Welcome to the latest RoboStreet newsletter, where we bring you the latest updates and insights on the financial market. As we approach the end of the first quarter of 2023, the stock market continues to show signs of volatility, with the technology sector driving a slight upward trend. These come as fears about banking turmoil have started to ease, and short-term Treasury yields are declining, indicating a general shift towards safe-haven assets.

This week, all eyes were on several Fed speeches in anticipation of Friday’s marquee PCE data reports. Richmond Fed President Thomas Barkin sees a “pretty wide” range of outcomes for the May meeting, while Boston Fed President Susan Collins anticipates “modest” additional tightening. Meanwhile, Minneapolis Fed President Neel Kashkari said the Fed has more work to do to bring service inflation down.

Uncertainty still looms as the upcoming earnings season is expected to be crucial for the market’s future direction. Analysts predict a decline in earnings per share in the first quarter of 2023 compared to that of the previous year, which could further dampen investor sentiment. Additionally, comments from several Fed officials about the central bank’s potential move at its next meeting add to the market’s apprehension.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The issue of economic growth slowdown continues to concern investors, but the positive side of the banking issue is that the Federal Reserve will act less aggressively in lifting interest rates. This move could reduce economic demand and help tame inflation, much of which has been caused by the current banking woes. The Fed has already reduced the federal funds rate by a quarter of a percentage point in March, down from previous increases of half a percentage point.

Despite these uncertainties, the latest economic data has added some positive sentiment to the markets. Wall Street showed mostly positive results on Monday, with stocks trading higher and investors focusing on the banking sector. First Citizens’ purchase of substantial parts of the failed Silicon Valley Bank brought relief to fears surrounding the industry.

Looking ahead, market sentiment at the end of the first quarter will likely be decided by the inflation data for February, due out on Friday. The annual rate of the Federal Reserve’s favorite inflation gauge, the core PCE index, is expected to hold steady at 4.7%. Globally, Asian markets traded to mixed results, while European markets closed in the green.

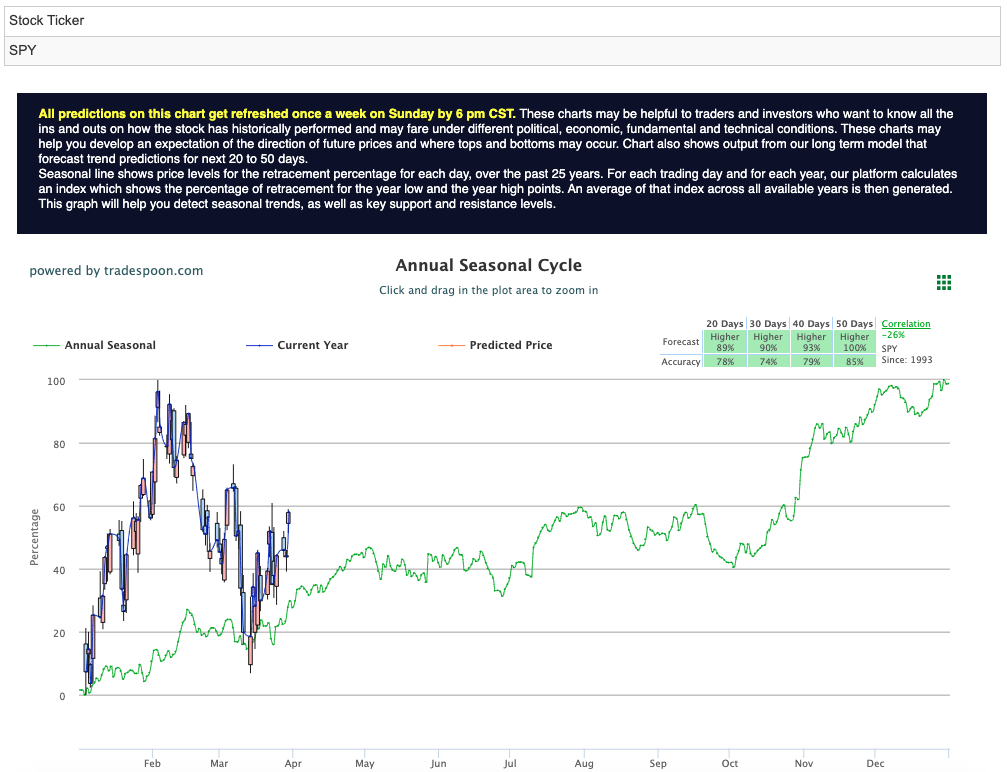

Given the market’s expected sideways trading for the next two to eight weeks, we recommend being market-neutral and encouraging subscribers to hedge their positions. The $VIX trades near the $21 level, and upcoming earnings reports from companies like $MU and $WBA, as well as liquidity issues in regional and global banks, could influence the market’s next move. Overhead resistance levels in the SPY are presently at $402 and then $408, while support is at $392 and then $384. See $SPY Seasonal Chart:

With this in mind, I have identified the next RoboStreet symbol to keep an eye on. If the right entry point presents itself, I will be adding it to my portfolio.

JPMorgan Chase & Co. (JPM) is a leading, global financial services firm that operates in over 100 countries. The company provides a broad range of financial services, including investment banking, commercial banking, asset management, and consumer and business banking.

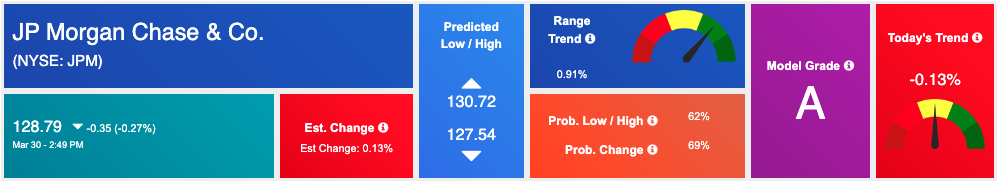

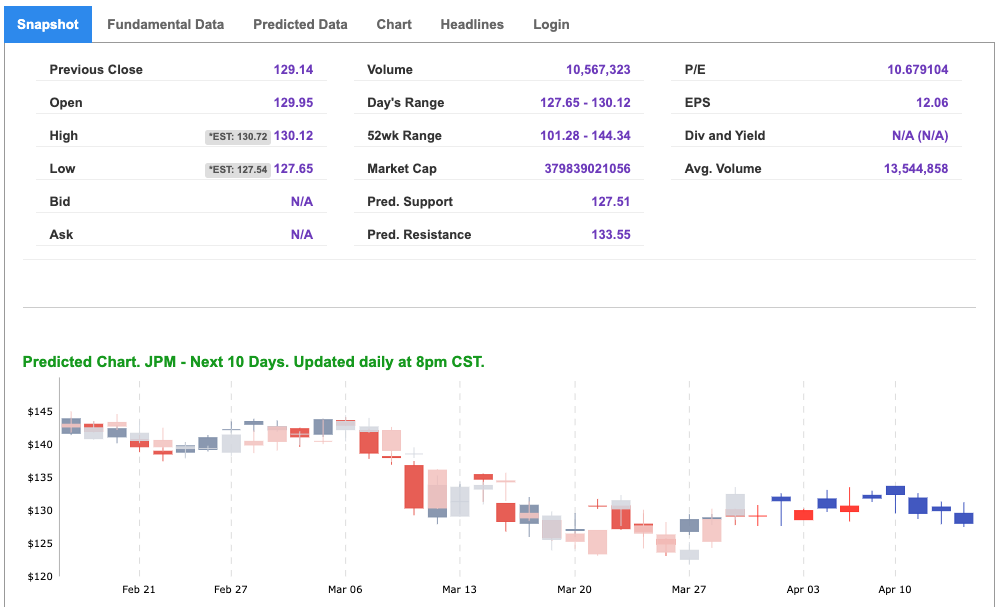

JPM is a component of the Dow Jones Industrial Average and is one of the largest and most widely followed financial institutions in the world. Like other financial stocks, JPM’s stock price is influenced by a variety of factors, including changes in interest rates, economic growth, and regulatory policies. As of March 30th, 2023, JPM’s stock price is trading at around $128 per share, with a market capitalization of approximately $378 billion – sitting in the middle of its 52-week range of $101 to $144.

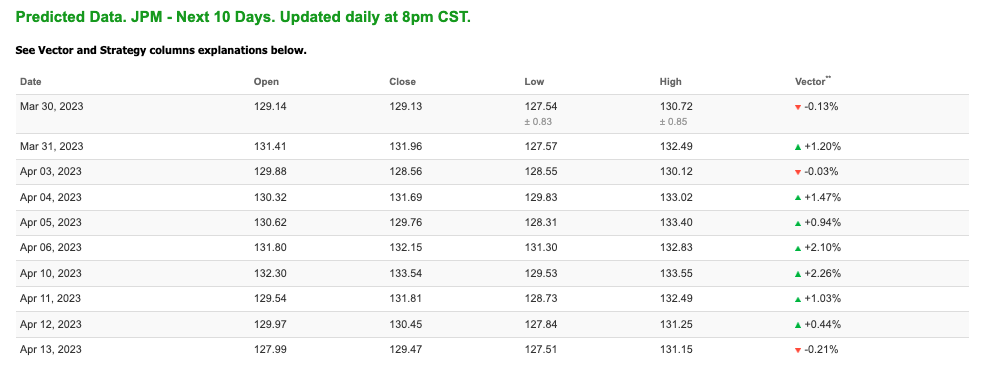

Looking at JPM’s 10-day forecast, using the Stock Forecast Toolbox, we see a steady one-directional vector trend that is key in finding symbols that will trade in a given direction. With JPM pointing towards trading higher, I am also taking into account its model grade of “A,” which indicates the symbol is within the top 10% of accuracy within our data universe. See JPM’s 10-day forecasted data:

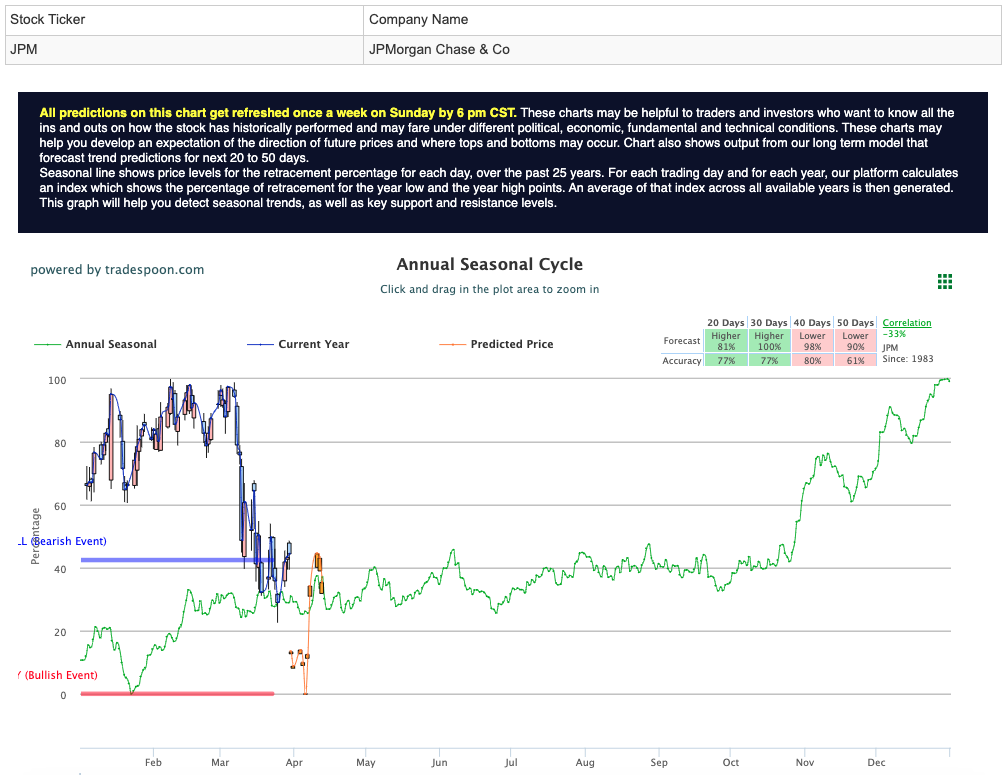

Using our Seasonal Chart tool, which is primed for long-term forecasts, JPM shows two time-frames that flash high percentage accuracy signals towards trading “higher.” With JPM trading higher in the next 20 and 30-day periods, along with our Stock Forecast Toolbox prediction, I am seeing a consistent trend toward the upside for JPM. See $JPM Seasonal Chart:

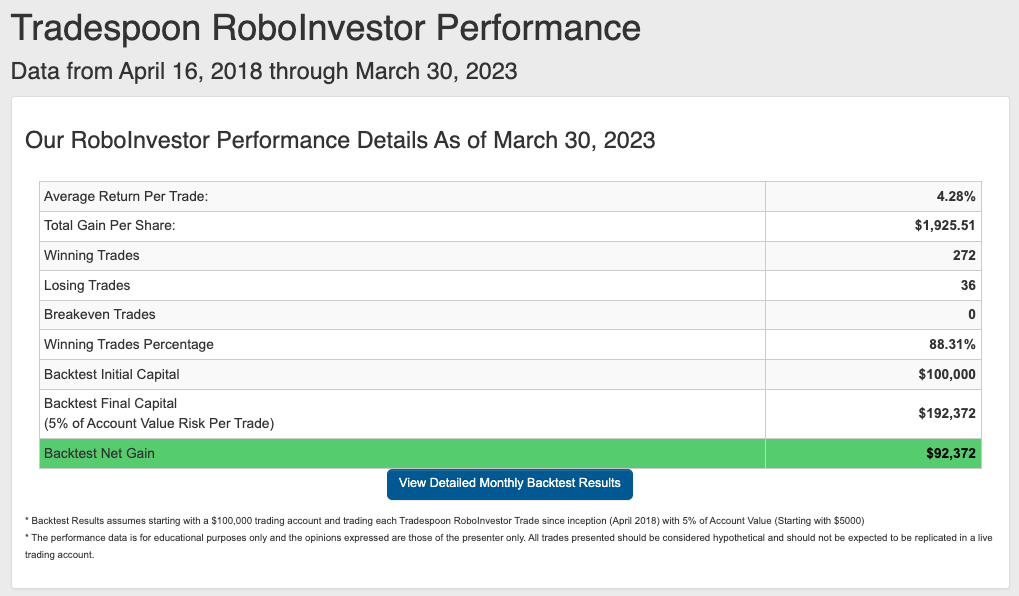

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.31% going back to April 2018.

In 2023, investors are facing a dynamic market affected by a combination of factors such as inflation, Federal policies, and geopolitical tensions, including the ongoing conflict in Ukraine. To successfully navigate this complex landscape, it is crucial to partner with a trustworthy and knowledgeable investment platform. RoboInvestor provides the necessary expertise and tools to help investors manage their portfolios with confidence and capitalize on opportunities in the fast-paced market.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!