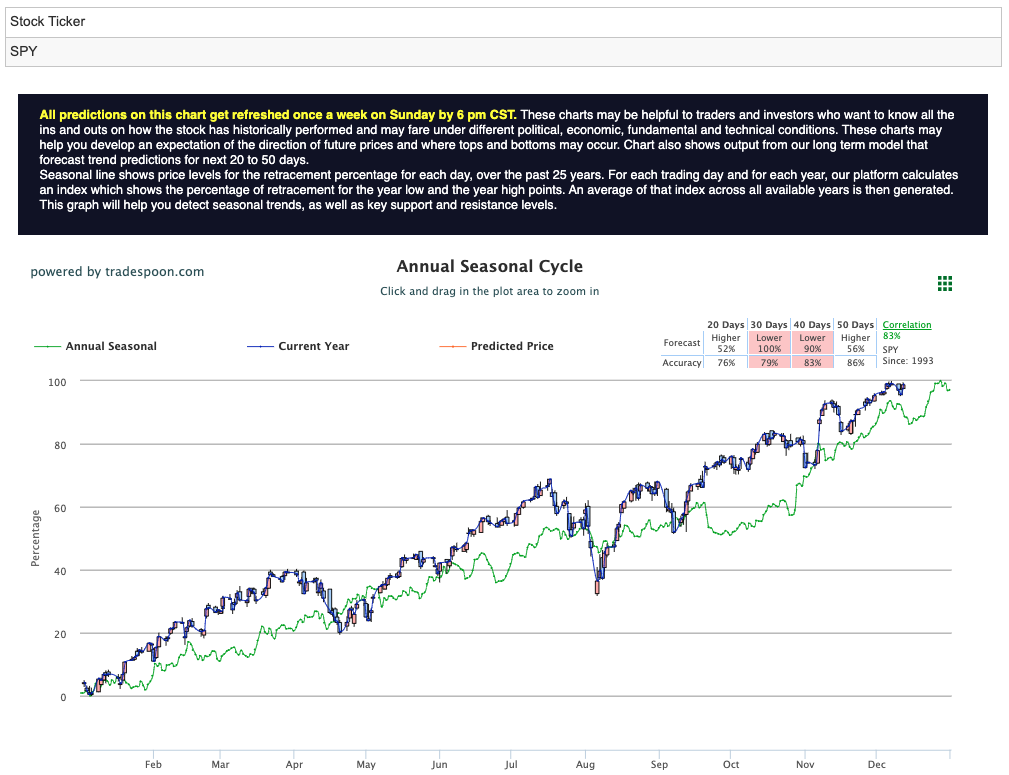

The S&P 500 rally could extend to $620-$640 in the coming months, with support expected in the $560-$580 range. However, risks such as rising unemployment, potential bank failures tied to commercial and residential real estate, and a cooling economy warrant caution.

As we approach 2025, markets will continue to balance inflationary pressures, central bank policies, and broader economic conditions. While the road ahead may include volatility, the long-term trend remains intact, with equities well-positioned to capitalize on easing inflation and economic growth.

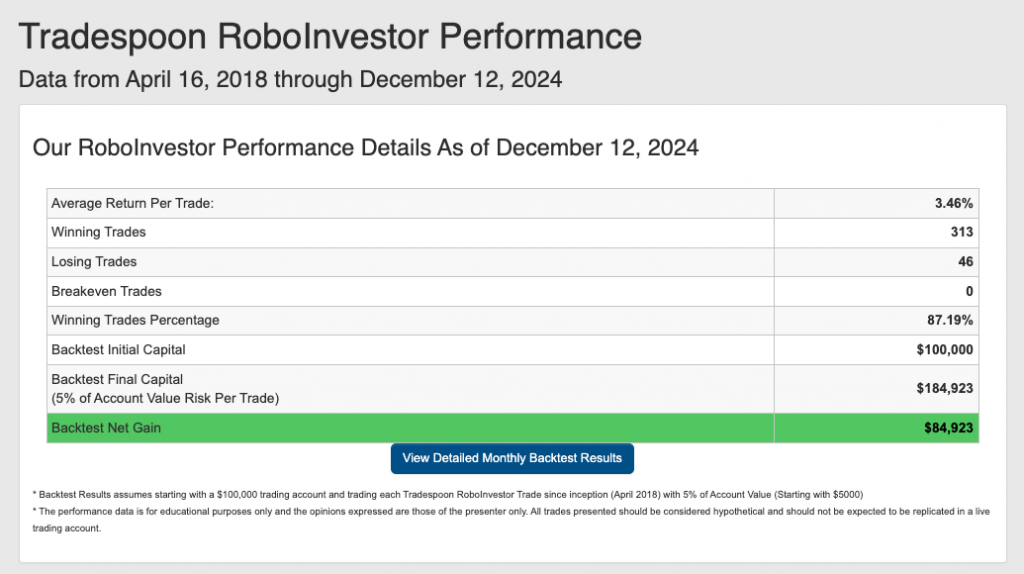

Enhance your investment decisions by leveraging the power of AI with our RoboInvestor stock and ETF advisory service. Utilizing advanced technology, this service identifies trades with a high probability of profitability. Our proprietary AI platform cuts through market noise and removes emotional biases, delivering clear, data-driven insights and strategies to help you succeed in today’s dynamic market environment.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.19% going back to April 2018.

As we near 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!