The S&P 500 staged an impressive comeback on Monday, recording its largest recovery since September. After dipping as much as 0.9% earlier in the day, the benchmark index closed 0.2% higher, marking a significant intraday reversal. The last time the S&P 500 achieved such a turnaround was on September 11, when it climbed more than 1% after being down 1.6% earlier in the session. Similarly, the Russell 2000, a key measure of small-cap stocks, rebounded from a 1.4% decline to close just 0.3% lower, signaling broader market resilience.

Monday’s trading session was relatively subdued in terms of economic data and corporate earnings. However, the calm before the storm will not last, as pivotal inflation reports are due in the coming days. The Producer Price Index (PPI) is set to be released on Tuesday, followed by the Consumer Price Index (CPI) on Wednesday. These reports will be closely watched by market participants, especially in the wake of Friday’s robust jobs data, which exceeded expectations and sent bond yields higher. The stronger-than-expected labor market data added complexity to the Federal Reserve’s decision-making process, dampening hopes for interest rate cuts in the near term.

Tech stocks, particularly those tied to artificial intelligence, struggled to find footing. The Biden administration’s announcement of new export restrictions on advanced AI chips to certain countries weighed heavily on semiconductor stocks, with Nvidia and its peers facing significant pressure. This sector-specific weakness dragged the Nasdaq Composite down 0.4%, while the Dow Jones Industrial Average closed 359 points higher, or 0.9%, buoyed by gains in financial and energy stocks.

Bond yields continued their ascent, reflecting renewed concerns about inflation and tighter monetary policy. The 2-year Treasury yield climbed to 4.4%, while the 10-year and 30-year yields reached 4.8% and nearly 5%, respectively. Rising yields underscore the growing belief that the Federal Reserve will keep interest rates elevated for an extended period. Adding to inflationary pressures, the University of Michigan’s consumer sentiment survey showed one-year inflation expectations jumping to 3.3%, the highest level since May 2024, up from 2.8% in December.

In the energy market, crude oil prices extended their rally following the expansion of U.S. sanctions on Russian oil. These measures targeted several producers and hundreds of tankers, further tightening global supply and contributing to inflation concerns. With energy prices on the rise, the Federal Reserve may face additional challenges in balancing economic growth with its inflation targets.

Earnings season is also ramping up, with major financial institutions set to report results this week. Wells Fargo, Citigroup, BlackRock, and JPMorgan are slated to release their quarterly earnings on Wednesday. Market participants will scrutinize these reports for insights into the health of the financial sector and broader economic trends. Wells Fargo and Citigroup posted gains of 0.8% and 1.9%, respectively, in Monday’s session, while JPMorgan rose 1.8%. The bank recently announced a shift to a five-day in-office workweek starting in March, moving away from its current three-day policy. Additional reports from Bank of America, Morgan Stanley, Charles Schwab, UnitedHealth, SLB, and Fastenal are expected later in the week, providing further clarity on corporate performance and economic conditions.

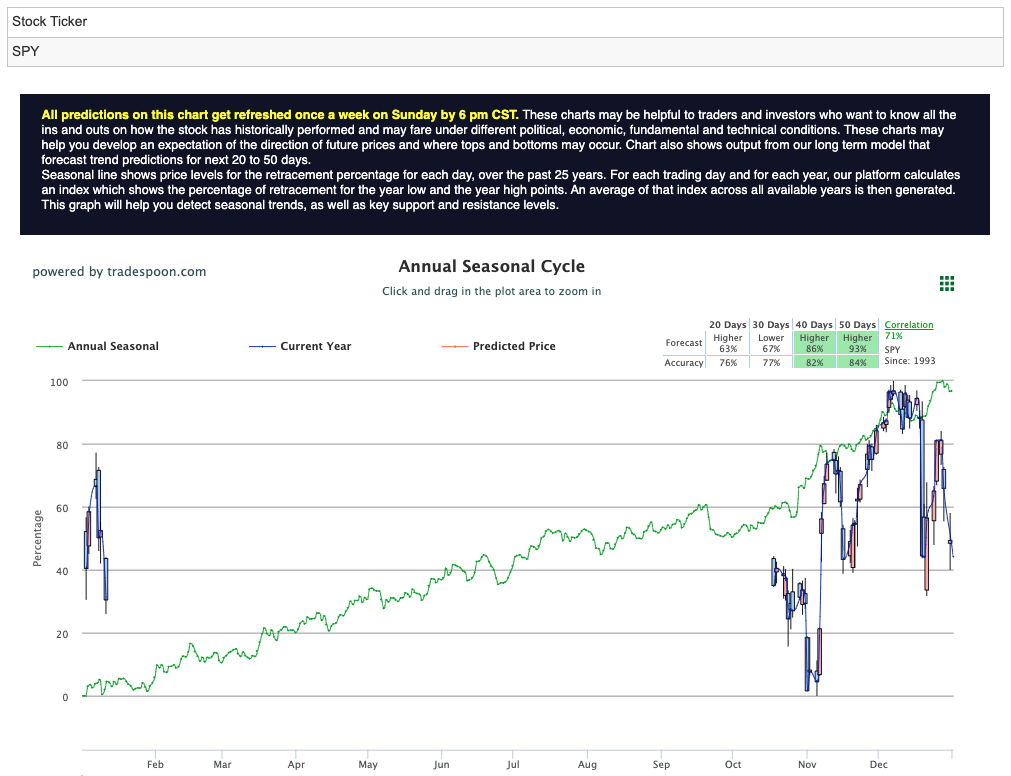

The broader market remains in a state of cautious optimism. Inflation data has so far come within expectations, and the earnings season has begun on a positive note. However, risks remain. The potential for a recession looms as the economy shows signs of cooling, unemployment ticks higher, and small banks face challenges related to exposure in commercial and residential real estate. Despite these headwinds, the S&P 500 continues to push toward new highs. Analysts anticipate the SPY ETF to reach levels between $620 and $640 in the coming months, with support seen in the $560 to $580 range. While the long-term trend remains intact, rising bond yields and geopolitical concerns warrant a balanced and vigilant approach to market participation. For reference, the SPY Seasonal Chart is shown below:

As the week progresses, all eyes will be on the inflation data and its implications for Federal Reserve policy. Combined with a packed earnings calendar, these factors are likely to drive market sentiment and dictate the near-term trajectory of equities. In this high-stakes environment, staying informed and adaptable will be key for investors navigating an increasingly complex landscape.

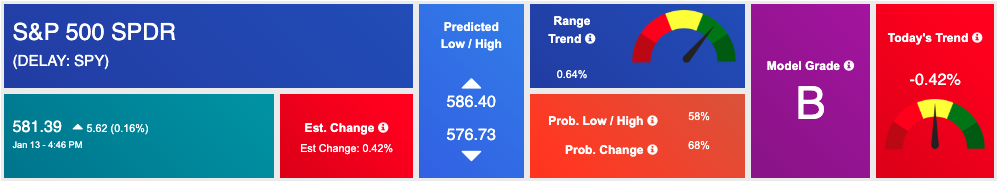

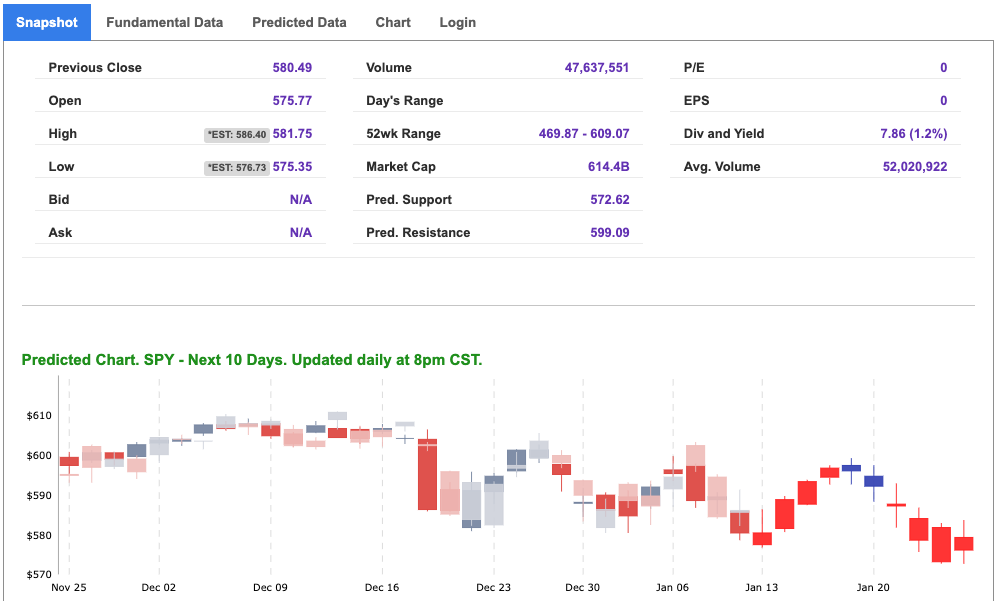

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

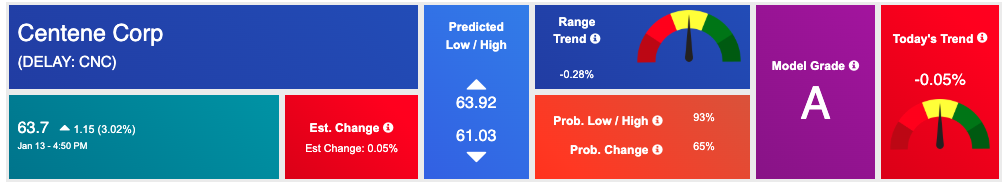

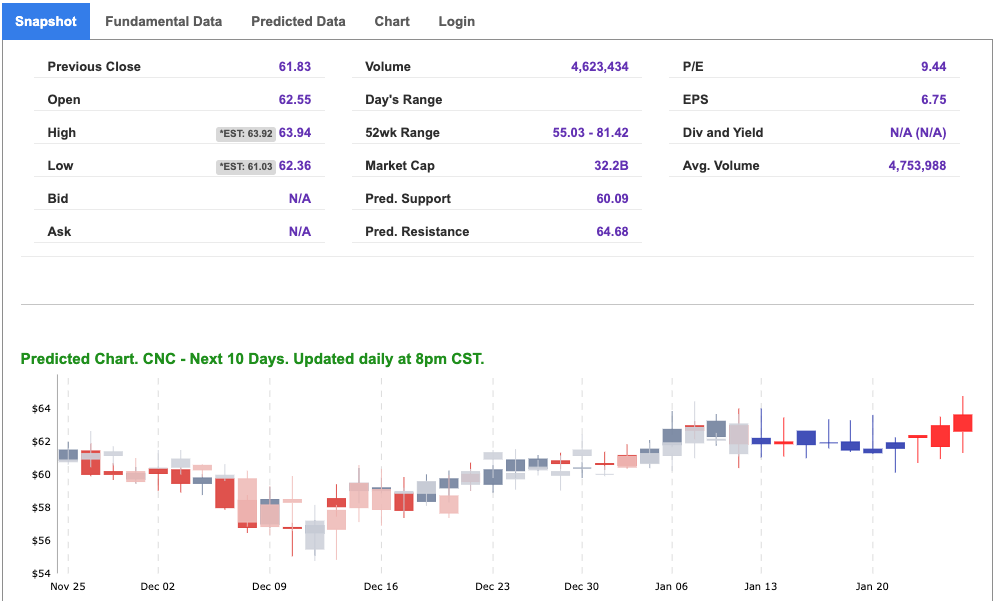

Our featured symbol for Tuesday is Centene Corp. – CNC is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $63.7 with a vector of -0.05% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, cnc. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

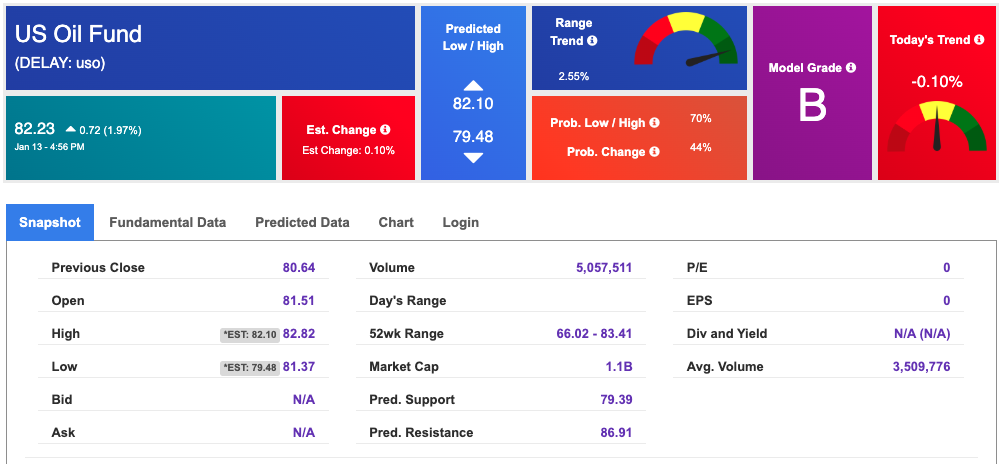

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $78.78 per barrel, down 0.01%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $82.23 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

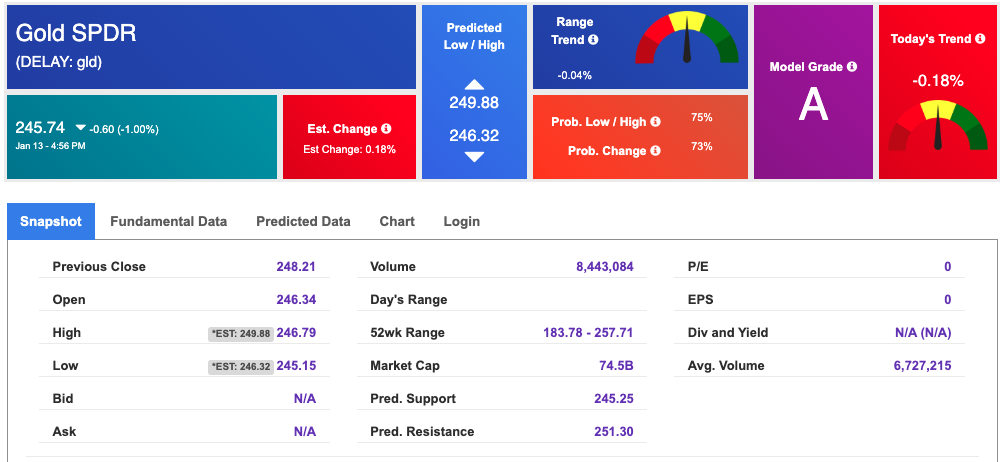

The price for the Gold Continuous Contract (GC00) is up 0.11% at $2681.60 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $245.74 at the time of publication. Vector signals show -0.18% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

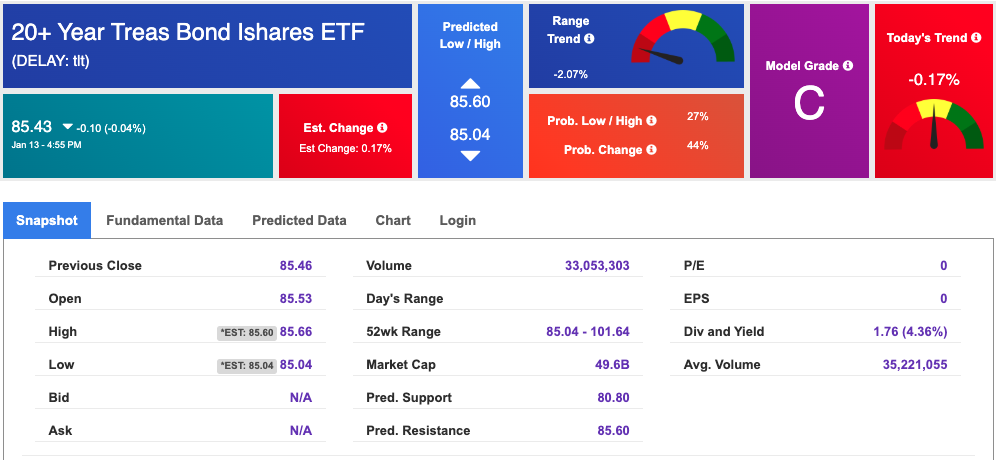

The yield on the 10-year Treasury note is up at 4.787% at the time of publication.

The yield on the 30-year Treasury note is up at 4.954% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

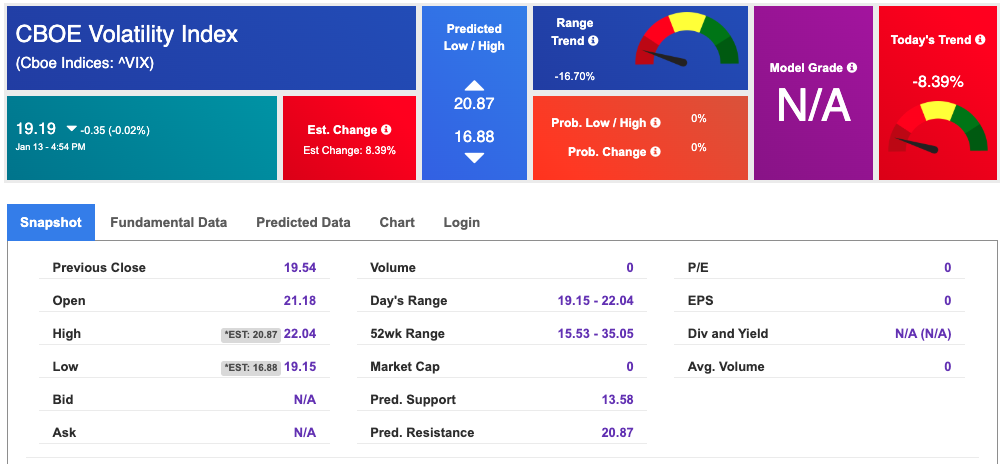

The CBOE Volatility Index (^VIX) is priced at $19.19 down 0.02% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!