This week began with a remarkable performance by the Nasdaq Composite, which closed at a record high, contrasting with a significant decline in the Dow Jones Industrial Average, which fell over 200 points. Bond yields also surged, with the 10-year Treasury yield climbing to 4.542%. Consumer confidence saw a slight increase in May, but inflation expectations for the year also rose. This contributed to higher bond yields following weak demand at auctions for 2-year and 5-year notes. Hawkish statements from Federal Reserve officials, coupled with rising consumer confidence and inflation expectations, set a negative tone for the markets on Tuesday. However, strong performances from Nvidia and other semiconductor stocks helped the Nasdaq outpace its peers. Meanwhile, crude oil futures increased due to heightened tensions in the Middle East after an Israeli airstrike in Rafah and a deadly clash between Israeli and Egyptian forces.

On Wednesday, stocks experienced a sharp decline as the CBOE Volatility Index (VIX) jumped 6%, signaling increased market anxiety over future interest rate policies. The 10-year Treasury yield rose to 4.623%. Marathon Oil shares climbed following ConocoPhillips’ $22.5 billion acquisition deal. Post-market, investors awaited Salesforce’s earnings report. Bond yields were further pressured upwards after the Treasury’s auction of seven-year notes yielded 4.65%, exceeding market expectations. Concerns grew about whether demand for Treasurys would keep up with supply.

U.S. consumer confidence unexpectedly improved in May, ending a three-month decline, driven by optimism in the labor market. However, inflation concerns persisted, with many households expecting higher interest rates over the next year. The Conference Board’s survey indicated that more consumers fear the economy might slip into a recession within the next 12 months, yet there was notable optimism about the stock market, with nearly half of respondents expecting stock prices to rise in the coming year.

Consumers’ perspectives on inflation and interest rates were influenced by rising price pressures in the first quarter and robust economic growth. This shift led financial markets to push back their expectations for a Fed rate cut from June to September. The Federal Reserve has maintained its policy rate in the 5.25%-5.50% range since July.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The latest Beige Book report from the Federal Reserve paints a detailed picture of the U.S. economy in the six weeks leading up to May 20. Across the twelve Federal Reserve districts, economic activity varied, with ten districts reporting slight or modest growth, while two districts indicated no significant change, suggesting pockets of stagnation. One notable concern highlighted in the report is the persistent issue of inflation, as prices continued to rise across most regions. Some businesses faced challenges as consumers resisted price increases, leading to narrower profit margins. This resistance underscores the delicate balance between companies’ efforts to pass on higher costs and consumers’ willingness to bear them.

Employment trends showed a slight increase in job growth, consistent with previous reports. Despite businesses offering higher wages and better benefits, many struggled to fill open positions, contributing to ongoing wage pressures and overall inflation. While consumer confidence saw a modest improvement in May, reversing a recent decline, concerns regarding inflation lingered. A significant number of households expected higher interest rates over the next year, reflecting apprehension about the economy’s future trajectory. Additionally, there was notable concern about the potential for a recession within the next 12 months, despite nearly half of consumers anticipating stock prices to rise in the coming year.

The Beige Book also sheds light on challenges facing the housing market. Despite an increase in supply, high interest rates dampened home-buying activity, leading to a significant decline in the pending home sales index in April across all four regions. This decline underscores the impact of higher borrowing costs on affordability and the dynamics of the housing market. These economic conditions present significant implications for Federal Reserve policy, with persistent inflation and a tight labor market delaying plans to cut interest rates. The Fed is expected to consider rate cuts only once inflation shows clear signs of moderation, providing relief to homebuyers and supporting broader economic growth.

On Thursday, U.S. stocks continued their downward trend as traders analyzed economic and labor market data ahead of the Federal Reserve’s preferred inflation gauge release on Friday. The Dow extended its losses, driven by a steep drop in Salesforce shares, which fell more than 16% after missing revenue estimates and issuing weak guidance. Economic growth for the first quarter was revised down to 1.3% from an initial 1.6%, while cooler inflation provided some hope for a potential Fed rate cut.

Jobless claims rose to 219,000, surpassing estimates and indicating a cooling labor market that could support easing monetary policy. Markets now turn their attention to the upcoming personal consumption expenditures (PCE) data, which is expected to show a 2.7% year-over-year inflation rate for April.

The pending home sales index dropped 7.7% in April, with all four regions experiencing declines. High interest rates continued to deter home purchases despite increased supply. A potential rate cut by the Federal Reserve later this year could improve affordability and increase supply.

The dollar weakened as Treasury yields fell, influenced by data suggesting a cooling U.S. economy. First-quarter GDP growth was revised down to 1.3%, while jobless claims rose more than expected, casting doubt on another rate hike and undermining the dollar’s strength.

Bond yields remained volatile, trading between 4.3% and 4.7%, with markets under continued pressure. Value stocks and interest-sensitive stocks are retesting April lows, with value stocks falling below their 50-day moving average. The debate over interest rate cuts persists, driven by economic data. The 10-year yield breaking above 4.5% and fluctuating within the 4.3% to 4.7% range remains a key focus.

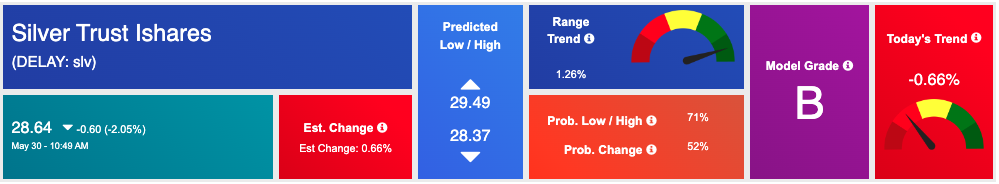

Inflation data from Germany exceeded expectations, suggesting that the European Central Bank might lower interest rates sooner than anticipated. The VIX is at 14, indicating low market fear, while the Nasdaq 100 (QQQ) and S&P 500 (SPY) are near all-time highs. Value- and interest-sensitive stocks continue to underperform, while silver (SLV) and gold (GLD) have rallied, and further inflation data is awaiting.

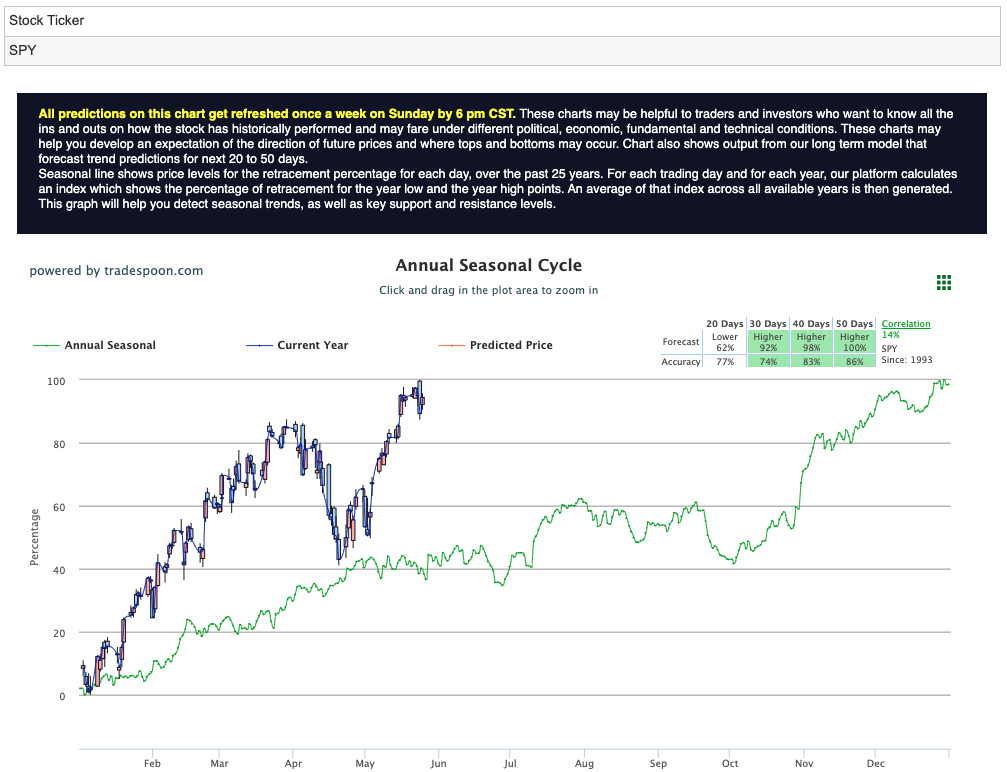

Despite mixed economic signals, bullish sentiment is emerging as inflation aligns with expectations and the earnings season surpasses forecasts. The S&P 500 is expected to post higher highs and lows, with resistance at $540-$550 and support at $500-$510 in the coming months. For reference, the SPY Seasonal Chart is shown below:

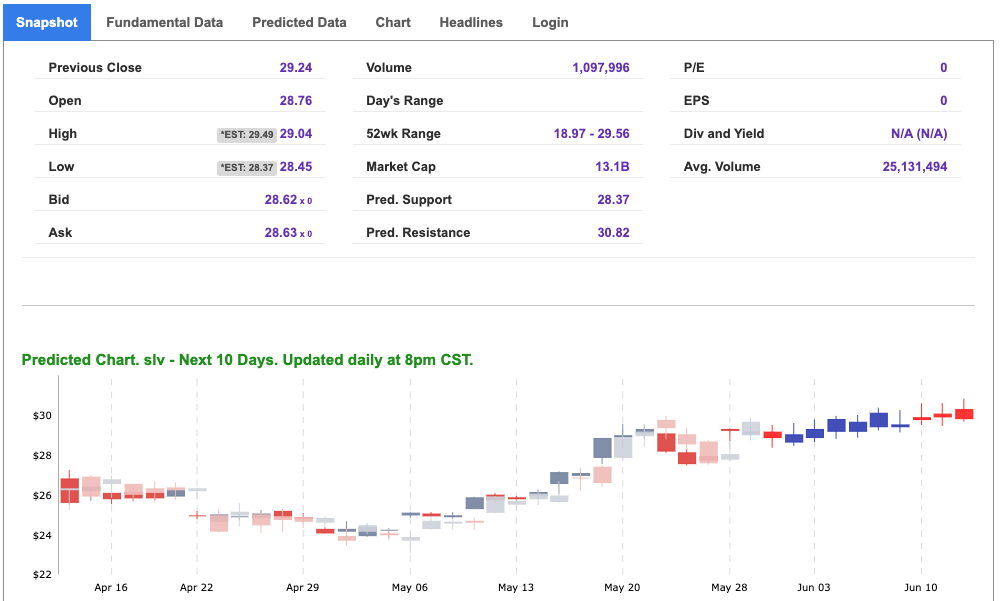

Given the current market conditions, I am looking to add the iShares Silver Trust (SLV) to my portfolio. SLV is an exchange-traded fund (ETF) that seeks to reflect the performance of the price of silver, minus the Trust’s expenses. Launched by iShares in April 2006, SLV offers investors a convenient and cost-effective way to gain exposure to the silver market without having to deal with the complexities of purchasing and storing physical silver. The fund is designed to track the daily price movements of silver bullion, providing a straightforward means for investors to diversify their portfolios with a precious metal that has both industrial and investment demand.

The decision to add SLV to my portfolio is influenced by several factors derived from the current market conditions. The bond market is showing signs of instability, with the 10-year Treasury yield fluctuating between 4.3% and 4.7% and recent auctions indicating weak demand. This volatility often drives investors towards precious metals like silver, which are considered safe-haven assets.

Although consumer confidence has improved, inflation expectations remain high. The recent Beige Book report highlighted persistent inflation, with some businesses unable to fully pass on higher costs to consumers. As inflationary pressures continue, silver, historically known as an inflation hedge, becomes more attractive. Additionally, the increase in jobless claims to 219,000, exceeding estimates, suggests a cooling labor market. This could prompt the Federal Reserve to reconsider its monetary policy stance, potentially leading to lower interest rates. Lower interest rates typically weaken the dollar and boost demand for commodities like silver.

Data indicating a possible slowdown in the U.S. economy has already begun to undermine the strength of the dollar. A weaker dollar generally leads to higher prices for dollar-denominated commodities, including silver, making SLV a potentially profitable addition. Beyond its role as a precious metal, silver is also a critical industrial commodity, used in electronics, solar panels, and other technologies. As global industries recover and expand, the demand for silver is likely to increase, further supporting the price of SLV.

Global economic conditions also play a role. Inflation data from Germany has been better than expected, and there is speculation that the European Central Bank might lower interest rates soon. These global economic trends can lead to increased demand for silver as an alternative investment, reinforcing the potential for SLV’s growth.

In summary, the combination of volatile bond yields, persistent inflation concerns, a cooling labor market, a weakening dollar, and robust industrial demand creates a favorable environment for silver. Therefore, adding SLV to my portfolio appears to be a prudent decision, offering both a hedge against inflation and an opportunity to capitalize on the current economic conditions.

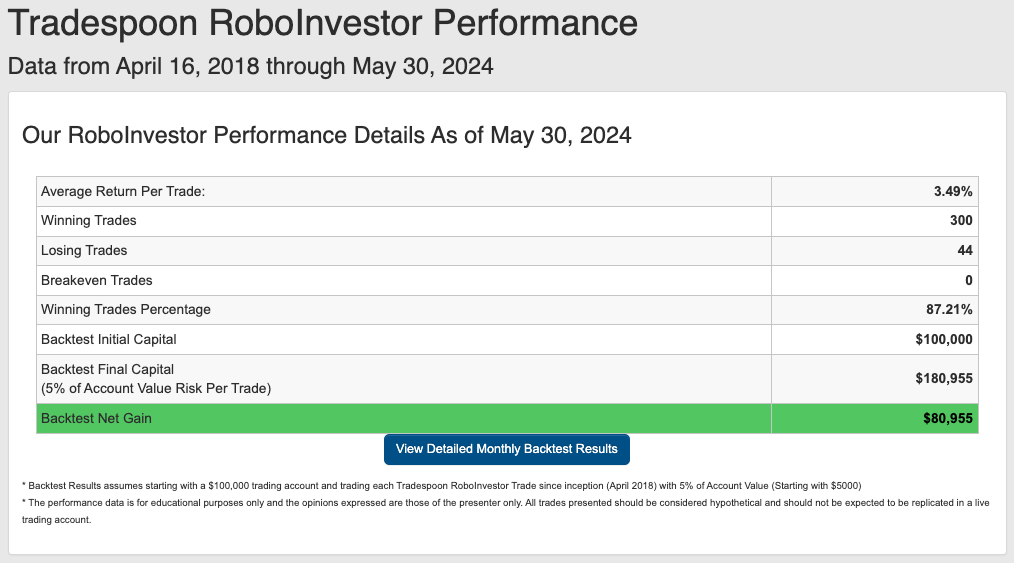

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.21% going back to April 2018.

As we navigate deeper into 2024, investors face a labyrinth of market challenges, from surging inflation to shifting Federal policies and geopolitical uncertainties like the ongoing conflict in Ukraine. In such turbulent times, having a trusted and informed investment partner becomes paramount. Enter RoboInvestor – your steadfast ally in the ever-evolving financial landscape. Offering a comprehensive array of resources and expert insights, RoboInvestor empowers you to navigate your portfolio with confidence and seize promising opportunities amidst the rapid pace of market dynamics.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!