The stock market kicked off the holiday-shortened Thanksgiving week with a strong start, building on the momentum seen in recent sessions. Investor enthusiasm surged as President-elect Donald Trump’s selection for Treasury Secretary—a Wall Street favorite—was announced, signaling a continuation of market-friendly policies. The Dow Jones Industrial Average notched another record high, while the S&P 500 and Nasdaq followed suit, reflecting widespread confidence across sectors.

Treasury yields and the U.S. dollar softened to start the week, adding fuel to the rally. This shift in bond markets comes as traders and economists look toward the Federal Reserve’s final meeting of the year with heightened anticipation. The central bank faces a crucial decision: whether to cut interest rates further or hold them steady at just over 4.5%. Market sentiment is divided, with roughly equal odds of a rate cut or a pause. While the Fed has been lowering rates to support the labor market, inflationary concerns—heightened by the incoming administration’s proposals for tax cuts and tariffs—may lead policymakers to hold off on further easing.

Last week, the stock market ended near record highs, buoyed by strong corporate earnings and growing hopes of a “soft landing” for the economy. High-profile companies such as Nvidia, Snowflake, and CrowdStrike reported impressive results, showcasing strength in key growth sectors. Nvidia reaffirmed its dominance in AI and semiconductors, with robust revenue and demand for its cutting-edge Blackwell chips. However, the stock faced pressure as analysts questioned whether its high valuations could be sustained. Meanwhile, Snowflake and CrowdStrike highlighted ongoing resilience in cloud computing and cybersecurity, underscoring the selective strength within technology.

The broader economic data was more mixed. U.S. PMI numbers showed continued growth but at a slower pace, and consumer sentiment dipped slightly in November, according to the University of Michigan. While the Consumer Sentiment Index fell to 71.8, it remained an improvement over prior years. Inflation expectations also eased slightly, providing a supportive backdrop for equities.

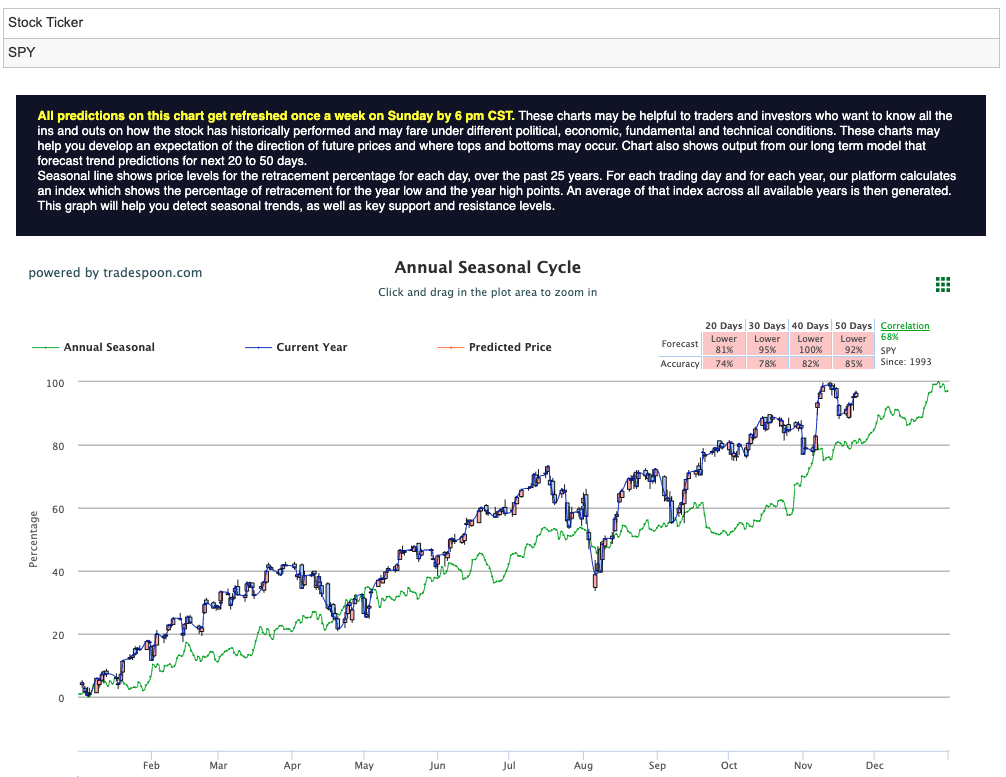

Despite these mixed signals, market sentiment remains bullish. With inflation broadly aligning with expectations and earnings continuing to outperform forecasts, the path forward for equities appears favorable. The SPY remains on track to test higher levels, with projections suggesting a move into the $600 to $610 range in the coming months. Near-term support levels are in the $540 to $550 range, which provides a cushion for any short-term pullbacks. For reference, the SPY Seasonal Chart is shown below:

However, risks remain on the horizon. The cooling economy, coupled with rising unemployment and potential challenges for smaller banks with exposure to commercial and residential real estate, warrants caution. Still, these headwinds are unlikely to derail the long-term trend, which remains upward.

Looking ahead, this week offers a packed economic calendar that could shape market direction. Key reports include September home prices, October new home sales, and November’s consumer confidence index. The Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) index, will also be released. This data, alongside the second estimate of third-quarter GDP and durable goods orders, will provide fresh insights into the economy’s health and the Fed’s progress in managing inflation.

Investors should prepare for some potential volatility as markets digest this influx of information. However, such moments often present opportunities. Pullbacks remain a chance to capitalize on the market’s longer-term strength, which continues to be underpinned by improving fundamentals and resilient corporate performance. With the year drawing to a close, the groundwork appears firmly in place for continued gains into 2025.

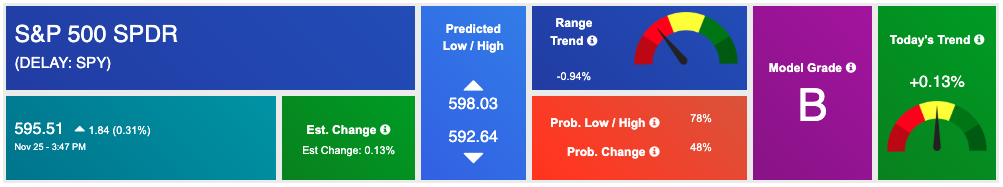

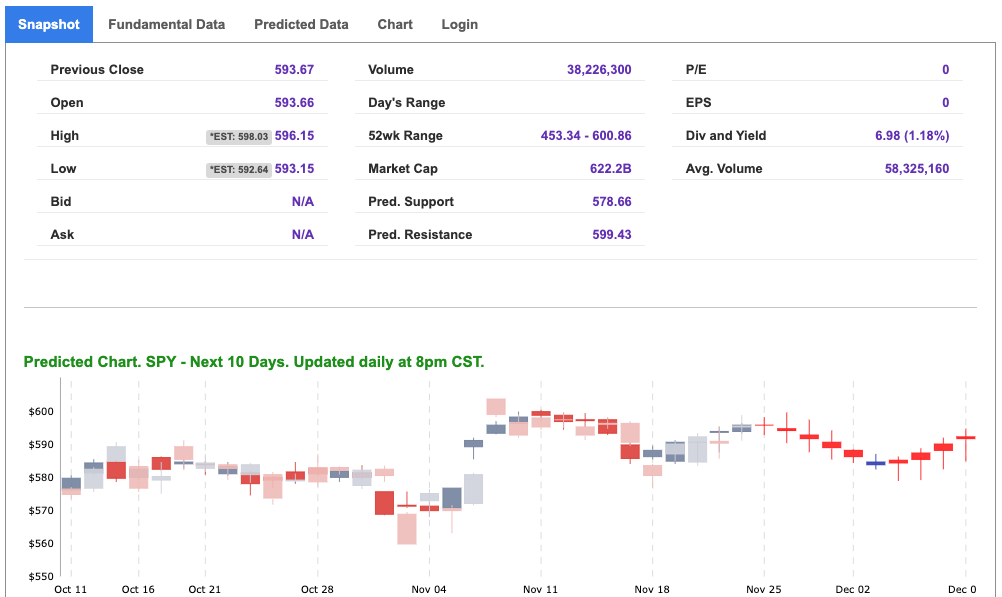

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

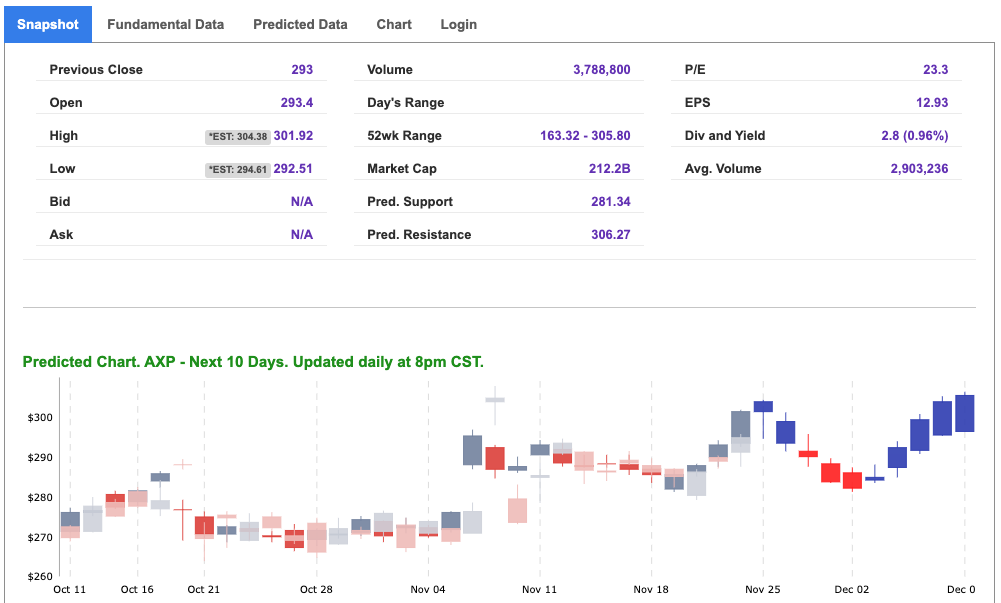

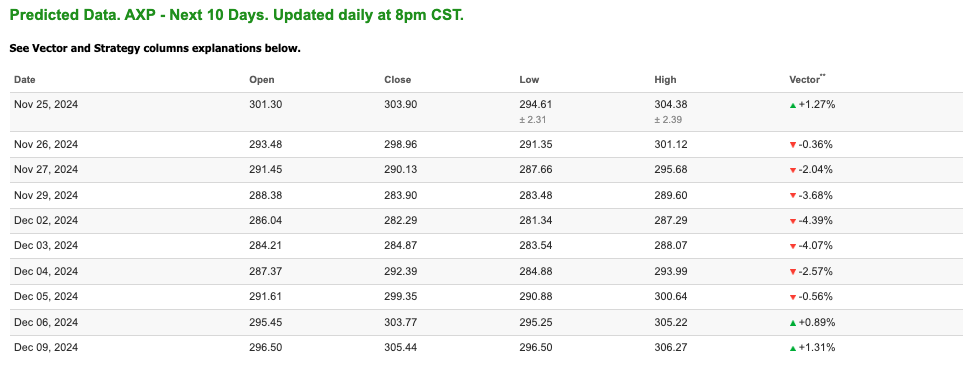

Our featured symbol for Tuesday is American Express Company – AXP is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $301.3 with a vector of +1.27% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, AXP. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

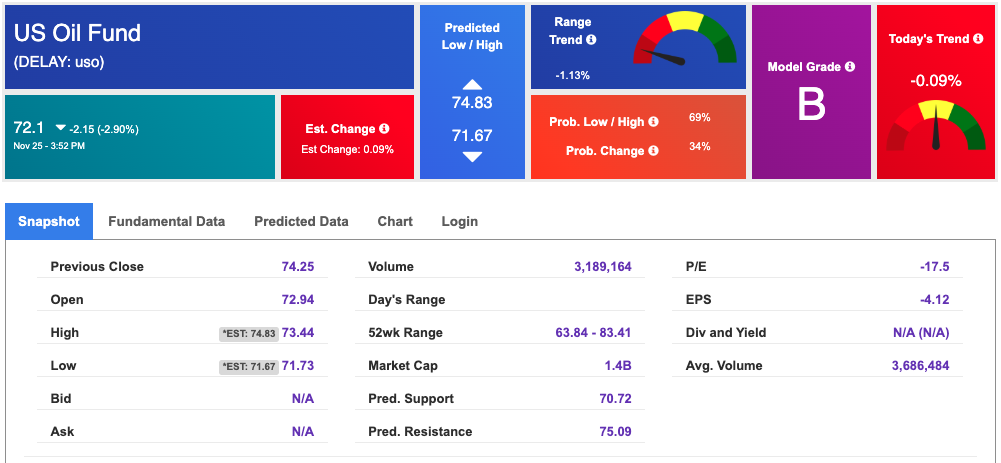

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $69.10 per barrel, down 3.00%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $72.1 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

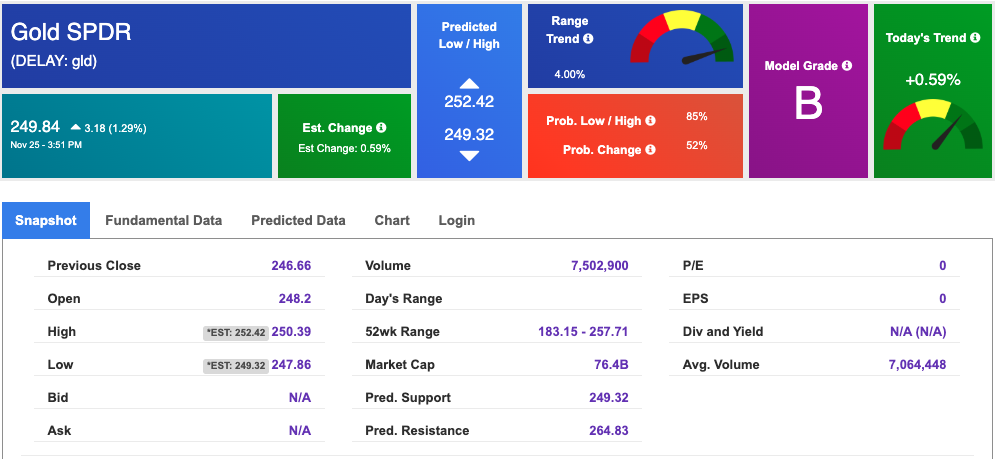

The price for the Gold Continuous Contract (GC00) is down 3.15% at $2627.00 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $249.84 at the time of publication. Vector signals show +0.59% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

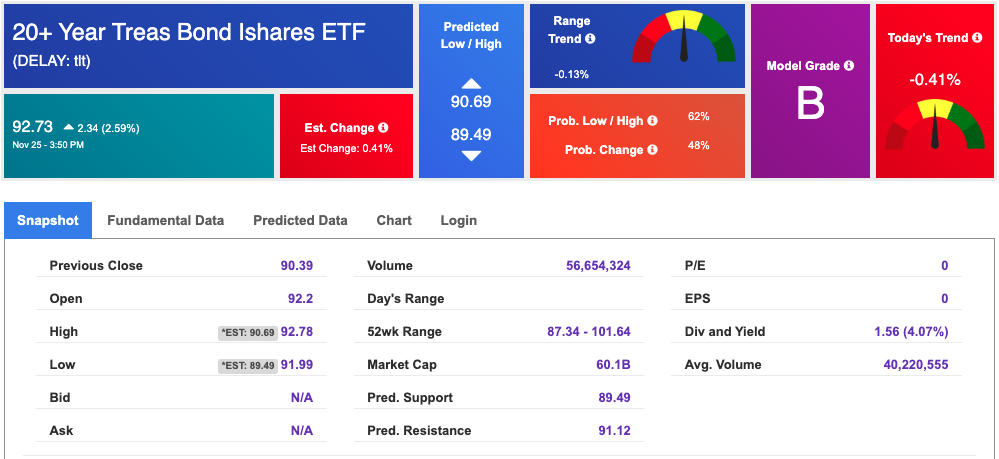

The yield on the 10-year Treasury note is down at 4.279% at the time of publication.

The yield on the 30-year Treasury note is down at 4.469% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

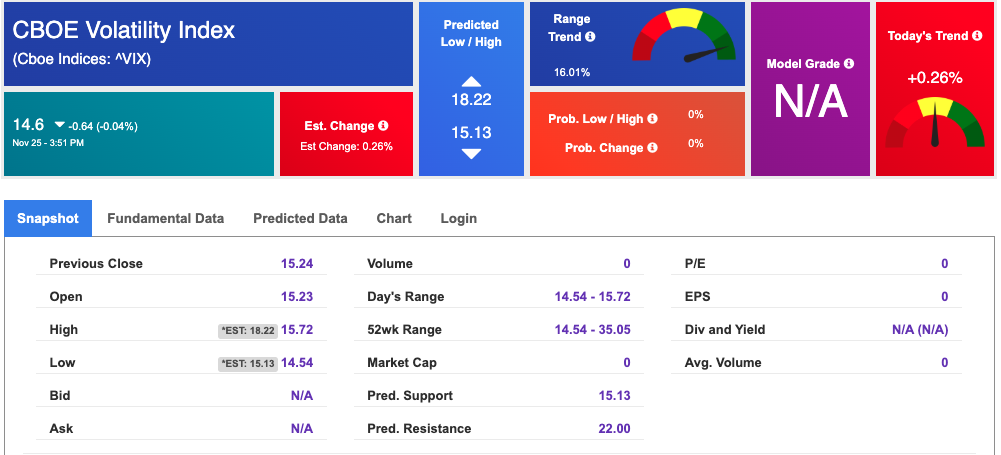

The CBOE Volatility Index (^VIX) is priced at $14.6 down 0.04% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!