The financial markets are grappling with uncertainty as volatility surges ahead of a crucial Federal Reserve meeting. This week has been marked by erratic trading, with major indices swinging between gains and losses as investors digest a slew of economic data. Inflation metrics, labor market indicators, and shifting interest rate expectations have put Wall Street on edge. As inflation cools in some areas but remains sticky in others, the Federal Reserve faces a tough decision—will it opt for a modest rate cut, or could inflationary pressures keep monetary policy tighter for longer? With so much at stake, the market’s next direction may hinge on the central bank’s actions.

On Thursday, the Bureau of Labor Statistics reported that the Producer Price Index (PPI) for August rose by 0.2%, aligning with economists’ expectations and slightly higher than July’s 0.1% increase. The year-over-year PPI growth rate slowed to 1.7%, down from 2.2% in July, reflecting some easing in inflation at the wholesale level. However, the core PPI, which excludes food and energy prices, increased by 0.3%, surpassing the forecasted 0.2% and raising concerns that underlying inflationary pressures are not subsiding as quickly as hoped.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

This core inflation increase is particularly significant because the PPI is often viewed as a precursor to consumer inflation, as businesses tend to pass on higher production costs to consumers. The hotter-than-expected core PPI figure signals that inflationary pressures may still be bubbling beneath the surface, potentially complicating the Federal Reserve’s upcoming decision on interest rates.

In parallel with the PPI data, initial jobless claims were reported at 230,000 for the week, matching expectations. This relatively stable reading on the labor market comes after months of strong job growth but hints at a gradual cooling. The combination of steady employment numbers and persistent inflation raises the stakes for the Fed as it considers its next move.

The Federal Reserve’s September meeting is shaping up to be a pivotal moment for markets. After months of speculation, the market has tempered its earlier expectations for an aggressive rate cut, particularly in light of recent inflation data. While some areas of the economy show signs of cooling, core inflation remains more resilient than anticipated. As of now, most market participants expect a 25-basis-point rate cut, rather than the 50-basis-point reduction that many were hoping for earlier in the year.

Wednesday’s Consumer Price Index (CPI) report added further complexity to the Fed’s decision-making process. The headline CPI, which includes volatile food and energy prices, rose by 0.2% in August, in line with expectations. On a year-over-year basis, consumer prices increased by 2.5%, slightly below the anticipated 2.6%, signaling a moderation in inflation. However, core CPI—which strips out food and energy—grew by 0.3% month-over-month, higher than the 0.2% expected, and matched the 3.2% year-over-year growth projection.

This uptick in core CPI reflects inflationary pressures in sectors like housing and medical care, areas that the Federal Reserve closely monitors. The persistence of these pressures indicates that inflation may not be cooling as quickly as previously thought, complicating the case for a larger interest rate cut.

In addition to inflation data, labor market indicators continue to play a critical role in the Fed’s calculus. Initial jobless claims edged up by 2,000 last week to 230,000, while continuing claims rose to 1.85 million, slightly above estimates. Though the labor market remains relatively tight, these incremental increases suggest that some slack may be developing. The most recent jobs report, released just last week, showed that the U.S. economy added 142,000 nonfarm payrolls in August, below the forecasted 160,000. This slight cooling in the labor market may give the Fed more room to maneuver as it contemplates rate cuts.

However, despite these indications of a softening labor market, the Fed is unlikely to proceed with a large cut, given that inflation remains above target in core categories. The central bank has repeatedly emphasized that its decisions will be data-dependent, and with inflation still elevated in certain sectors, the likelihood of a more aggressive rate cut has diminished.

The Federal Reserve is not operating in a vacuum. This week, the European Central Bank (ECB) lowered its key interest rate by a quarter-point, bringing its deposit rate down to 3.5%, signaling that central banks worldwide are starting to take a more dovish stance. Unlike the Fed, the ECB has already cut rates multiple times this year, having started back in June. While inflation in the Eurozone has moderated to 2.2%, the Fed faces a more complex situation with core inflation remaining stubbornly high in the U.S.

The Fed’s current target range for interest rates sits between 5.25% and 5.5%. A 25-basis-point reduction is widely anticipated, but any surprise move by the Fed—whether to hold rates steady or pursue a larger cut—could significantly impact market sentiment and future economic conditions.

This week has been a rollercoaster for equities, driven largely by speculation over the Fed’s upcoming rate decision. Monday saw a sharp rebound following last week’s selloff, only for markets to struggle for direction in the subsequent days. Tech stocks provided a brief lift to the Nasdaq on Tuesday, but the Dow lagged behind, weighed down by declines in financials. JPMorgan Chase, for example, fell 5%, despite positive developments regarding capital requirements from the Federal Reserve. Meanwhile, Ally Financial’s warning about increasing consumer stress added to concerns about the financial sector’s health.

Broadcom and Oracle were standout performers earlier in the week, recovering from last week’s losses, but Wednesday’s higher-than-expected core CPI print triggered fresh market jitters. The tech-heavy Nasdaq rallied briefly but ultimately gave way to broader concerns about inflation and interest rates.

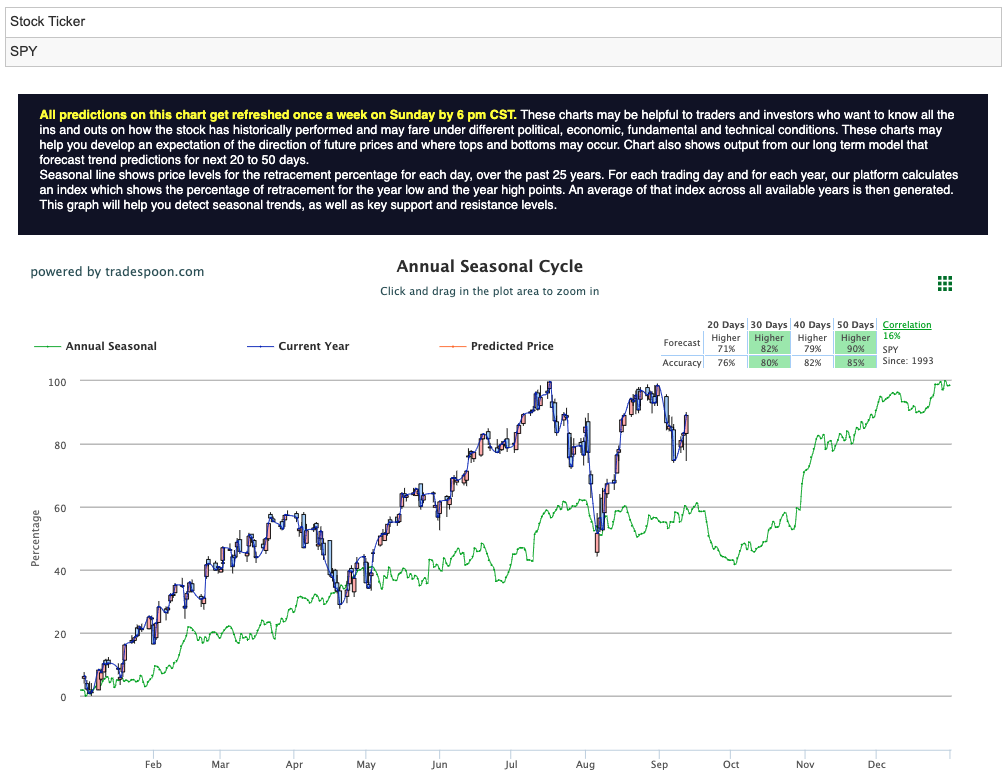

From a technical perspective, the S&P 500 continues to trade in a range between $540 and $552, with key resistance at $560–575. The Nasdaq’s QQQ index has fallen below its 50-day moving average, signaling short-term weakness. Meanwhile, the VIX, often seen as the market’s “fear gauge,” has climbed back above 20, reflecting the growing anxiety among investors. For reference, the SPY Seasonal Chart is shown below:

Bond markets have been equally volatile, with the 10-year Treasury yield swinging between 3.6% and 4.4%. As investors adjust their expectations around the pace and magnitude of Fed rate cuts, volatility in both equities and bonds is likely to persist. Gold (GLD) has surged to all-time highs, driven by recession fears and a weakening U.S. dollar, while oil prices remain soft despite a slight rebound.

As the Federal Reserve meeting approaches, uncertainty reigns supreme. Inflation is cooling in some areas, but core categories remain sticky, complicating the case for a larger rate cut. Meanwhile, the labor market is showing early signs of weakening, but not enough to prompt aggressive monetary easing. With global central banks already moving to lower rates, the Fed will likely follow suit, but the size and pace of those cuts remain to be seen.

For now, maintaining a cautious and balanced approach seems prudent. While the market’s long-term trend remains intact, short-term volatility is expected to continue as investors grapple with the implications of the Fed’s next move. With a potential recession on the horizon and inflation still a concern, defensive strategies may offer the best protection in this uncertain environment. Stay tuned—next week’s Fed decision could be the key to unlocking the market’s direction for the remainder of 2024.

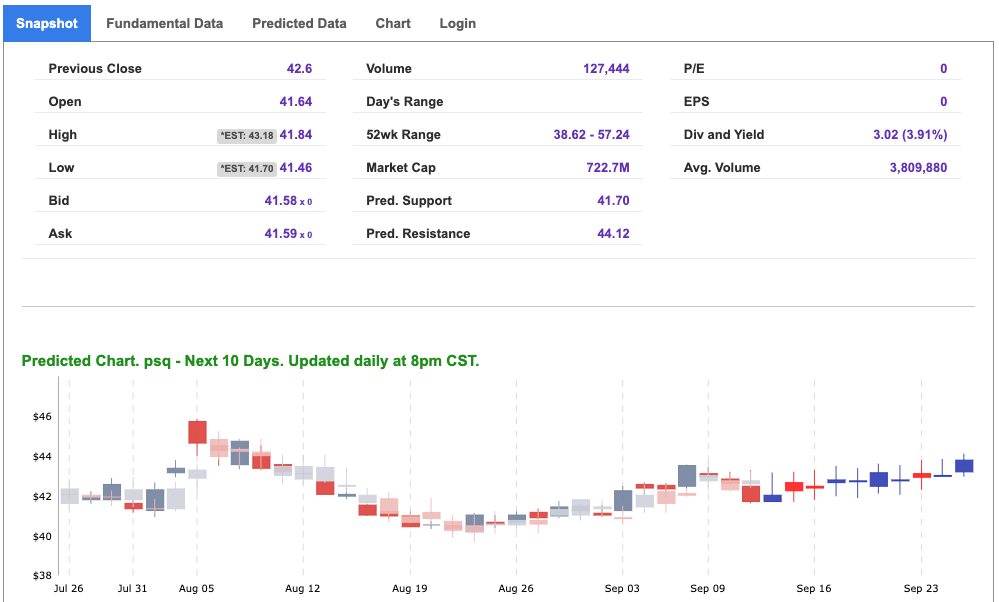

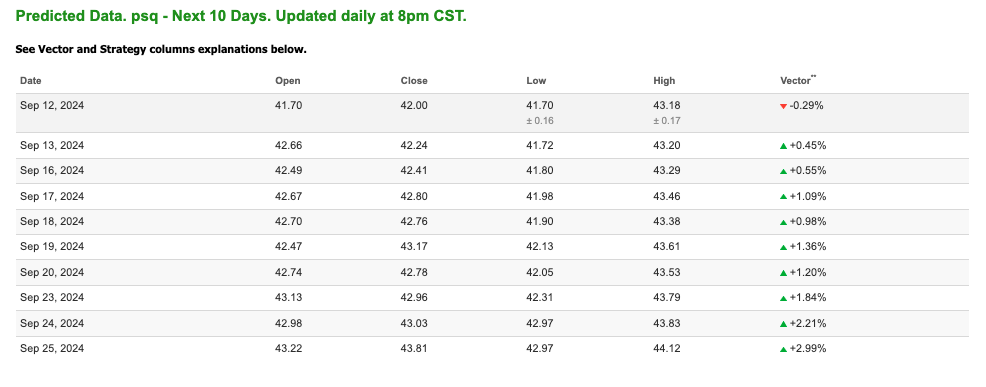

With the stock market facing increased volatility and uncertainty surrounding the Federal Reserve’s next move, investors are seeking effective ways to safeguard their portfolios against potential losses. One such strategy gaining attention is the ProShares Short QQQ (PSQ), an inverse exchange-traded fund (ETF) designed to deliver the opposite performance of the Nasdaq-100 Index (QQQ). In other words, PSQ allows investors to benefit when the Nasdaq declines, making it an appealing option in times of market turbulence.

PSQ is a single-inverse ETF, which means that for every 1% drop in the Nasdaq-100, PSQ seeks to gain approximately 1%. This makes it a valuable tool for those who want to hedge their exposure to large-cap technology stocks without resorting to more complex tactics like shorting individual stocks or using options. By holding PSQ, investors can potentially offset losses in their broader equity portfolios if the tech sector, and the Nasdaq-100 in particular, experiences a downturn.

Several factors make PSQ a timely and strategic play in the current economic environment. The tech sector, which has driven much of the market’s gains in 2023, is showing signs of weakness. Major technology companies, known as the “Magnificent Seven,” have traded lower recently after a period of strong performance. The technology sector, known for its sensitivity to interest rate changes, could face more challenges as inflationary pressures persist and global economic uncertainties rise.

The current market volatility, reflected by the VIX (often called the “fear gauge”) climbing back above 20, highlights growing concerns among investors. As expectations for aggressive Federal Reserve rate cuts diminish due to stubborn inflation in core sectors like housing and healthcare, uncertainty is creating an environment where downside risks in the tech-heavy Nasdaq-100 are elevated. PSQ provides a hedge against these risks, offering a defensive position in a market where volatility is surging.

Moreover, shaky economic data points, including a disappointing August jobs report, are stoking fears of an economic slowdown. While inflation data such as the 0.2% monthly increase in the Producer Price Index (PPI) suggests some relief, core inflation remains elevated in areas critical to consumers and businesses alike. In this context, tech stocks—which tend to be more volatile during economic downturns—are particularly vulnerable, adding to the appeal of holding PSQ.

Fed policy also plays a crucial role in PSQ’s attractiveness. While a 25-basis-point rate cut is widely anticipated at the Federal Reserve’s next meeting, there is growing skepticism about the possibility of deeper cuts given persistent inflationary pressures. Technology companies, which have benefited significantly from the low-interest-rate environment of recent years, could be under greater pressure if borrowing costs remain higher for longer. In this scenario, PSQ stands as a tool to capitalize on the potential weakness in tech stocks.

From a technical perspective, the Nasdaq-100’s QQQ has fallen below its 50-day moving average, a bearish signal for investors. If this trend continues, it could indicate more downsides for the index, further reinforcing the case of holding PSQ as a hedge. As tech stocks stumble, PSQ could help investors balance out losses and maintain a more resilient portfolio.

In conclusion, as the market braces for potential turbulence and uncertainty over the Federal Reserve’s direction, PSQ offers a strategic and timely hedge. Given the current vulnerability in the tech sector, rising volatility, and the prospect of limited rate cuts, PSQ provides a straightforward way for investors to manage risk and protect against potential declines in the Nasdaq-100.

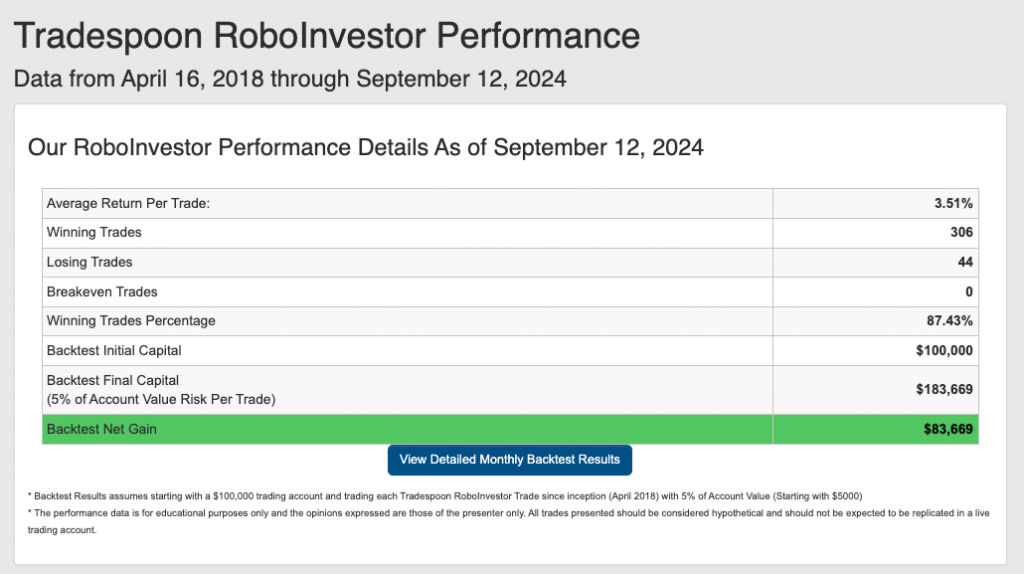

Enhance your investment decisions by leveraging the power of AI with our RoboInvestor stock and ETF advisory service. Utilizing advanced technology, this service identifies trades with a high probability of profitability. Our proprietary AI platform cuts through market noise and removes emotional biases, delivering clear, data-driven insights and strategies to help you succeed in today’s dynamic market environment.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.43% going back to April 2018.

As we advance toward the back end of 2024, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and navigating the fluctuating market conditions effectively.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!