As the trading week unfolded, the Dow Jones Industrial Average managed to close at a record high in what was otherwise a choppy session, reflecting broader market uncertainty. The technology sector, in particular, faced headwinds as investors anxiously awaited Nvidia’s highly anticipated earnings report scheduled for midweek. This report is not just another earnings release—it holds the potential to either invigorate or temper the rally in artificial intelligence (AI) stocks, a critical driver of recent market performance.

The week began on a cautious note, with Monday’s trading session characterized by a noticeable lack of momentum. Investors appeared to be holding their breath, with many refraining from making significant moves ahead of Nvidia’s earnings. The semiconductor giant’s performance in the second quarter was widely expected to set the tone for the broader market, particularly in the context of the ongoing surge in AI-related stocks. This hesitancy may also be linked to concerns that Nvidia might not deliver the robust results needed to sustain the AI-driven momentum, which had already shown signs of slowing earlier in the week.

By Wednesday, the market’s focus had sharpened squarely on Nvidia. As a bellwether for tech stocks and a proxy for broader market sentiment, Nvidia’s earnings report was anticipated to provide crucial insights into the state of AI spending and its sustainability as a growth driver. When the results came in, Nvidia did not disappoint—at least not on paper. The company posted second-quarter results that surpassed Wall Street’s expectations, with revenue from its AI data center segment more than doubling, underscoring the strong demand for its cutting-edge chips.

Despite these stellar results, Nvidia’s stock price took a hit. The company’s shares, which had already surged over 150% since the start of the year, experienced a sell-off following the earnings release. This reaction highlights the complexities of market expectations, where even a strong performance can lead to a decline if investors had hoped for more—or if they decided to lock in profits from what has been one of the year’s best-performing stocks. Nvidia’s post-earnings slump reverberated through the tech sector, contributing to a broader decline in technology shares and adding to the market’s volatility.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Thursday’s trading session offered a mix of optimism and caution. While the Dow continued its upward trajectory, notching another record close, the rally lost momentum before the final bell. Nvidia’s continued decline weighed on tech stocks, erasing earlier gains in the Nasdaq and leading to a more mixed performance across major indices.

However, the day was not without its bright spots. Positive economic data initially buoyed market sentiment. The second-quarter Gross Domestic Product (GDP) growth was revised upward to 3%, surpassing the previous forecast of 2.8%. This revision suggests that the U.S. economy is more resilient than previously thought, providing a counterbalance to concerns about an economic slowdown. Additionally, the Personal Consumption Expenditures (PCE) price index, a key measure of inflation, showed a slight deceleration, dropping to a 2.5% quarterly rate from an earlier estimate of 2.6%. This slowing inflation rate may ease some concerns about aggressive monetary tightening from the Federal Reserve.

Adding to the positive economic indicators, weekly jobless claims ticked down to 231,000, slightly better than the consensus forecast of 230,000. This decline in jobless claims suggests that the labor market remains robust, despite broader economic uncertainties.

As the week draws to a close, attention is shifting to the upcoming release of the Personal Consumption Expenditures (PCE) data on Friday. Although some analysts expect this report to be relatively uneventful, given the time economists have had to refine their forecasts, it remains a crucial piece of the inflation puzzle. The PCE data, which is closely watched by the Federal Reserve, will provide further insight into inflation trends and could influence future monetary policy decisions.

In the bond market, signs of U.S. economic resilience have pushed Treasury yields and the dollar higher. The 10-year Treasury yield has risen to 3.862%, reflecting market expectations that the Federal Reserve may not need to cut interest rates as aggressively as previously anticipated. This uptick in yields is part of a broader trend of volatility in the bond market, as investors reassess the timing and magnitude of potential rate cuts.

Despite the positive economic data, there remains a level of caution among market participants. The narrative of a “soft landing” for the economy—where inflation is tamed without tipping the economy into recession—has gained traction, giving bulls the upper hand for now. However, concerns about a potential market correction persist, particularly given the recent volatility in Treasury yields and the mixed performance of tech stocks.

Given the current market dynamics, a market-neutral stance seems prudent. While the long-term trend for equities remains intact, the market appears to have set a near-term top, with inflation coming in line with expectations and earnings season largely surpassing forecasts. However, the risk of a market correction looms, especially as the economy shows signs of cooling, unemployment begins to tick up, and concerns grow over the potential failure of small banks with significant exposure to commercial and residential real estate.

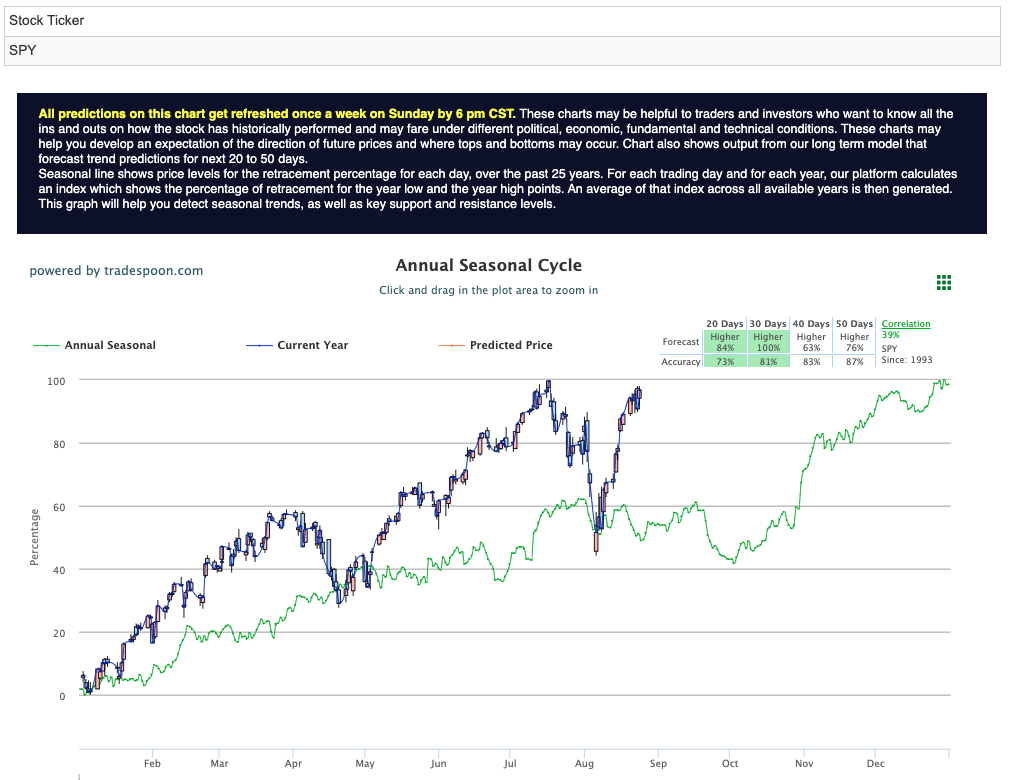

In the short to medium term, the SPY (S&P 500 ETF) is expected to trade within a defined range, with resistance levels around $560–575 and support at $480–510. This sideways trading pattern reflects the market’s current state of uncertainty, with investors balancing optimism about economic resilience against the risks of a slowdown or recession. For reference, the SPY Seasonal Chart is shown below:

Looking further ahead, the long-term outlook for the market remains positive, but investors should brace for continued volatility. The recent breakout of GLD (Gold ETFs) to all-time highs, combined with a weaker dollar, signals that some investors are seeking safe havens amid the ongoing market uncertainty. Meanwhile, the volatility in the bond market, particularly the 10-year Treasury yield’s fluctuations, underscores the challenges facing the market as it navigates this complex economic landscape.

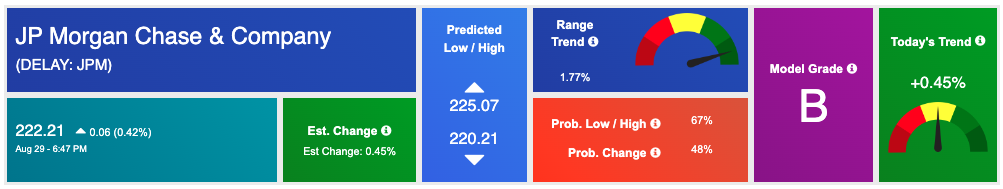

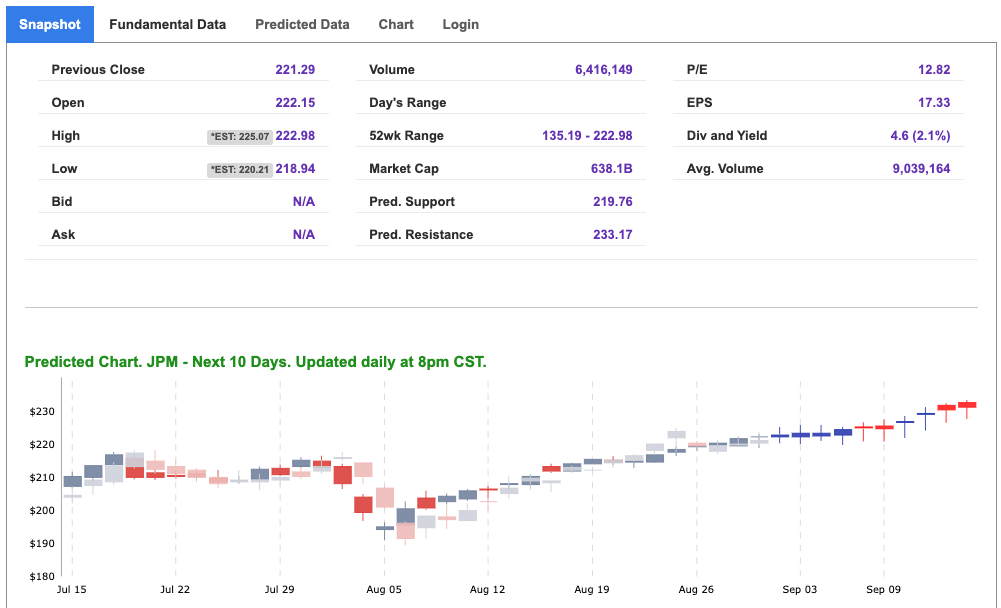

Amidst this backdrop of market volatility and economic uncertainty, one stock stands out as a compelling buy for the upcoming week: JPMorgan Chase (JPM). As one of the largest and most stable financial institutions in the world, JPMorgan offers a strong value proposition, particularly in the current market environment.

1. Resilience in Economic Uncertainty: JPMorgan’s strength lies in its ability to navigate economic uncertainty, which is particularly relevant given the current market conditions. As the economy shows signs of resilience—evidenced by the upward revision in GDP and the slight deceleration in inflation—JPMorgan is well-positioned to benefit. The bank’s robust balance sheet and diversified revenue streams allow it to weather economic fluctuations better than many of its peers.

2. Rising Interest Rates: The rising Treasury yields, particularly the 10-year yield, bode well for JPMorgan’s net interest income. As interest rates rise, banks like JPMorgan can charge more for loans, boosting their profitability. With the Federal Reserve potentially slowing down its rate-cutting pace due to the economy’s resilience, JPMorgan stands to gain from the higher rate environment.

3. Strong Financial Performance: JPMorgan has consistently delivered strong financial results, even in challenging environments. The bank’s recent earnings reports have exceeded expectations, highlighting its ability to generate substantial profits in both high and low-interest-rate environments. As earnings season continues to wind down, JPMorgan’s strong fundamentals make it an attractive option for investors seeking stability and growth.

4. Defensive Play in a Volatile Market: In a market characterized by high volatility, particularly within the tech sector, JPMorgan represents a defensive play. Financial stocks tend to be less volatile than tech stocks, providing a safer haven for investors looking to protect their portfolios from large swings. Moreover, JPMorgan’s diversified business model, which includes investment banking, wealth management, and consumer banking, adds layers of protection against sector-specific downturns.

5. Dividends and Shareholder Returns: JPMorgan also stands out for its commitment to returning value to shareholders. The bank has a solid track record of paying dividends and executing share buybacks, making it an appealing choice for income-focused investors. With a dividend yield that is attractive relative to current bond yields, JPMorgan offers a compelling income stream in addition to potential capital appreciation.

In the context of a market facing uncertainty from multiple fronts—ranging from volatile tech earnings to fluctuating bond yields—JPMorgan Chase emerges as a stock that combines stability with growth potential. Its ability to capitalize on rising interest rates, coupled with its strong financial performance and defensive characteristics, makes it a smart buy in the current environment.

As we move into the upcoming week, with key economic data releases on the horizon and market volatility likely to persist, adding JPMorgan Chase to your portfolio could be a prudent move. Whether you’re seeking to hedge against volatility or looking for a solid income-generating asset, JPMorgan offers a compelling mix of growth, stability, and income potential that can help anchor your investment strategy in these uncertain times.

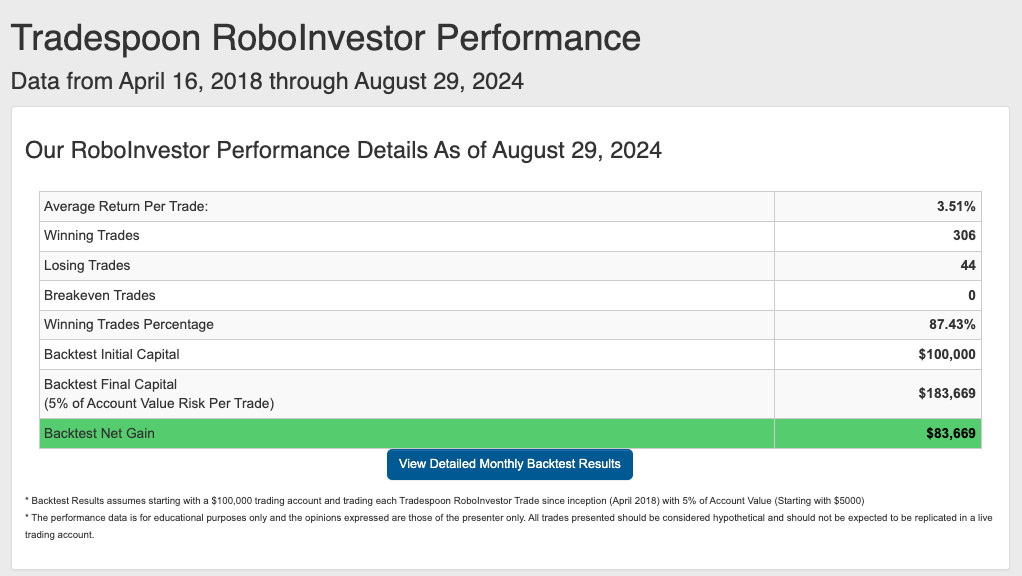

Enhance your investment decisions by leveraging the power of AI with our RoboInvestor stock and ETF advisory service. Utilizing advanced technology, this service identifies trades with a high probability of profitability. Our proprietary AI platform cuts through market noise and removes emotional biases, delivering clear, data-driven insights and strategies to help you succeed in today’s dynamic market environment.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.43% going back to April 2018.

As we advance toward the back end of 2024, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and navigating the fluctuating market conditions effectively.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!