The S&P 500 soared to a record close on Thursday, as renewed optimism surrounding China’s stimulus efforts and robust U.S. economic data lifted investor sentiment. Wall Street embraced strong earnings reports from major companies, particularly Micron Technology, which helped boost the Dow and Nasdaq into positive territory. The recent data on U.S. jobless claims further solidified confidence in the labor market, showing that while hiring may be slowing, layoffs remain low and those employed are holding onto their jobs.

Micron Leads Semiconductor Surge Amid Mixed Tech Performance

Technology stocks, especially semiconductors, led the market rally after Micron Technology delivered a positive earnings report and a promising outlook for the upcoming quarter. Micron’s stock surged nearly 15%, bolstering confidence in the broader AI sector. However, the rally in chip stocks faced turbulence as shares of Super Micro Computer plummeted after reports of a U.S. Department of Justice investigation surfaced. Super Micro, a key player in the AI space, saw its decline weigh on the sector, reflecting broader concerns about regulatory scrutiny on high-flying tech stocks.

U.S. Market Resilience Amidst Manufacturing Challenges

The week began with signs of resilience across U.S. equity markets. Despite economic uncertainty, the Dow Jones Industrial Average, S&P 500, and Nasdaq all posted modest gains on Monday, recovering from a volatile previous week. The Dow edged up by 24 points, the S&P 500 gained 0.2%, and the Nasdaq rose 0.1%. However, this upward momentum was briefly interrupted by weaker-than-expected manufacturing data. The S&P Global Flash U.S. Manufacturing PMI for September dropped to 47 from 47.9 in August, signaling continued contraction in the manufacturing sector.

Nevertheless, the market swiftly recovered, with the Dow finishing the day up 17 points, reflecting resilience despite the challenges in the manufacturing space. The S&P 500 and Nasdaq saw incremental gains of 0.2% and 0.3%, respectively, as investors digested the latest economic indicators.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Consumer Confidence and Manufacturing Data: Diverging Trends

Consumer confidence remains strong, buoyed by a tight labor market and steady wages, which has helped sustain spending in key sectors like retail and housing. This optimism supports economic growth despite rising inflation and interest rates.

In contrast, U.S. manufacturing continues to contract. The S&P Global Flash U.S. Manufacturing PMI fell to 47 in September, signaling ongoing weakness in industrial activity. Slowing orders and supply chain challenges have weighed on production, underscoring the divide between resilient consumer demand and a struggling manufacturing sector.

These mixed signals leave the U.S. economy at a crossroads, with strong consumer activity countered by an industrial slowdown, raising questions about future growth as the Federal Reserve navigates its next policy moves.

Federal Reserve in Focus: Rate Cuts and Economic Signals

Investor attention has increasingly shifted to the Federal Reserve’s actions, particularly following the Federal Open Market Committee’s (FOMC) recent half-point rate cut. Although initially seen as a proactive measure to prevent a deeper economic slowdown, the aggressive cut has since raised concerns that the Fed may be bracing for more significant headwinds.

With several key Federal Reserve officials, including Chicago Fed President Austan Goolsbee and Minneapolis Fed President Neel Kashkari, set to speak this week, their commentary will be crucial in determining future rate policy. Investors are now grappling with the possibility of additional cuts, especially as inflation cools and growth moderates. The upcoming release of the Personal Consumption Expenditures (PCE) price index on Friday will be a pivotal indicator, as it’s one of the Fed’s preferred measures of inflation.

Treasury yields have also become a focal point for market participants, with the 10-year U.S. Treasury yield fluctuating between 3.6% and 4.4%, reflecting market uncertainty about future rate cuts and the broader economic outlook. The yield curve’s volatility continues to signal unease, even as inflation shows signs of stabilizing.

China Stimulus Sparks Optimism, but Uncertainty Lingers

China’s latest round of stimulus measures has reignited hopes that the world’s second-largest economy might be turning a corner. On Thursday, reports surfaced that China plans to issue 2 trillion yuan (approximately $285 billion) in sovereign debt to fuel economic growth, while Bloomberg noted the possibility of a further 1 trillion yuan injection into large state banks.

This move follows earlier stimulus efforts, which were met with skepticism by investors who felt they lacked the scale needed to truly revitalize the economy. Thursday’s news lifted Chinese stocks, but many market participants remain cautious, uncertain about whether these actions will be sufficient to counter China’s persistent economic slowdown.

The impact of China’s stimulus has also rippled through global markets, with European stocks feeling the pressure from weaker-than-expected manufacturing data. Manufacturing PMIs in France and Germany both fell below the key 50 threshold, signaling a contraction in business activity. This spurred a sell-off in the euro, which briefly dropped 0.7% against the U.S. dollar before recovering.

Volatility Remains Despite Record Highs

Despite the S&P 500’s record close, market volatility remains a concern. The VIX index, a key measure of market risk, stayed at 15, suggesting that investor anxiety has not completely dissipated. Many are keeping a close watch on whether the market’s rally can expand beyond the technology and AI sectors, with interest rates playing a critical role in determining the next leg of market movement.

Investors are increasingly looking for a broader participation in the market rally, especially as sectors like utilities and consumer goods lag behind. Some strategists are betting on companies tied to renewable energy, such as Vistra and Constellation Energy, as part of a growing interest in green technology that complements the AI-driven boom.

GDP Growth and Earnings Season Fuel Optimism

In other economic news, the Bureau of Economic Analysis confirmed that U.S. gross domestic product (GDP) grew at an annualized rate of 3% in the second quarter, unchanged from its prior estimate. This is significantly higher than the 1.4% growth in the first quarter, reflecting stronger economic momentum despite lingering inflation concerns.

On the corporate front, Costco posted mixed results for its fiscal fourth quarter, with earnings of $5.29 per share beating expectations, but revenue falling slightly short of forecasts at $79.7 billion. Despite the minor revenue miss, Costco’s results were seen as solid, and the company’s yearly profit hit $7.37 billion, further boosting confidence in consumer resilience.

Looking Ahead: Soft Landing or Recession?

Despite the positive headlines, many investors remain cautious. While inflation is moderating and the labor market remains robust, risks of a recession are growing as economic growth slows and unemployment begins to tick up. The potential failure of smaller banks with significant exposure to commercial and residential real estate continues to be a risk, which could weigh on market sentiment in the months ahead.

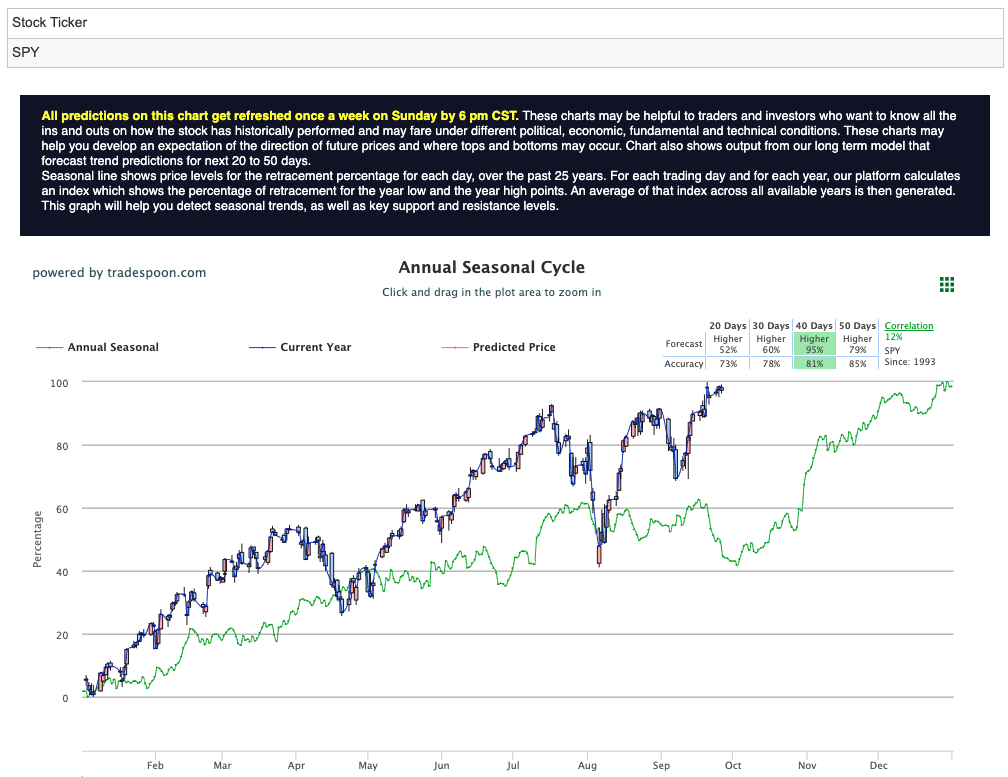

The S&P 500 rally appears capped at the $560–575 level, with support seen around $480–510 in the coming months. Many analysts expect the market to trade sideways in the short to medium term, with the long-term uptrend remaining intact. However, the road ahead is likely to be bumpy, with investors closely monitoring inflation trends, Federal Reserve policy, and corporate earnings. For reference, the SPY Seasonal Chart is shown below:

For now, caution is advised, and chasing rebounds with additional capital may not be wise. As the U.S. economy approaches a potential “soft landing,” the next few months will be critical in determining whether the market can sustain its recent gains or if another correction looms on the horizon.

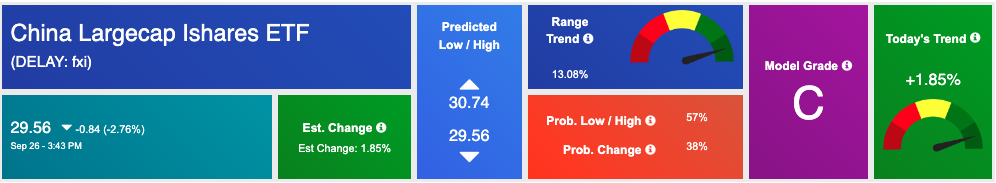

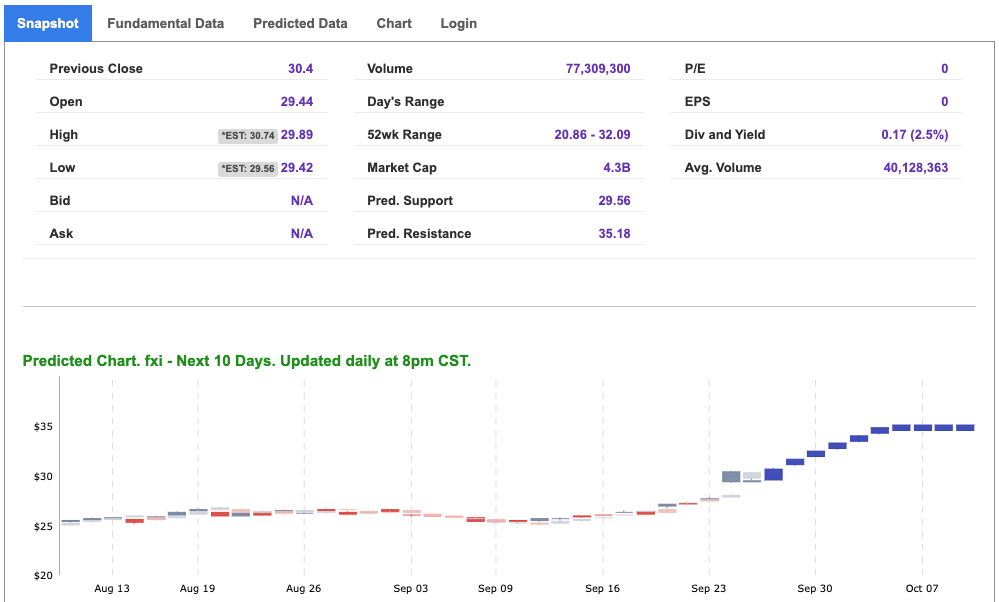

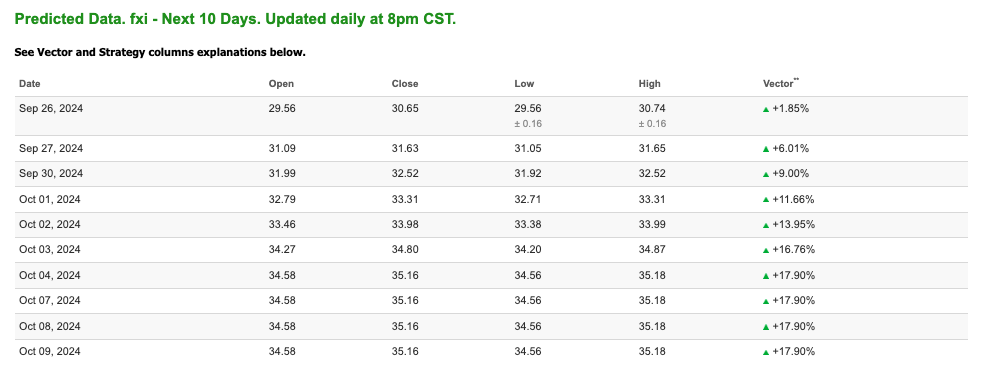

However, as we assess the current market environment, one symbol stands out as a compelling opportunity for the upcoming week: FXI, the iShares China Large-Cap ETF. While U.S. markets have reached new highs, driven by robust economic data and China’s latest round of fiscal stimulus, the potential for further growth in Chinese equities is becoming more pronounced. FXI, which tracks the performance of 50 of the largest companies in China, offers a timely chance to capitalize on this momentum.

China’s latest efforts to stabilize its economy include a massive 2 trillion yuan (around $285 billion) in sovereign debt issuance and potential capital injections into large state banks. These measures are designed to reinvigorate growth and stimulate key sectors like infrastructure, technology, and manufacturing. With this stimulus set to inject liquidity and confidence into the market, Chinese large-cap companies—many of which are heavily weighted in FXI—stand to benefit.

FXI includes major players such as Tencent, Alibaba, and China Construction Bank, which are positioned to see gains as the country pushes for economic recovery. The increased government spending and fiscal measures are expected to directly support these industries, providing an attractive entry point for investors looking to gain exposure to China’s growth story.

Furthermore, with China’s stocks rallying on the back of this fiscal boost, FXI offers a diversified approach to investing in the country’s blue-chip companies, spreading risk while maximizing potential upside. As China embarks on one of its most aggressive stimulus efforts in recent years, FXI is well-positioned to capture the upside from these government-driven economic policies, making it a top recommendation for the week ahead.

In a market that’s still digesting mixed signals from global economic conditions, FXI presents an opportunity to tap into China’s recovery and growth, complementing the broader optimism surrounding global equities.

Enhance your investment decisions by leveraging the power of AI with our RoboInvestor stock and ETF advisory service. Utilizing advanced technology, this service identifies trades with a high probability of profitability. Our proprietary AI platform cuts through market noise and removes emotional biases, delivering clear, data-driven insights and strategies to help you succeed in today’s dynamic market environment.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

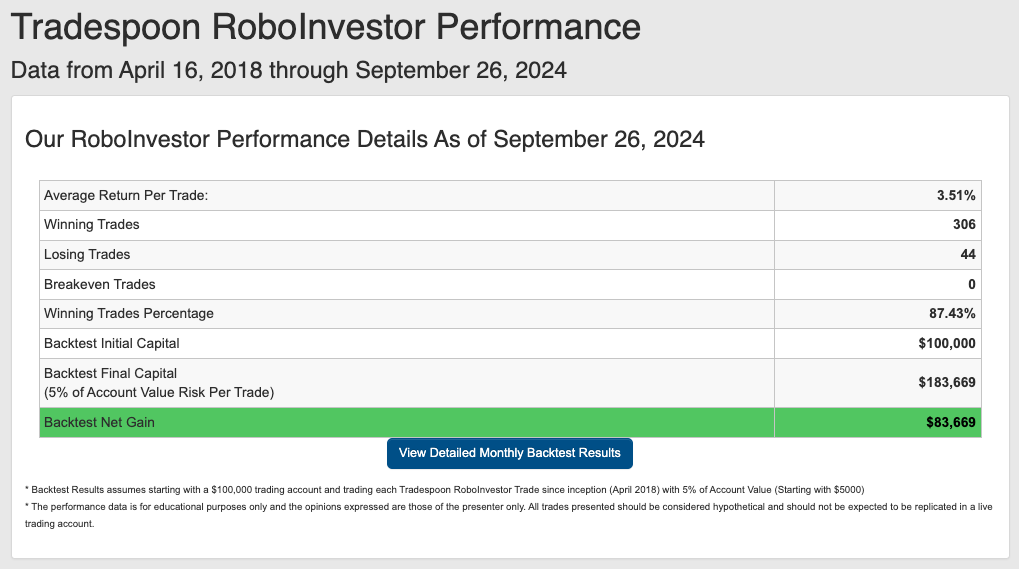

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.43% going back to April 2018.

As we advance toward Q4, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!